11 Best Value Energy Stocks: Undervalued Opportunities in Energy Sector 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Value of Energy Sector Investing

The energy sector represents one of the most cyclical and capital-intensive industries in the global economy, creating substantial opportunities for value investors during periods of market pessimism or commodity price volatility. Energy companies often trade at significant discounts to intrinsic value due to environmental concerns, regulatory uncertainty, and commodity price fluctuations, yet many maintain strong cash generation capabilities and essential market positions.

Mathematical Foundation of Energy Valuation:

Energy company valuation requires understanding cyclical earnings patterns:

Normalized FCF = Number of Years in Cycle / Sum of FCF over Complete Cycle

This approach smooths out commodity price volatility to identify companies with sustainable competitive advantages and efficient capital allocation across energy cycles.

Value Energy Selection Criteria:

- Undervalued Status: Trading below calculated intrinsic value based on fundamental analysis

- Energy Sector Focus: Companies operating across oil & gas, renewable energy, and energy infrastructure

- Quality Business Fundamentals: Strong operational metrics and competitive positioning

- Cash Flow Generation: Ability to generate substantial free cash flow across commodity cycles

Top 11 Value Energy Stocks - Ranked by Undervaluation Percentage

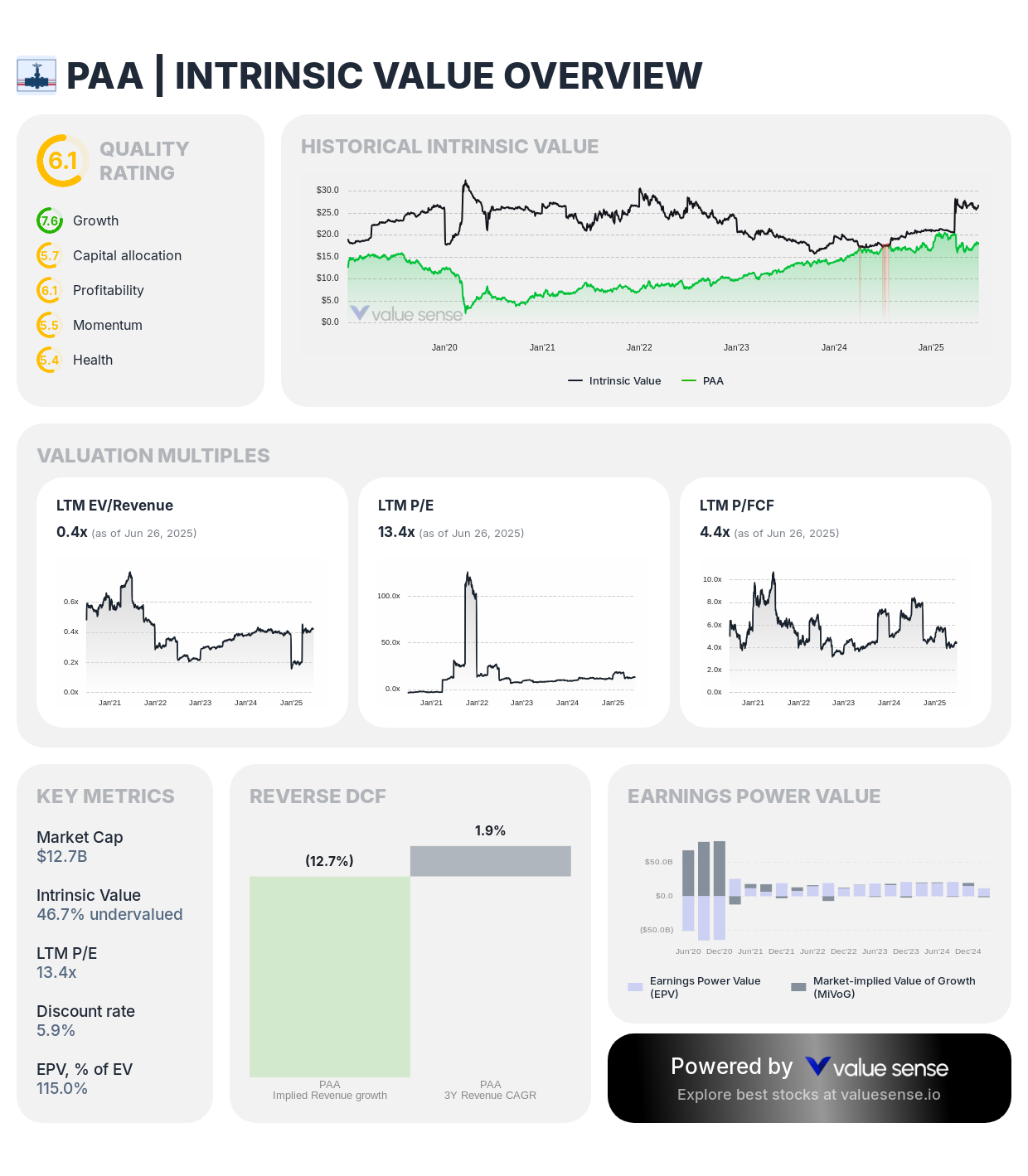

1. Plains All American Pipeline, L.P. (PAA) - 46.7% Undervalued ⭐

Complete Analysis:

- Quality Rating: 6.1 (Strong)

- Intrinsic Value: $26.8

- Undervaluation: 46.7%

- 1-Year Return: 8.5%

- Revenue: $50.1B

- Free Cash Flow: $2,866.0M

- Revenue Growth: 3.7%

- FCF Margin: 5.7%

Investment Thesis: Plains All American Pipeline represents the most significantly undervalued energy opportunity with 46.7% discount to intrinsic value, reflecting the midstream company's essential pipeline infrastructure and stable cash flows. As one of North America's largest crude oil and NGL pipeline operators, Plains provides critical transportation services with long-term contracts and fee-based revenue streams that create predictable cash generation.

Why It's Undervalued: Market concerns about environmental regulations and energy transition have created undervaluation of Plains' essential infrastructure assets. The company's strategic pipeline network, long-term contracts, and operational efficiency improvements support substantially higher valuations than current market pricing reflects.

Investment Highlights:

- Extensive pipeline network providing essential crude oil and NGL transportation services

- Fee-based revenue model with long-term contracts reducing commodity price exposure

- Strategic positioning in key production basins including Permian, Bakken, and Eagle Ford

- Strong free cash flow generation supporting distribution payments and debt reduction

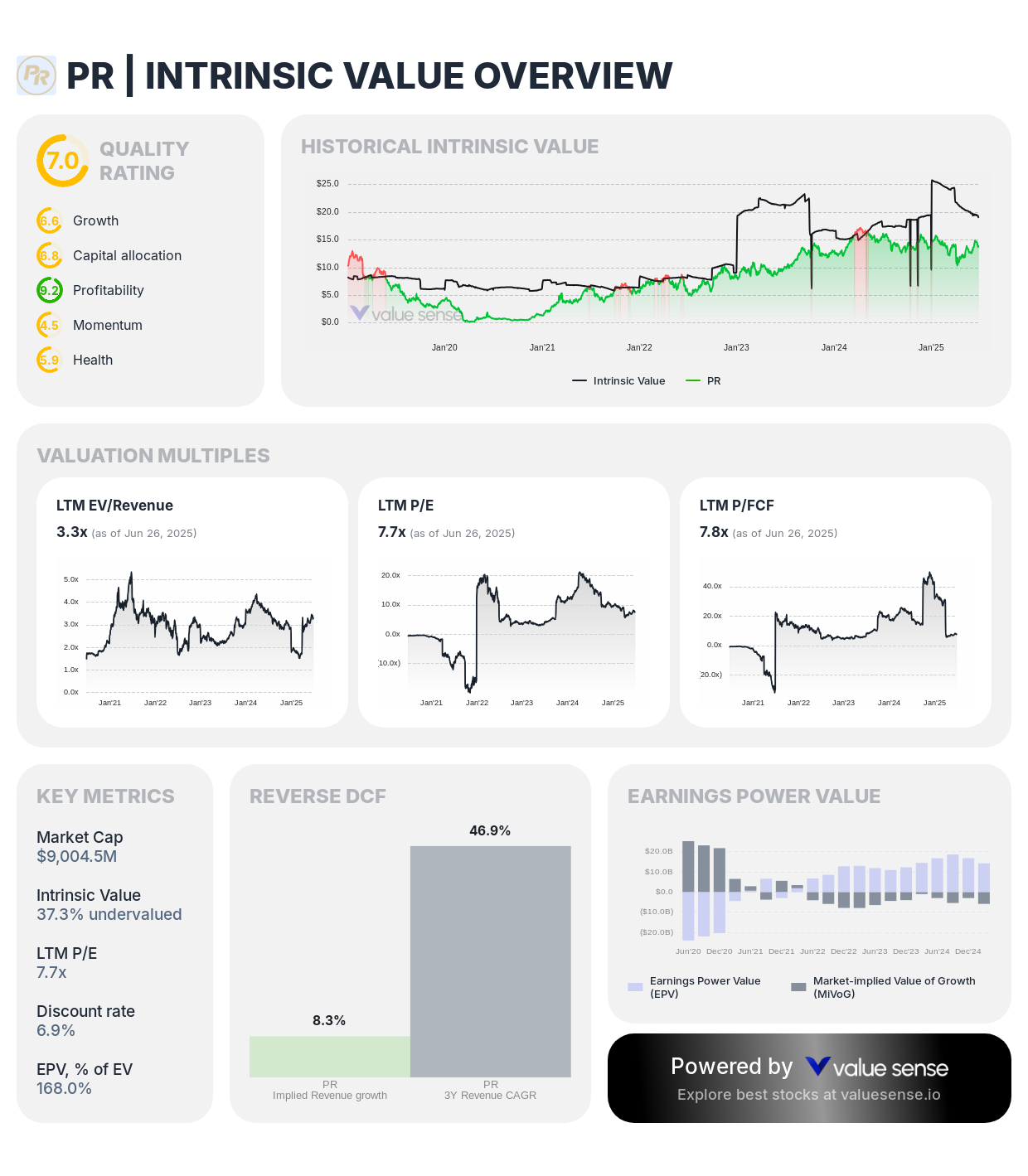

2. Permian Resources Corporation (PR) - 37.3% Undervalued

Complete Analysis:

- Quality Rating: 7.0 (Strong)

- Intrinsic Value: $19.1

- Undervaluation: 37.3%

- 1-Year Return: (7.3%)

- Revenue: $3,757.7M

- Free Cash Flow: $1,161.2M

- Revenue Growth: 0.3%

- FCF Margin: 30.9%

Investment Thesis: Permian Resources demonstrates substantial undervaluation at 37.3% below intrinsic worth with strong quality rating of 7.0, reflecting the independent oil and gas company's efficient operations in the prolific Permian Basin. The company's exceptional free cash flow margin of 30.9% and strategic asset positioning create significant value that current market pricing underestimates.

Why It's Undervalued: General market skepticism toward oil and gas companies has created undervaluation of Permian's high-quality assets and operational efficiency. The company's focus on the most productive US oil basin and conservative capital allocation approach support higher valuations.

Investment Highlights:

- Premium acreage position in the Permian Basin with low breakeven costs

- Exceptional free cash flow generation with 30.9% margin demonstrating operational efficiency

- Conservative capital structure and disciplined resource development approach

- Strategic positioning in North America's most productive and lowest-cost oil region

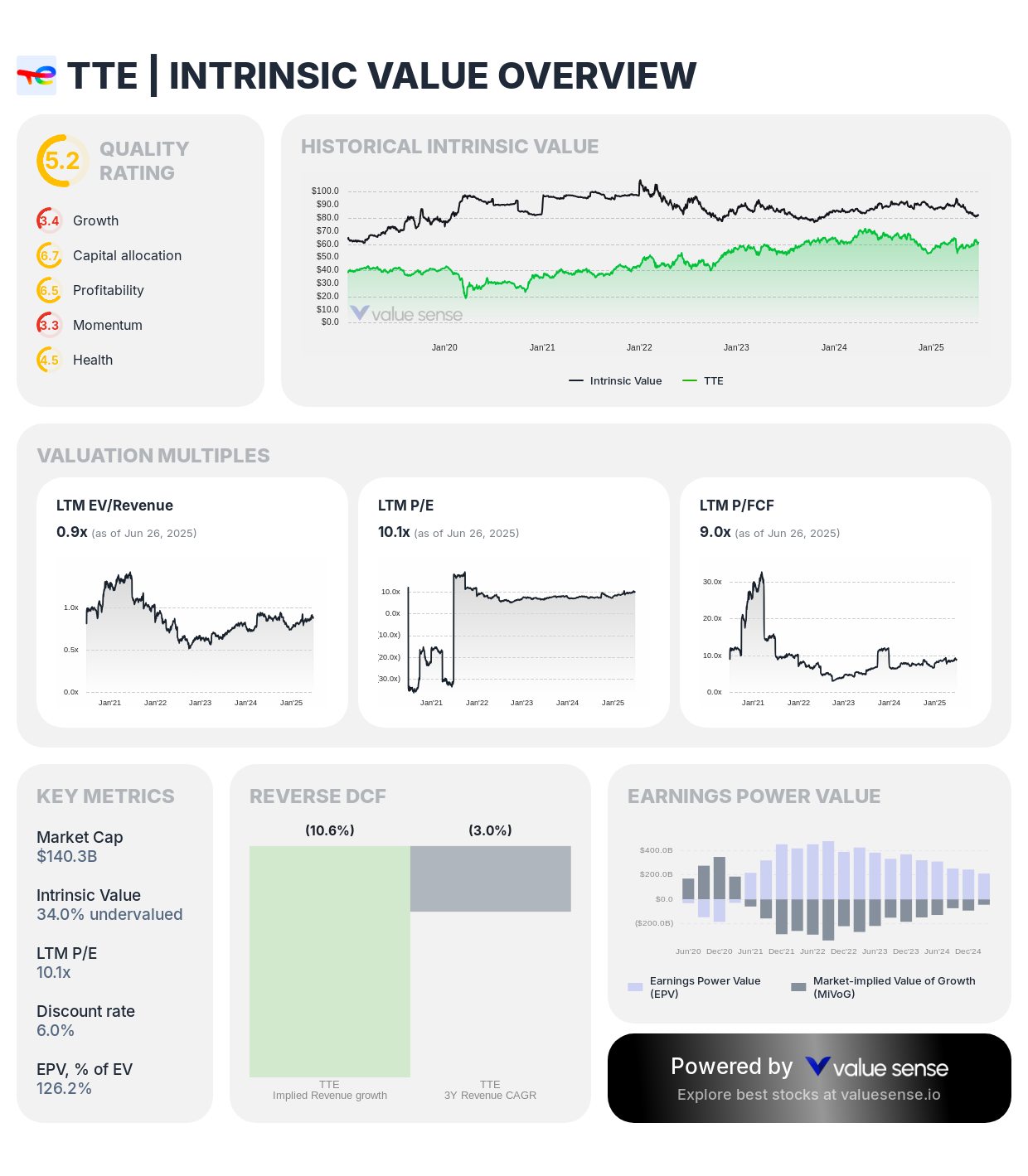

3. TotalEnergies SE (TTE) - 34.0% Undervalued

Complete Analysis:

- Quality Rating: 6.2 (Strong)

- Intrinsic Value: $82.5

- Undervaluation: 34.0%

- 1-Year Return: (4.9%)

- Revenue: $191.6B

- Free Cash Flow: $15.5B

- Revenue Growth: (9.9%)

- FCF Margin: 8.1%

Investment Thesis: TotalEnergies presents significant undervaluation at 34.0% below intrinsic value, reflecting the integrated energy company's successful transformation toward renewable energy and natural gas while maintaining strong oil and gas operations. The French energy giant's diversified portfolio and strategic investments in clean energy create substantial value that current pricing fails to recognize.

Why It's Undervalued: Market concerns about European energy policy and transition costs have created undervaluation of TotalEnergies' balanced approach to energy transformation. The company's integrated business model and renewable energy investments support higher valuations.

Investment Highlights:

- Integrated energy business model spanning upstream, downstream, and renewable energy

- Strategic investments in renewable energy and natural gas positioning for energy transition

- Strong balance sheet and cash generation supporting shareholder returns

- Global diversification reducing geographic and regulatory concentration risks

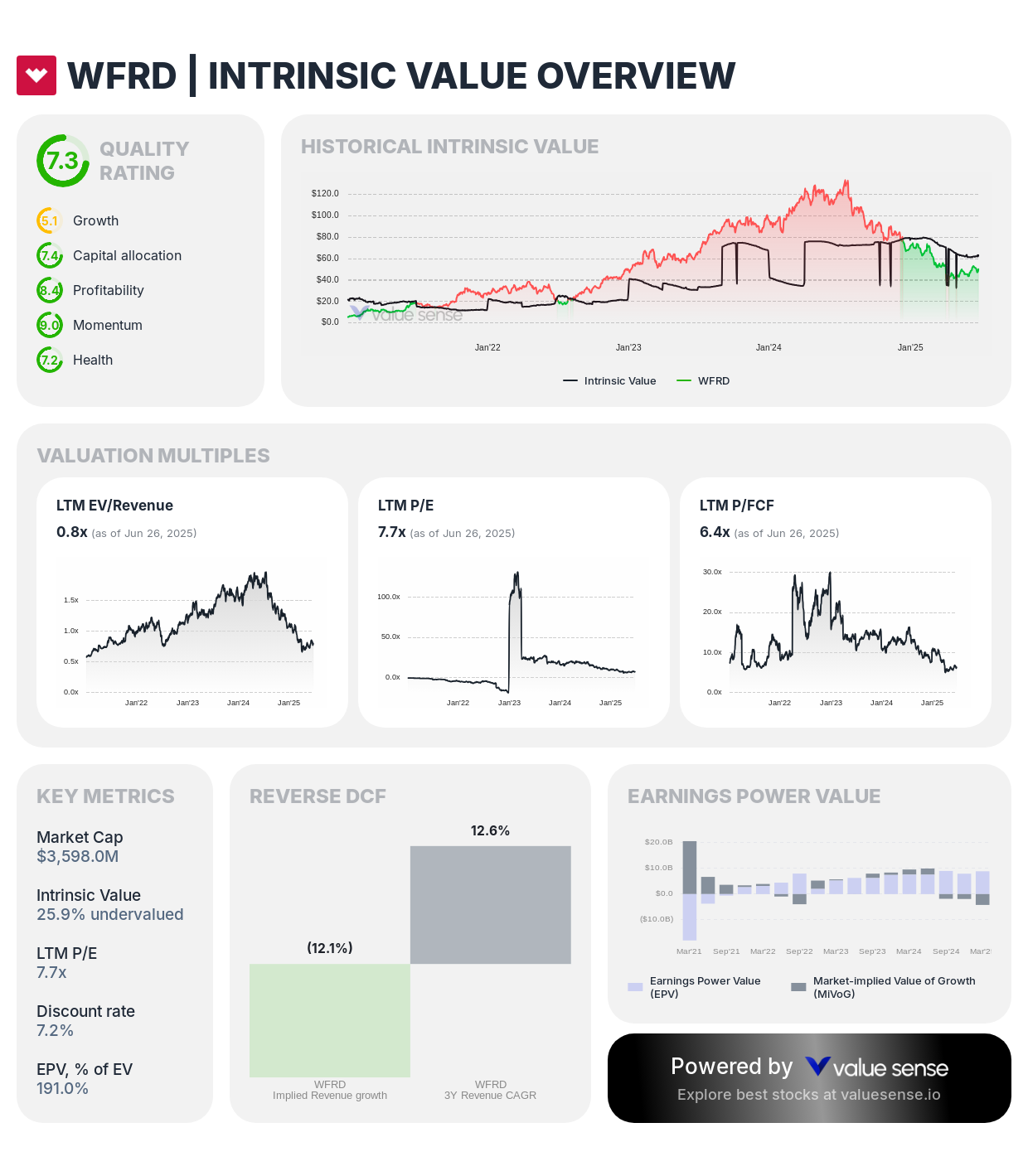

4. Weatherford International plc (WFRD) - 25.9% Undervalued

Complete Analysis:

- Quality Rating: 7.3 (Strong)

- Intrinsic Value: $63.1

- Undervaluation: 25.9%

- 1-Year Return: (57.8%)

- Revenue: $5,348.0M

- Free Cash Flow: $563.0M

- Revenue Growth: 0.8%

- FCF Margin: 10.5%

Investment Thesis: Weatherford International presents attractive undervaluation at 25.9% below intrinsic value with exceptional quality rating of 7.3, reflecting the oilfield services company's successful restructuring and technological capabilities. Despite significant recent decline, Weatherford's specialized services and international exposure create value opportunities.

Why It's Undervalued: The dramatic 57.8% one-year decline has created significant undervaluation of Weatherford's restructured operations and technological capabilities. The company's international exposure and specialized services support higher valuations.

Investment Highlights:

- Global oilfield services provider with specialized technological capabilities

- Successful financial restructuring improving operational flexibility

- International exposure providing geographic diversification

- Technology-focused services commanding premium pricing

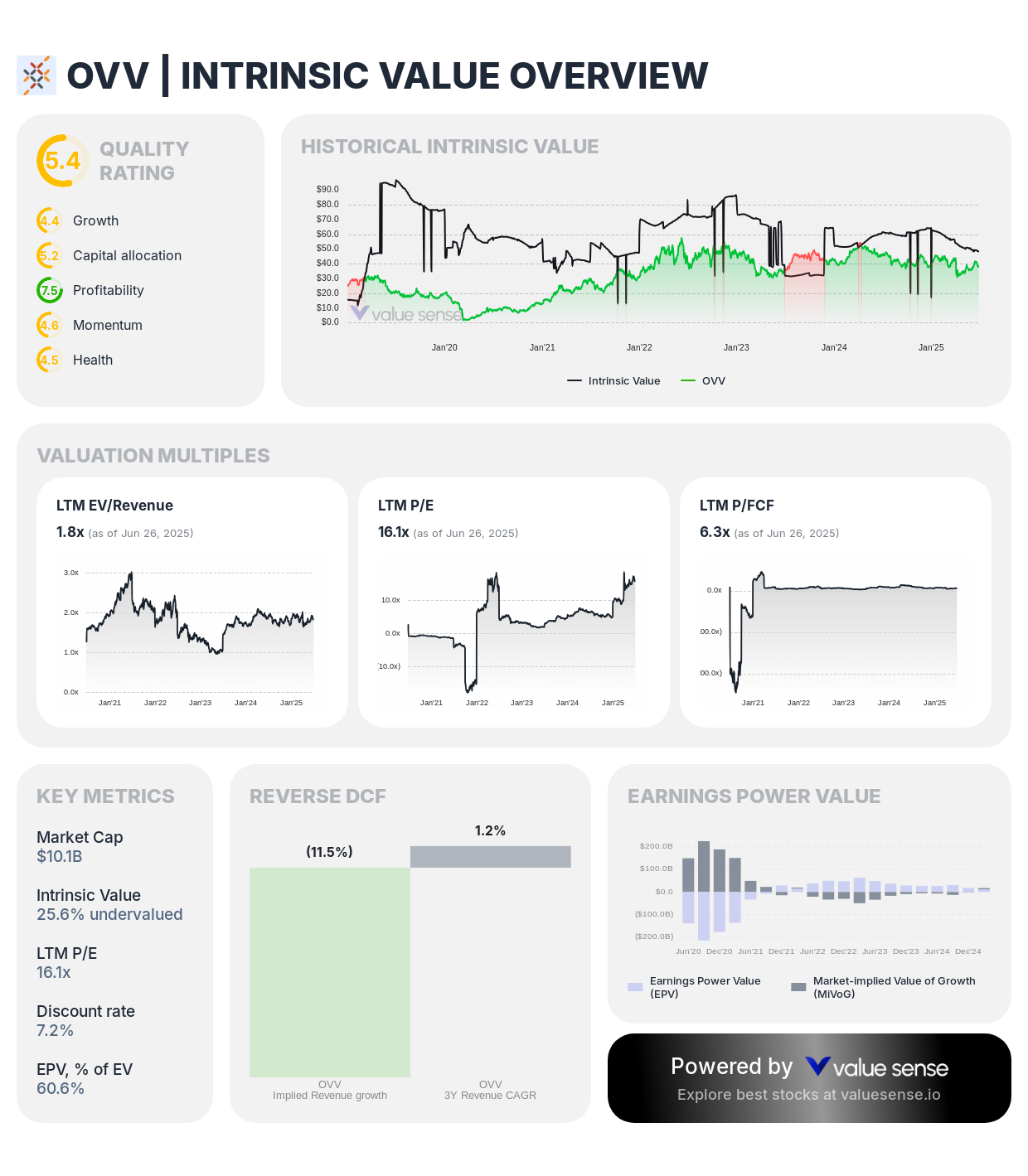

5. Ovintiv Inc. (OVV) - 25.6% Undervalued

Complete Analysis:

- Quality Rating: 6.4 (Strong)

- Intrinsic Value: $48.6

- Undervaluation: 25.6%

- 1-Year Return: (14.5%)

- Revenue: $9,103.0M

- Free Cash Flow: $1,602.7M

- Revenue Growth: (13.3%)

- FCF Margin: 17.6%

Investment Thesis: Ovintiv demonstrates solid undervaluation at 25.6% below intrinsic worth with strong quality rating of 6.4, reflecting the North American oil and gas company's multi-basin operations and operational efficiency. The company's strong free cash flow margin of 17.6% and conservative capital allocation create value that current pricing underestimates.

Why It's Undervalued: Market concerns about natural gas prices and production growth have created undervaluation of Ovintiv's diversified asset base and operational improvements. The company's multi-basin strategy and efficiency gains support higher valuations.

Investment Highlights:

- Diversified operations across multiple North American basins reducing single-area risk

- Strong free cash flow generation with 17.6% margin demonstrating operational efficiency

- Conservative capital allocation prioritizing debt reduction and shareholder returns

- Technology-driven operational improvements enhancing productivity and margins

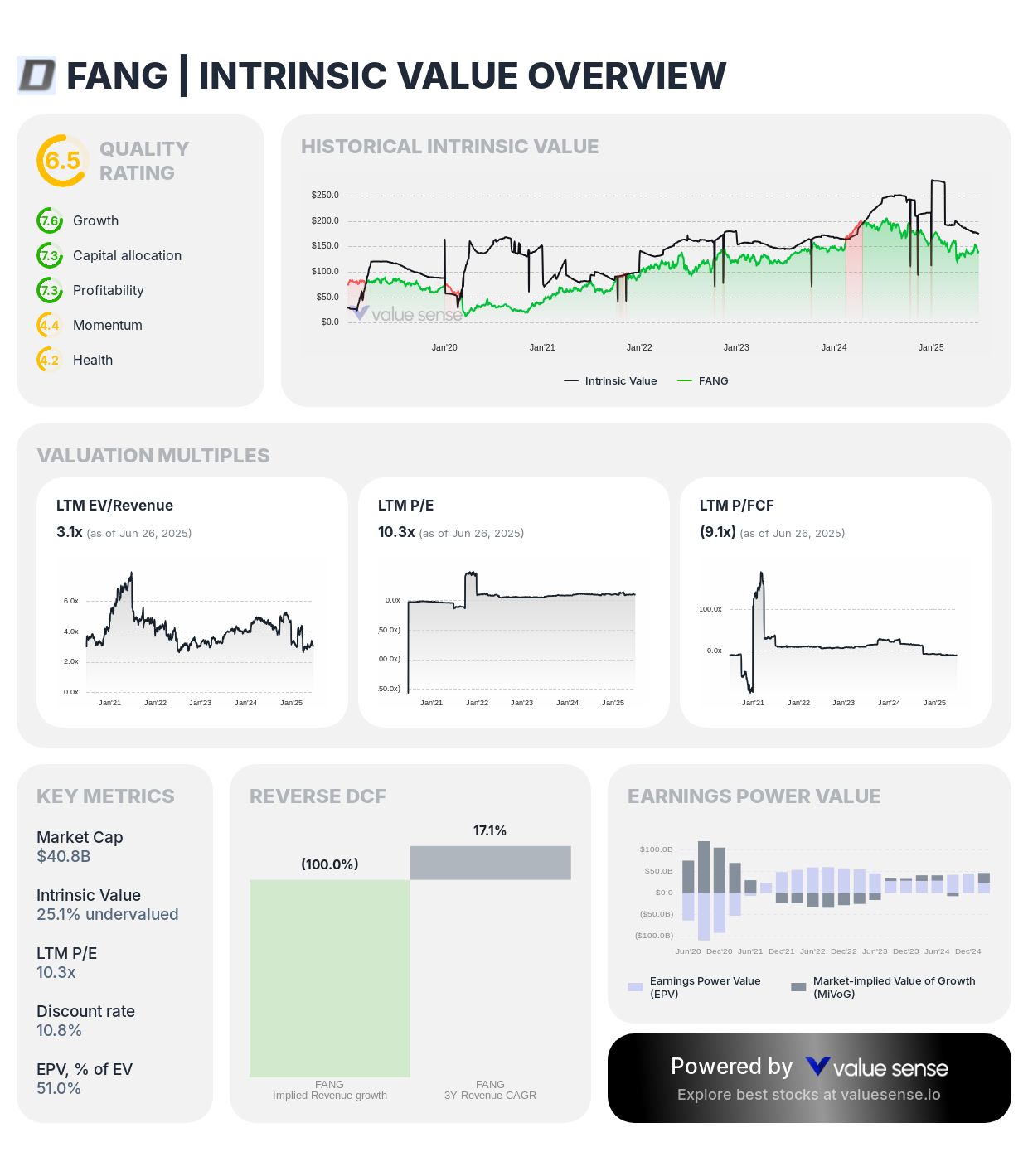

6. Diamondback Energy, Inc. (FANG) - 25.1% Undervalued

Complete Analysis:

- Quality Rating: 6.5 (Strong)

- Intrinsic Value: $176.2

- Undervaluation: 25.1%

- 1-Year Return: (26.7%)

- Revenue: $12.9B

- Free Cash Flow: ($4,463.0M)

- Revenue Growth: 48.3%

- FCF Margin: (34.8%)

Investment Thesis: Diamondback Energy presents undervaluation at 25.1% below intrinsic worth despite negative free cash flow, reflecting the independent oil company's strategic acquisition activity and Permian Basin positioning. The company's premium acreage and operational capabilities create long-term value despite current cash flow challenges from expansion investments.

Why It's Undervalued: Recent acquisition activity has temporarily impacted free cash flow metrics, but Diamondback's strategic positioning and operational efficiency support higher valuations as integration benefits materialize.

Investment Highlights:

- Premium acreage position in the Permian Basin with low-cost production capabilities

- Strategic acquisition strategy expanding scale and operational efficiency

- Advanced drilling and completion technologies improving well productivity

- Strong operational track record in the most productive US oil basin

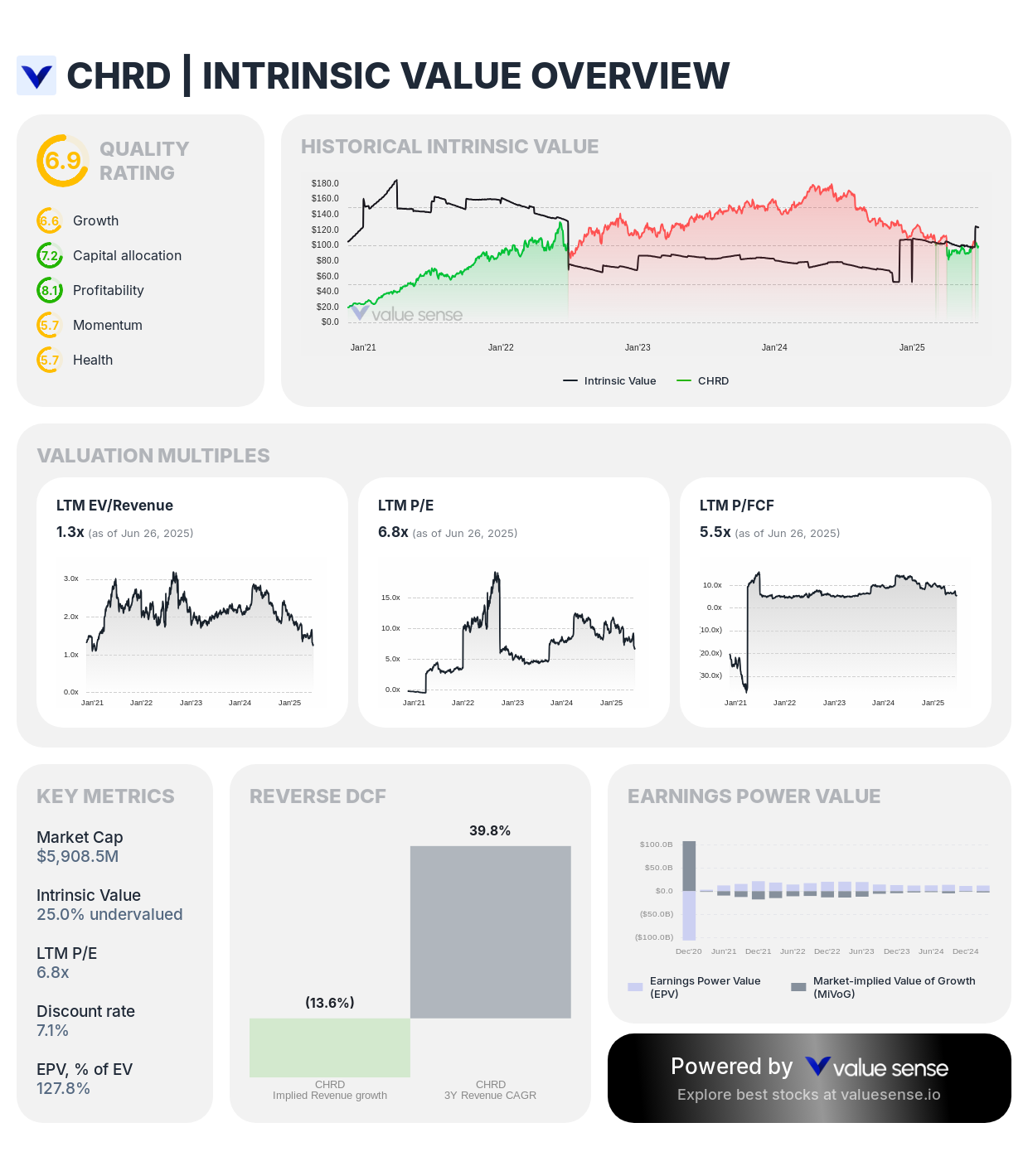

7. Chord Energy Corporation (CHRD) - 25.0% Undervalued

Complete Analysis:

- Quality Rating: 6.3 (Strong)

- Intrinsic Value: $124.1

- Undervaluation: 25.0%

- 1-Year Return: (38.2%)

- Revenue: $5,380.9M

- Free Cash Flow: $1,081.6M

- Revenue Growth: 31.7%

- FCF Margin: 20.1%

Investment Thesis: Chord Energy demonstrates solid undervaluation at 25.0% below intrinsic worth with strong quality rating of 6.3, reflecting the independent oil and gas company's focused operations in the Williston Basin. The company's operational efficiency and strong free cash flow margin of 20.1% create value opportunities despite recent share price decline.

Why It's Undervalued: The significant 38.2% one-year decline has created attractive entry valuation for this quality operator. Chord's efficient Bakken operations and conservative approach to capital allocation support value realization over time.

Investment Highlights:

- Focused operations in the Williston Basin (Bakken) with operational expertise

- Strong free cash flow generation with 20.1% margin demonstrating efficiency

- Conservative capital allocation approach prioritizing shareholder returns

- Technological innovation improving drilling and completion efficiency

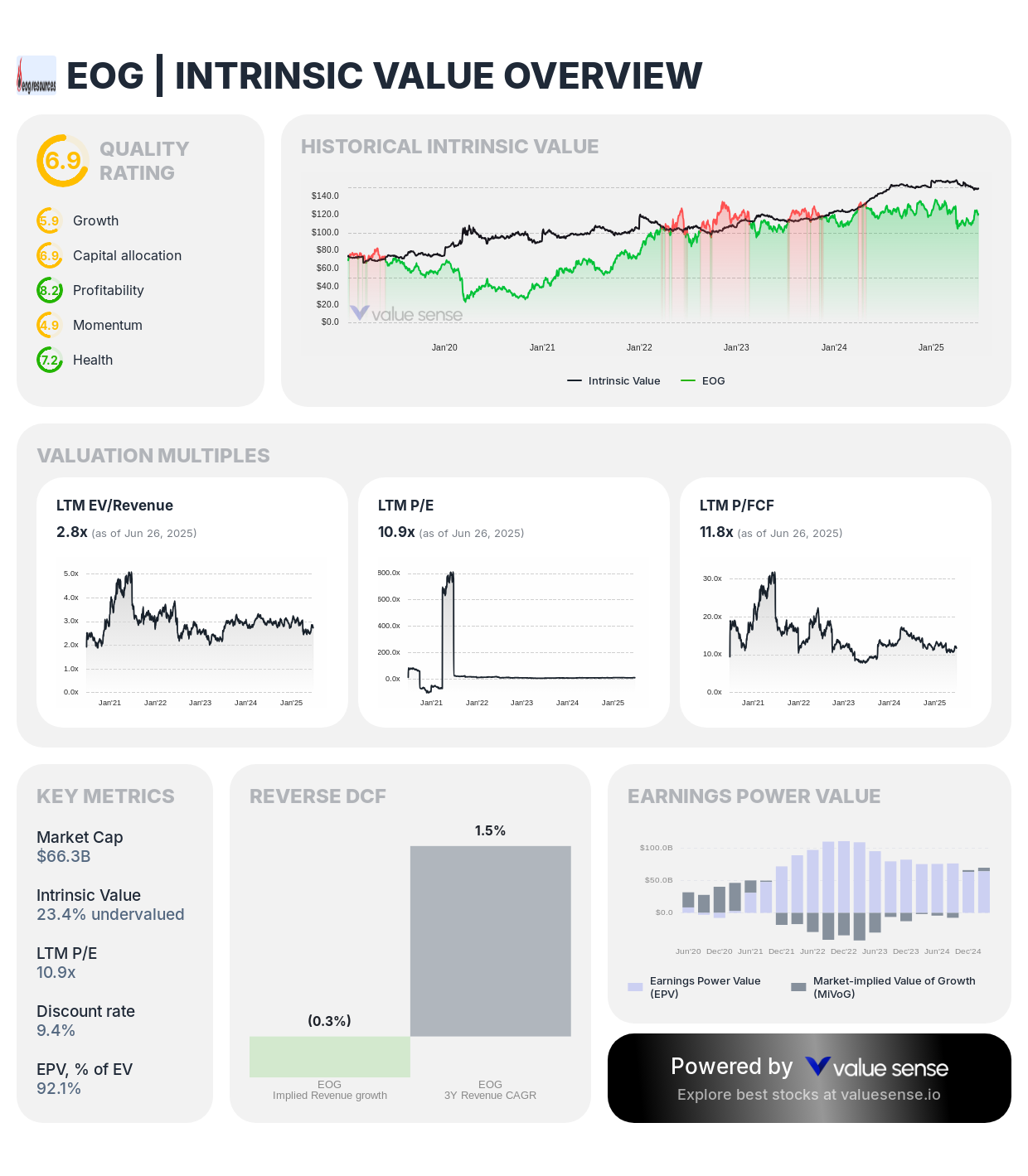

8. EOG Resources, Inc. (EOG) - 23.4% Undervalued

Complete Analysis:

- Quality Rating: 6.9 (Strong)

- Intrinsic Value: $149.4

- Undervaluation: 23.4%

- 1-Year Return: (0.7%)

- Revenue: $23.4B

- Free Cash Flow: $5,611.0M

- Revenue Growth: (0.2%)

- FCF Margin: 24.0%

Investment Thesis: EOG Resources demonstrates solid undervaluation at 23.4% below intrinsic value with strong quality rating of 6.9, reflecting the independent oil and gas company's operational excellence and technology leadership. The company's exceptional free cash flow margin of 24.0% and conservative approach create substantial value that current pricing underestimates.

Why It's Undervalued: Market concerns about oil price volatility have created undervaluation of EOG's operational efficiency and technology advantages. The company's premium drilling locations and technological innovation support higher valuations.

Investment Highlights:

- Technology leadership in horizontal drilling and completion techniques

- Premium drilling inventory with low breakeven costs and high returns

- Conservative capital allocation approach prioritizing returns over growth

- Exceptional operational efficiency with 24.0% free cash flow margin

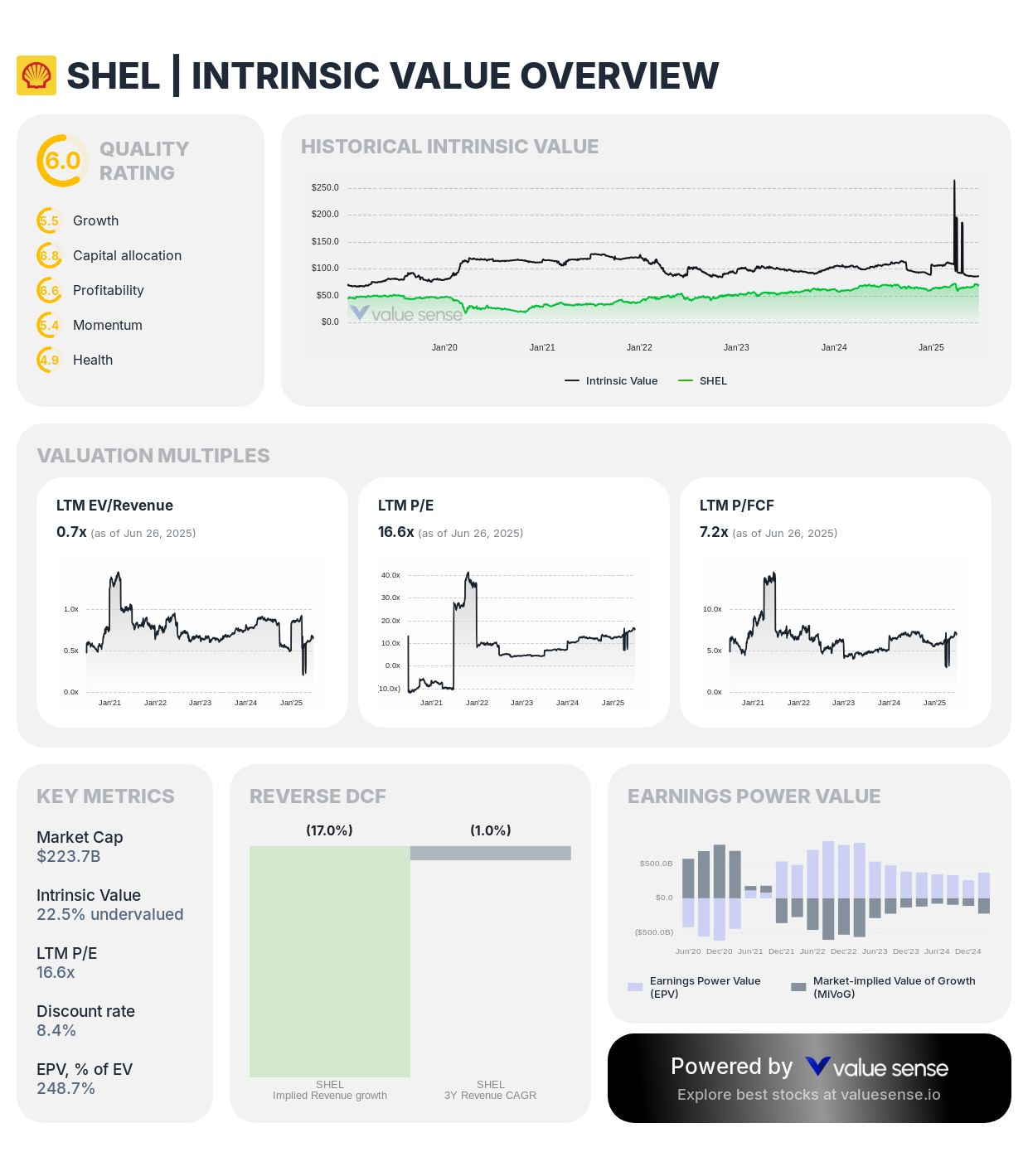

9. Shell plc (SHEL) - 22.5% Undervalued

Complete Analysis:

- Quality Rating: 6.6 (Strong)

- Intrinsic Value: $87.0

- Undervaluation: 22.5%

- 1-Year Return: 3.3%

- Revenue: $281.1B

- Free Cash Flow: $31.3B

- Revenue Growth: (7.0%)

- FCF Margin: 11.1%

Investment Thesis: Shell presents attractive undervaluation at 22.5% below intrinsic worth, reflecting the integrated energy giant's balanced approach to traditional and renewable energy investments. The company's substantial free cash flow generation and strategic positioning for energy transition create value that current market pricing underestimates.

Why It's Undervalued: Environmental concerns and energy transition uncertainty have created undervaluation of Shell's integrated business model and strategic investments. The company's balanced portfolio and cash generation capabilities support higher valuations.

Investment Highlights:

- Integrated energy business model providing stability across commodity cycles

- Strategic investments in renewable energy and lower-carbon solutions

- Substantial free cash flow generation supporting shareholder returns

- Global scale advantages and operational efficiency across energy value chain

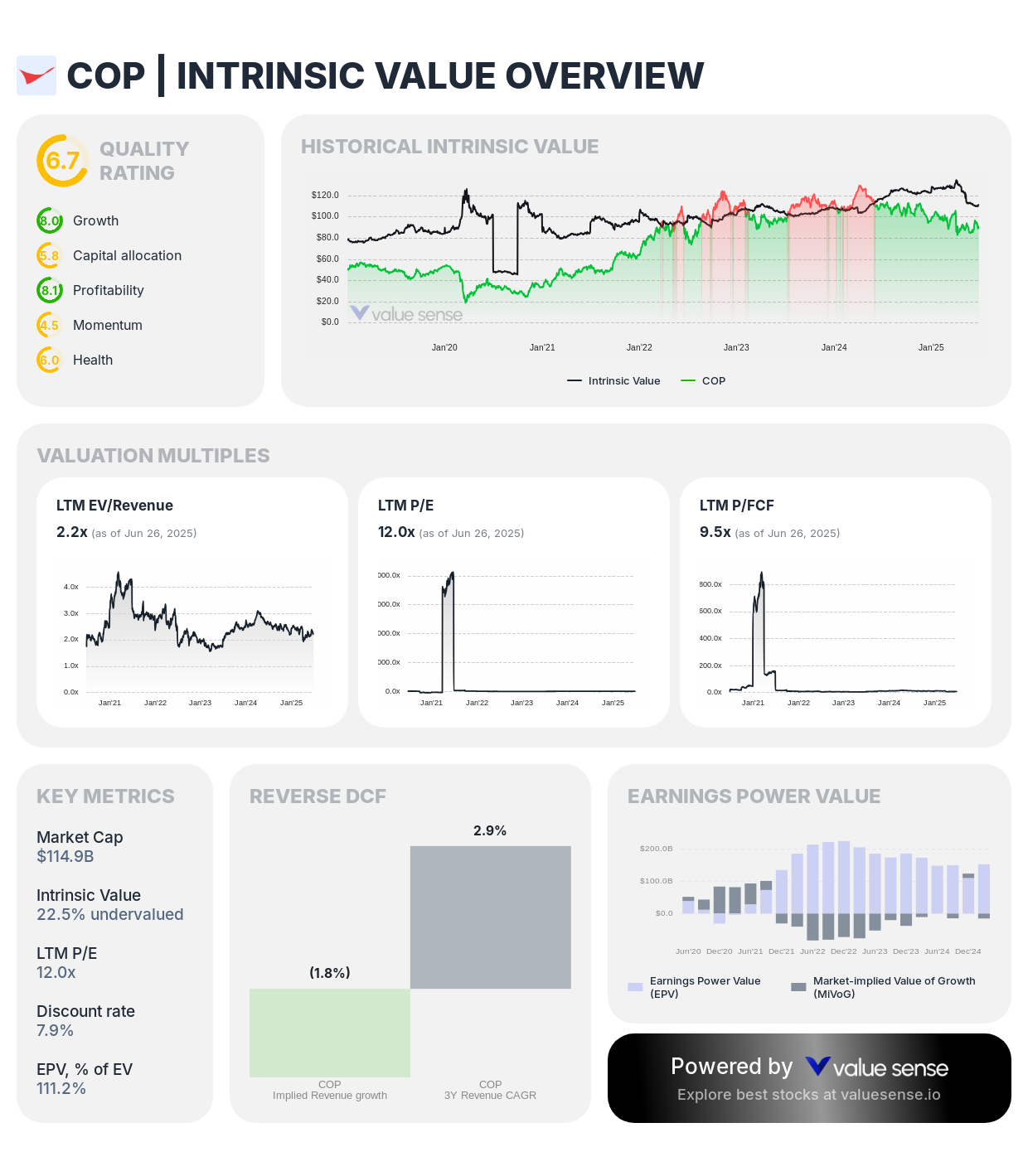

10. ConocoPhillips (COP) - 22.5% Undervalued

Complete Analysis:

- Quality Rating: 6.7 (Strong)

- Intrinsic Value: $111.4

- Undervaluation: 22.5%

- 1-Year Return: (18.2%)

- Revenue: $58.5B

- Free Cash Flow: $12.1B

- Revenue Growth: 6.2%

- FCF Margin: 20.6%

Investment Thesis: ConocoPhillips demonstrates solid undervaluation at 22.5% below intrinsic value with strong quality rating of 6.7, reflecting the independent oil and gas company's disciplined capital allocation and operational efficiency. The company's exceptional free cash flow margin of 20.6% and shareholder-friendly policies create substantial value.

Why It's Undervalued: Market concerns about oil price volatility have created undervaluation of ConocoPhillips' operational excellence and capital discipline. The company's low-cost production and shareholder returns support higher valuations.

Investment Highlights:

- Low-cost, diversified production portfolio with operational flexibility

- Disciplined capital allocation prioritizing shareholder returns over growth

- Exceptional free cash flow generation with 20.6% margin

- Variable dividend policy providing additional returns during strong commodity cycles

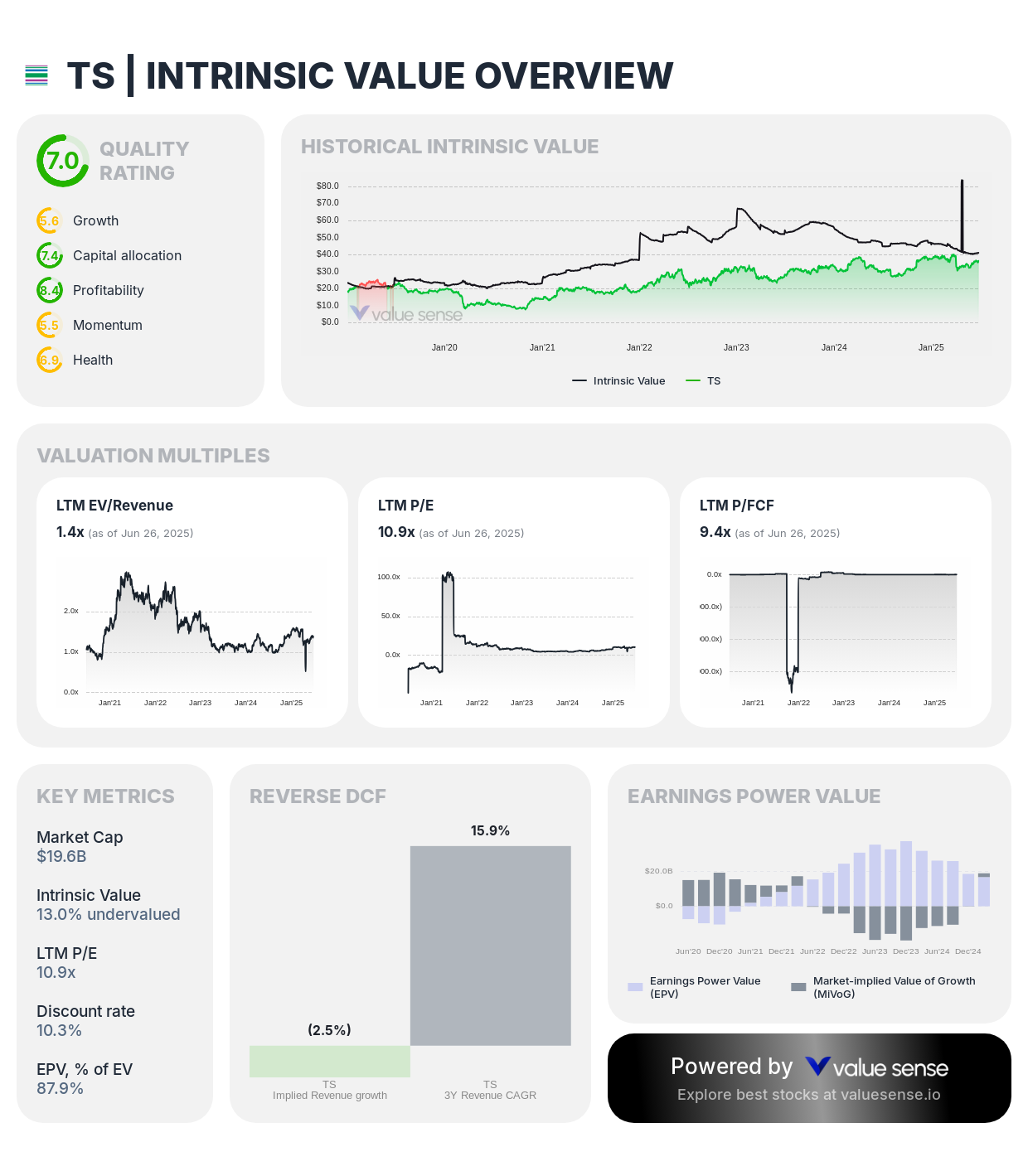

11. Tenaris S.A. (TS) - 13.0% Undervalued

Complete Analysis:

- Quality Rating: 7.0 (Strong)

- Intrinsic Value: $41.2

- Undervaluation: 13.0%

- 1-Year Return: 22.1%

- Revenue: $12.0B

- Free Cash Flow: $2,086.1M

- Revenue Growth: (15.3%)

- FCF Margin: 17.4%

Investment Thesis: Tenaris presents moderate undervaluation at 13.0% below intrinsic worth with strong quality rating of 7.0, reflecting the steel pipe manufacturer's essential role in oil and gas infrastructure. The company's technological leadership and global market position create value despite cyclical industry challenges.

Why It's Undervalued: Cyclical concerns about drilling activity have created modest undervaluation of Tenaris' technological advantages and market leadership. The company's premium products and global reach support value realization.

Investment Highlights:

- Global leadership in oil country tubular goods with technological advantages

- Premium product portfolio commanding higher margins than commodity steel

- Strategic positioning in key oil and gas production regions

- Strong balance sheet and cash generation supporting operational flexibility

Energy Sector Value Investment Strategy

Prioritize Infrastructure and Midstream Assets: Focus on companies with fee-based revenue models like Plains All American Pipeline (46.7% undervalued) that provide essential services with reduced commodity exposure. These businesses offer more predictable cash flows and defensive characteristics within the energy sector.

Diversify Across Energy Subsectors: Spread investments across upstream production (Permian Resources, EOG, ConocoPhillips), midstream infrastructure (Plains All American), integrated majors (Shell, TotalEnergies), and oilfield services (Weatherford, Tenaris) to reduce concentration risk while maintaining energy sector exposure.

Emphasize Free Cash Flow Generation: Prioritize companies demonstrating strong free cash flow margins like EOG Resources (24.0%) and Permian Resources (30.9%) that can generate substantial cash across commodity cycles. Strong cash generation provides downside protection and supports shareholder returns.

Consider ESG and Energy Transition Positioning: Evaluate companies' strategies for energy transition and environmental sustainability. TotalEnergies and Shell's renewable energy investments may provide better long-term positioning despite current undervaluation in traditional energy operations.

Key Takeaways for Energy Value Investors

✅ Exceptional Value Leader: Plains All American Pipeline (46.7% undervalued) offers the best combination of undervaluation and infrastructure stability

✅ Quality Operations: All companies maintain quality ratings above 6.0 indicating strong operational fundamentals

✅ Cash Flow Focus: Multiple companies demonstrate exceptional FCF margins above 20% providing financial flexibility

✅ Diversified Opportunities: Value opportunities span upstream, midstream, integrated, and service companies

✅ Cyclical Positioning: Current undervaluations may reflect cyclical lows creating attractive entry points for patient investors

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best Undervalued Large Cap US Stocks

📖 10 Best Compounding Quality Stocks

📖 7 Best Undervalued Cheap Stocks Under $20

FAQ About Energy Value Investing

What makes energy stocks particularly attractive for value investors?

Energy stocks often trade at significant discounts due to commodity price volatility, environmental concerns, and regulatory uncertainty, creating opportunities when underlying asset quality remains strong. Companies like Plains All American Pipeline with 46.7% undervaluation demonstrate how market pessimism can create substantial value gaps. Energy companies also generate substantial free cash flows during favorable cycles, providing opportunities for patient investors willing to accept commodity exposure.

How should investors evaluate the sustainability of energy company cash flows?

Energy cash flow sustainability requires analyzing normalized earnings across commodity cycles, capital allocation discipline, and operational efficiency improvements. Companies like EOG Resources with 24.0% FCF margins and Permian Resources with 30.9% margins demonstrate operational excellence that supports cash generation across price environments. Focus on companies with low breakeven costs, diversified production portfolios, and conservative capital structures.

What are the primary risks of investing in undervalued energy stocks?

Energy investing carries risks including commodity price volatility, regulatory changes, environmental liabilities, and energy transition uncertainty. Companies may face stranded asset risks as renewable energy adoption accelerates, while regulatory changes could impact operations and profitability. However, many energy companies have improved operational efficiency and capital discipline, while essential infrastructure companies like pipelines offer more defensive characteristics.

What timeline should investors expect for energy value realization?

Energy value realization depends on commodity cycles, company execution, and market sentiment recovery. Infrastructure companies like Plains All American may realize value more quickly through operational improvements, while upstream companies depend more on commodity price recovery. Maintain 3-5 year investment horizons and focus on companies with strong operational metrics and capital discipline rather than attempting to time commodity cycles.

Important Note on Energy Investing: Energy stocks carry inherent risks from commodity price volatility, regulatory changes, and energy transition uncertainty. While current undervaluations may present attractive opportunities, investors should understand cyclical nature of energy businesses and potential for extended periods of underperformance. Diversification across energy subsectors and quality focus on operational excellence can help manage these risks.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Energy investments carry significant risks including commodity price volatility and regulatory changes. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.