ValueAct Capital Portfolio Q3'2006: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

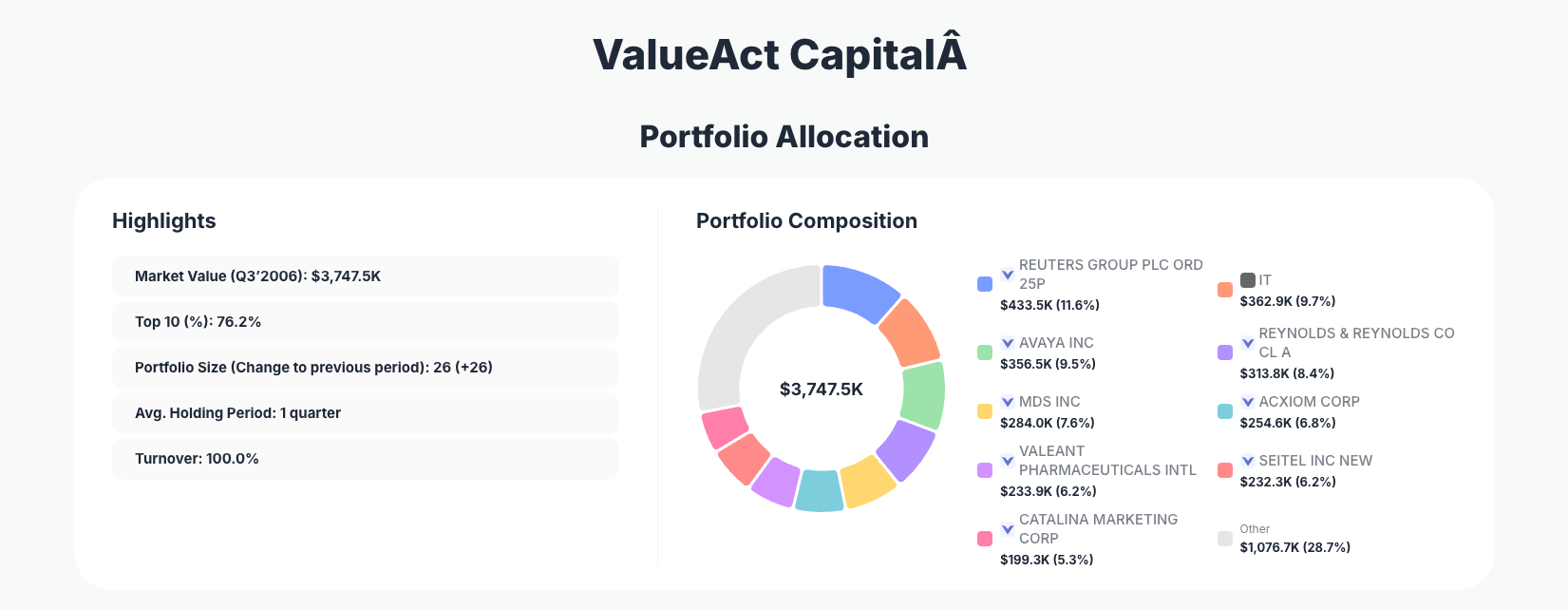

ValueAct Capital, the activist investment firm known for driving operational improvements in undervalued companies, kicked off its early portfolio tracking era with a bold Q3 2006 13F filing. Their $3.7M portfolio showcases a completely new slate of 26 positions—all fresh "Buy" moves—signaling high-conviction bets on overlooked opportunities in information services, technology, and healthcare during a period of market volatility.

Portfolio Overview: High-Conviction Launch with Extreme Concentration

Portfolio Highlights (Q3 2006): - Market Value: $3,747.5K - Top 10 Holdings: 76.2% - Portfolio Size: 26 +26 - Average Holding Period: 1 quarter - Turnover: 100.0%

ValueAct Capital's Q3 2006 portfolio reflects a startup phase with aggressive positioning, as evidenced by the 100% turnover and entirely new positions across 26 holdings. The top 10 alone command 76.2% of the portfolio, demonstrating the firm's signature concentrated approach even in its nascent 13F disclosures. This structure underscores ValueAct's activist DNA—focusing capital on a handful of high-potential targets where they can influence outcomes.

The 1-quarter average holding period and full portfolio refresh highlight a dynamic strategy, likely testing theses in a mid-2000s market recovering from the dot-com bust. With total value at $3,747.5K, ValueAct allocated heavily to undervalued names in data services and tech infrastructure, sectors ripe for activist intervention amid economic uncertainty. Tracking via ValueSense's superinvestor page reveals how this early blueprint evolved into their multi-billion-dollar track record.

This concentration isn't reckless; it's calibrated for impact. By weighting 76% in just 10 names, ValueAct signals deep research and readiness to engage management, a hallmark that would define their future successes in pushing for strategic shifts.

Top Holdings: New Bets on Data Giants and Tech Underdogs

ValueAct's portfolio launched with every position marked as a "Buy," prioritizing information and tech services. Leading the pack is REUTERS GROUP PLC ORD 25P at 11.6% $433.5K, a fresh Buy capturing financial data dominance in the pre-Thomson Reuters era. Close behind, Gartner, Inc. (IT) claims 9.7% $362.9K as a new Buy, betting on IT research amid enterprise tech spending recovery.

AVAYA INC follows at 9.5% ($356.5K, Buy), targeting telecom equipment turnaround potential, while REYNOLDS & REYNOLDS CO CL A (8.4%, $313.8K, Buy) adds auto dealer software exposure. MDS INC (7.6%, $284.0K, Buy) brings healthcare diagnostics, and ACXIOM CORP (6.8%, $254.6K, Buy) focuses on data marketing. Rounding out the top tier, VALEANT PHARMACEUTICALS INTL (6.2%, $233.9K, Buy), SEITEL INC NEW (6.2%, $232.3K, Buy), and CATALINA MARKETING CORP (5.3%, $199.3K, Buy) diversify into pharma, seismic data, and retail marketing—all new positions.

Extending to changes, HANOVER COMPRESSOR CO enters at 4.9% ($185.1K, Buy), signaling energy services interest. These 11 fresh buys dominate the narrative, with the remaining top holdings reinforcing a theme of undervalued assets in data-driven and tech-adjacent spaces, setting the stage for activist value creation.

What the Portfolio Reveals

ValueAct's Q3 2006 moves paint a clear activist playbook: targeting undervalued firms with strong assets but operational inefficiencies, particularly in tech and data sectors.

- Sector Focus: Heavy tilt toward information services (Reuters, Gartner), telecom/tech (Avaya), healthcare (MDS, Valeant), and niche industrials—sectors with high fixed costs and activist-friendly boards.

- Quality Over Quantity: 76.2% in top 10 shows conviction in researched names, avoiding broad diversification.

- Risk Management: New portfolio with 100% turnover minimizes legacy risks, focusing on fresh opportunities post-2006 market shifts.

- Geographic Concentration: Primarily U.S.-listed but with global plays like Reuters (UK-based), blending domestic tech with international data moats.

This setup prioritizes businesses with scalable intellectual property or data advantages, where ValueAct could push for cost cuts or spin-offs.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| REUTERS GROUP PLC ORD 25P | $433.5K | 11.6% | Buy |

| Gartner, Inc. | $362.9K | 9.7% | Buy |

| AVAYA INC | $356.5K | 9.5% | Buy |

| REYNOLDS & REYNOLDS CO CL A | $313.8K | 8.4% | Buy |

| MDS INC | $284.0K | 7.6% | Buy |

| ACXIOM CORP | $254.6K | 6.8% | Buy |

| VALEANT PHARMACEUTICALS INTL | $233.9K | 6.2% | Buy |

| SEITEL INC NEW | $232.3K | 6.2% | Buy |

| CATALINA MARKETING CORP | $199.3K | 5.3% | Buy |

The table underscores ValueAct's concentrated firepower, with the top 10 devouring 76.2% of the $3.7M portfolio—all "Buy" actions in a brand-new 26-position lineup. No single holding exceeds 12%, yet the rapid drop-off after the top five illustrates disciplined sizing for maximum activist impact without overexposure.

This structure reveals a strategy optimized for influence: enough size in leaders like Reuters and Gartner to warrant board attention, balanced across 10 names to hedge sector risks. The uniform "Buy" status and 100% turnover signal a clean-slate approach, positioning ValueAct to build stakes and drive changes in promising but underperforming assets.

Investment Lessons from ValueAct Capital's Early Playbook

ValueAct's Q3 2006 portfolio offers timeless principles from an activist pioneer:

- Concentrate on Conviction Targets: 76% in top 10 shows betting big only where deep diligence uncovers activist potential.

- Embrace High Turnover for Fresh Starts: 100% refresh avoids anchoring bias, seizing new undervalued opportunities.

- Target Data and Tech Moats: Prioritize scalable info businesses (Reuters, Gartner) with intervention upside.

- Size Positions for Influence: 5-12% allocations provide leverage without dominating the portfolio.

- Launch with Diversified Niches: Blend tech, healthcare, and industrials to navigate 2006's uncertain recovery.

Looking Ahead: What Comes Next?

With a fully deployed $3.7M portfolio and 100% turnover, ValueAct appears cash-light but primed for rapid evolution. The 26 positions leave room for adds in similar data/tech themes, especially as 2006 markets stabilized post-Fed rate hikes.

Potential new investments could target more activist setups in enterprise software or healthcare services, building on successes like Gartner. Current holdings position ValueAct for upside if interventions unlock value—watch for stake increases or proxy fights. In today's environment, this early blueprint mirrors opportunities in AI-driven data firms.

FAQ about ValueAct Capital Portfolio

Q: What do all the new "Buy" positions in Q3 2006 reveal about ValueAct's strategy?

All 26 positions, including top bets like Reuters and Gartner, mark a complete portfolio overhaul, highlighting ValueAct's activist focus on fresh undervalued targets ripe for operational fixes.

Q: Why is ValueAct's portfolio so concentrated at 76.2% in the top 10?

Concentration enables meaningful influence in target companies, aligning with ValueAct's activist model where large stakes drive board engagement and value creation.

Q: What sectors dominate ValueAct's early holdings?

Information services (Reuters, Gartner), telecom/tech (Avaya), healthcare (Valeant, MDS), and marketing/data (Acxiom, Catalina) lead, reflecting bets on intellectual property-heavy firms.

Q: How can I track ValueAct Capital's portfolio today?

Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/valueactcapital for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!