ValueSense features - Stock Ideas

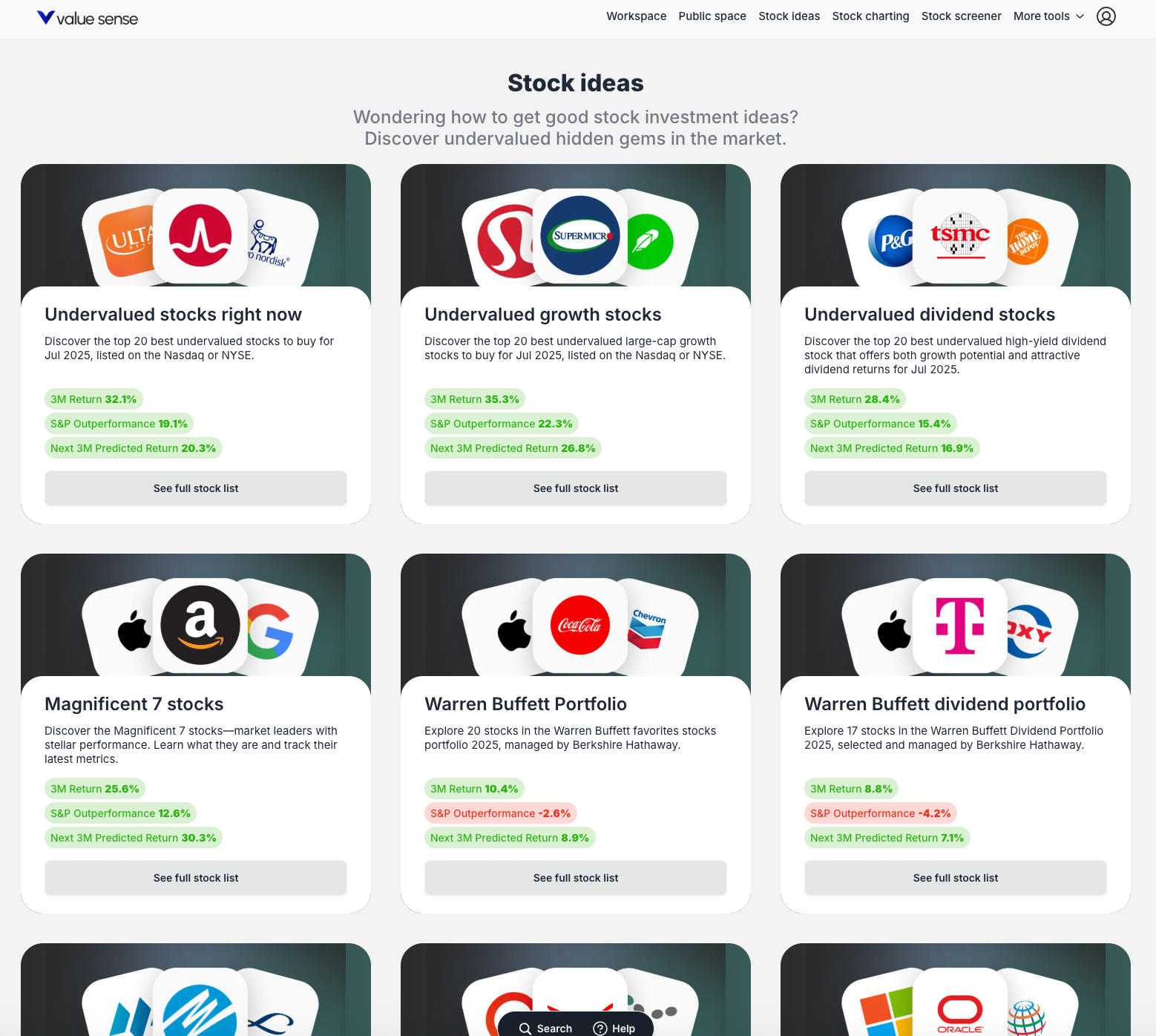

ValueSense's Stock Ideas feature provides a curated library of investment strategies and themed stock lists, making it easy to discover opportunities aligned with proven investment approaches. Instead of starting from scratch, you can explore professionally researched lists based on popular strategies, legendary investors, and specific market conditions.

Accessing Stock Ideas

From the Main Navigation

Click "Stock ideas" in the main navigation bar, located between "Public space" and "Stock charting." This takes you to the comprehensive Stock Ideas library.

Types of Stock Ideas Available

Value-Based Strategies

- Undervalued stocks right now: Companies trading below their intrinsic value

- Undervalued growth stocks: Growing companies available at attractive prices

- Undervalued dividend stocks: Dividend-paying companies trading at discounts

- Undervalued Weekly Performers: Recent winners still trading below fair value

Legendary Investor Portfolios

- Warren Buffett Portfolio: 23 stocks from Berkshire Hathaway's current holdings

- Warren Buffett dividend portfolio: Buffett's dividend-focused positions

- Magnificent 7 stocks: The top-performing mega-cap technology companies

Metric-Based Lists

- 52 week high/low stocks: Companies at significant price levels

- High ROIC stocks: Companies with exceptional return on invested capital

- Low P/E stocks: Value opportunities based on earnings multiples

- Companies with low debt: Financially stable companies with minimal leverage

Performance-Based Lists

- Top Weekly Performers: Best-performing stocks in recent periods

- Quality Stocks That Beat Index (1W): High-quality companies outperforming benchmarks

Understanding Stock Idea Cards

Each stock idea is presented as an informative card containing:

Visual Elements

- Title: Clear name of the investment strategy

- Company Logos: Visual representation of key stocks in the list

- Description: 1-2 sentence summary of the strategy's purpose

Performance Metrics

- 3M Return: How the strategy performed over the last 3 months

- S&P Outperformance: Performance compared to the S&P 500 benchmark

- Next 3M Predicted Return: Forward-looking performance estimate

Action Button

- "See full stock list": Access the detailed analysis and complete stock list

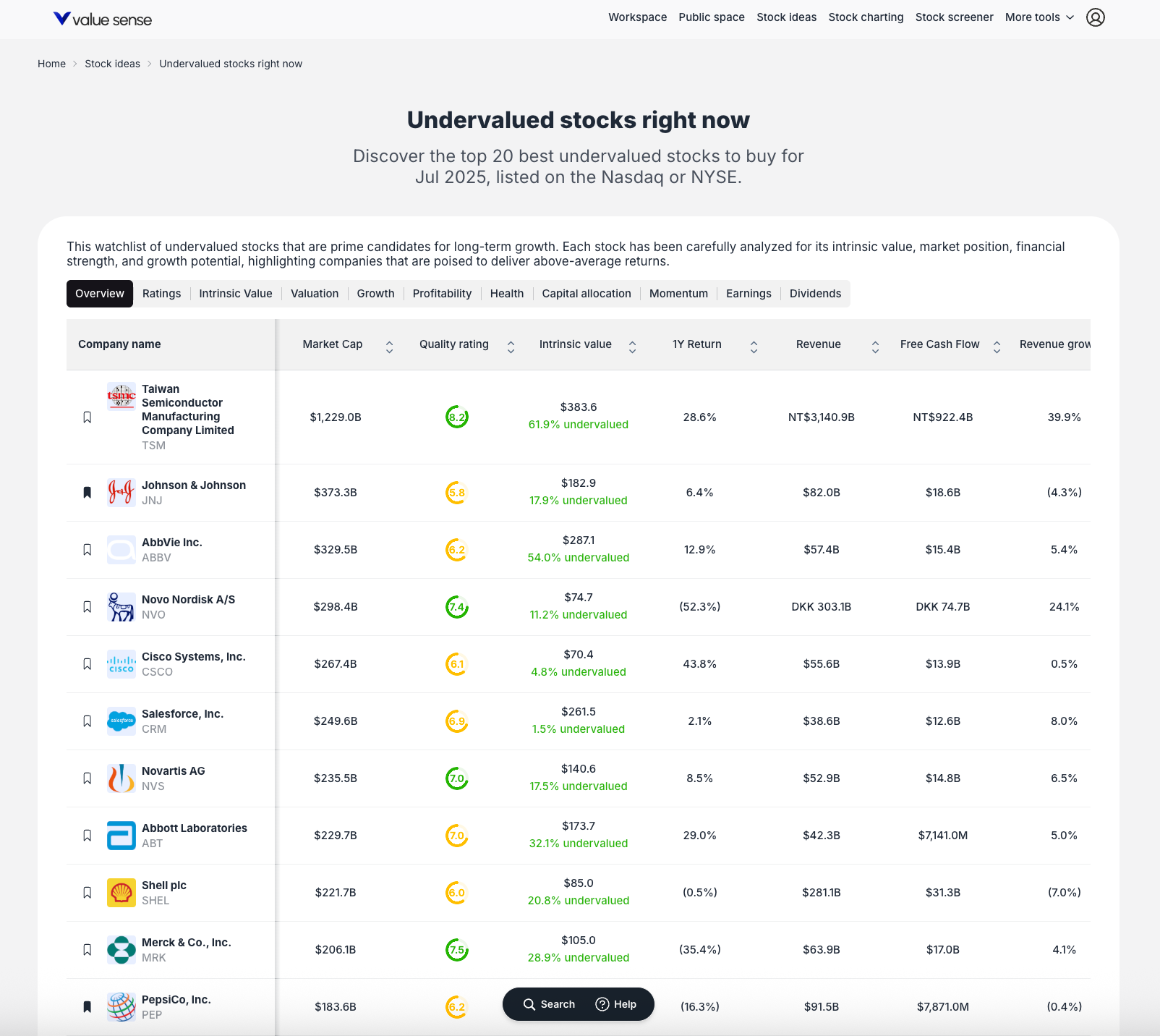

Detailed Stock Analysis

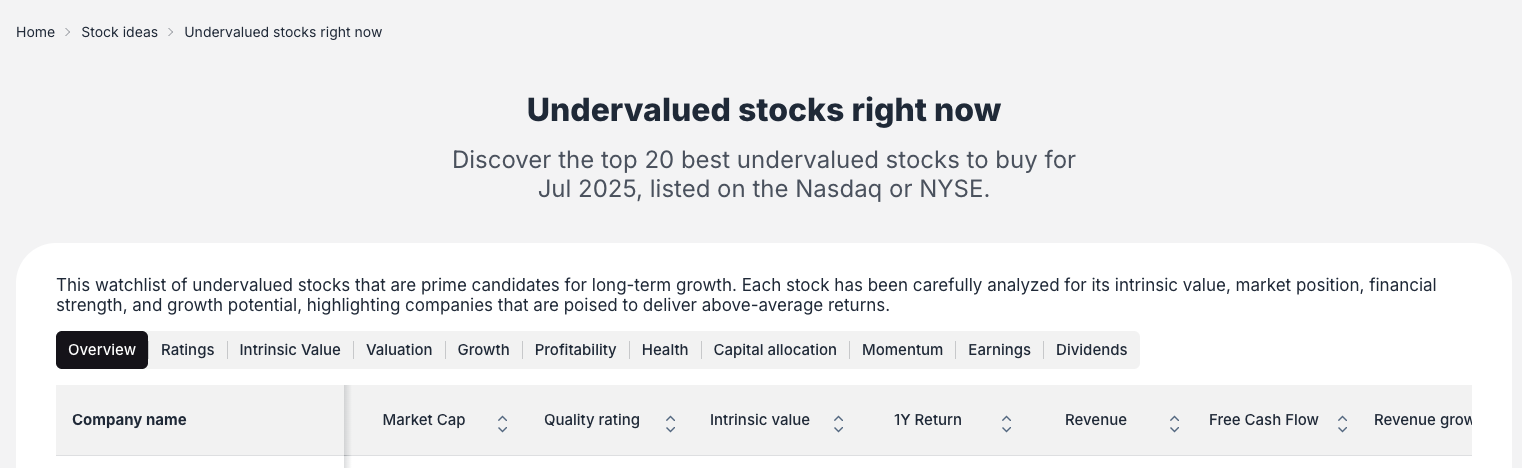

Multi-Dimensional Data Views

Once you select a stock idea, you can analyze the companies through multiple lenses using data tabs:

Overview Tab

- Company names and basic information

- Market capitalization

- Quality ratings

- Intrinsic value analysis

- 1-year return performance

Profitability Tab

- Gross, EBIT, EBITDA, and Net margins

- Profitability rating scores

- Comparative margin analysis across companies

Health Tab

- Debt levels (Net Debt, Net Debt to FCF)

- Liquidity ratios (Current and Quick ratios)

- Overall financial health scores

Capital Allocation Tab

- ROIC (Return on Invested Capital)

- ROE (Return on Equity)

- ROCE (Return on Capital Employed)

- Capital allocation efficiency scores

Momentum Tab

- Current stock prices and 52-week high/low data

- Recent performance metrics

- Momentum scoring

Earnings Tab

- EPS (Earnings Per Share) data

- Revenue information

- Growth rates and earnings surprises

Key Workflow for Using Stock Ideas

Step 1: Discovery

Browse the visual grid of stock idea cards to find strategies that align with your investment philosophy or current market interests.

Step 2: Initial Assessment

Review the performance metrics on each card to understand how the strategy has performed historically and its forward-looking potential.

Step 3: Deep Dive

Click "See full stock list" to access the complete analysis and stock listings.

Step 4: Comparative Analysis

Use the data tabs to compare companies within the list across different fundamental metrics. This helps identify the most attractive opportunities within each strategy.

Step 5: Individual Research

Identify specific companies that stand out in the analysis for further individual investigation.

Best Practices for Stock Ideas

Strategy Selection

- Choose ideas that align with your risk tolerance and investment timeline

- Consider market conditions when selecting performance-based strategies

- Mix different types of ideas for diversification

Analysis Approach

- Start with the Overview tab to get familiar with the companies

- Use the Health tab to assess financial stability

- Check the Profitability tab for business quality

- Review Momentum for timing considerations

Integration with Other Tools

- Use Stock Ideas as a starting point for deeper individual stock analysis

- Add interesting companies to your watchlists

- Create custom screeners based on insights from the ideas

Discovering More Opportunities

Explore More Stock Ideas

Each stock idea page includes an "Explore more stock ideas" section at the bottom, featuring additional strategies and helping you discover new investment approaches.

Continuous Discovery

- Check the Stock Ideas library regularly for new strategies

- Market conditions change, making different ideas more relevant over time

- Use various ideas to stay informed about different market segments

Stock Ideas transforms the overwhelming task of finding investment opportunities into a structured, strategy-based approach that leverages professional research and proven investment methodologies.