Van Den Berg Management I, Inc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

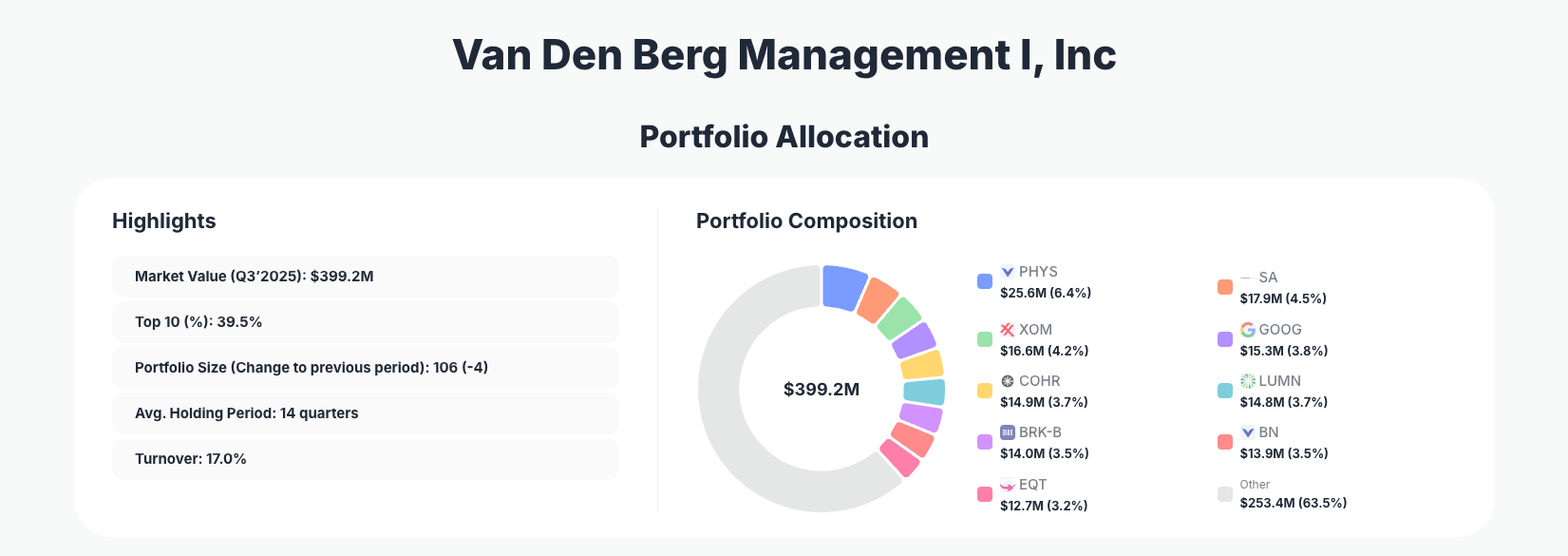

Van Den Berg Management I, Inc continues its disciplined value investing approach amid market volatility, emphasizing commodities and energy plays. Their Q3 2025 $399.2M portfolio shows active management with a new gold position and selective trims in energy and tech names, signaling caution on overvalued sectors while hunting for undervalued assets.

Portfolio Snapshot: Diversified Discipline with Strategic Tweaks

Portfolio Highlights (Q3’2025): - Market Value: $399.2M - Top 10 Holdings: 39.5% - Portfolio Size: 106 -4 - Average Holding Period: 14 quarters - Turnover: 17.0%

The Van Den Berg Management portfolio maintains a broad diversification across 106 positions, a slight reduction of four from the prior quarter, underscoring a patient approach to value hunting rather than chasing momentum. With top 10 holdings comprising just 39.5% of the total, the strategy avoids excessive concentration, allowing flexibility to capitalize on mispriced opportunities in commodities, energy, and select tech names. The 14-quarter average holding period reflects a long-term orientation, prioritizing intrinsic value over short-term noise.

Turnover at 17.0% indicates measured activity—enough to refine positions without excessive trading costs—while the portfolio's $399.2M market value positions it as a mid-sized player capable of nimble moves. This setup in Q3 2025 highlights a focus on hard assets like gold amid inflation concerns, balanced by trims in legacy energy and tech giants, suggesting the firm sees better risk-reward elsewhere in undervalued small-caps and explorers.

Recent changes reveal a tilt toward inflation hedges and energy producers, with the portfolio shrinking slightly in size but maintaining robust exposure to cyclical sectors. Tracking via ValueSense's superinvestor page shows how these adjustments align with broader market rotations away from megacaps.

Top Positions Breakdown: New Gold Entry Amid Energy and Tech Trims

Van Den Berg Management's portfolio leads with a bold new Sprott Physical Gold Trust (PHYS) "Buy" at 6.4% $25.6M, signaling a fresh bet on precious metals as an inflation hedge. This tops the changes list, followed by a minor trim in Seabridge Gold Inc. (SA) (Reduce 1.33%, 4.5%, $17.9M), maintaining gold exposure while dialing back slightly on this explorer.

Energy remains prominent, with significant reductions in Exxon Mobil (XOM) (Reduce 6.04%, 4.2%, $16.6M) and trims across the board, contrasted by an addition to EQT Corporation (EQT) (Add 1.22%, 3.2%, $12.7M). Tech exposure saw cuts like Alphabet (GOOG) (Reduce 6.02%, 3.8%, $15.3M) and Coherent (COHR) (Reduce 9.81%, 3.7%, $14.9M), indicating profit-taking in high-flyers.

Other notable moves include a small trim in Lumen Technologies (LUMN) (Reduce 0.25%, 3.7%, $14.8M), Berkshire Hathaway (BRK-B) (Reduce 0.49%, 3.5%, $14.0M), and Brookfield (BN) (Reduce 2.45%, 3.5%, $13.9M), plus an addition to Diamondback Energy (FANG) (Add 1.15%, 3.0%, $11.9M). These shifts blend commodity strength with energy upside, trimming legacy names for higher-conviction plays.

What the Portfolio Reveals About Van Den Berg's Strategy

Van Den Berg Management's Q3 moves paint a picture of value-oriented caution in a frothy market, favoring tangible assets over speculative growth.

- Commodities and Inflation Hedges: The new PHYS position and SA holding underscore a sector focus on gold, likely as a portfolio ballast against currency debasement and geopolitical risks.

- Energy Cyclicals Over Majors: Additions to EQT and FANG alongside XOM trims suggest preference for nimble producers with strong balance sheets, betting on natural gas and oil demand.

- Tech Pruning for Value: Reductions in GOOG and COHR indicate risk management, avoiding overvalued megacaps in favor of undervalued industrials and resources.

- Diversified Risk Approach: With 106 holdings and low top-10 concentration, the strategy spreads bets while maintaining conviction in cyclicals, supported by a lengthy 14-quarter hold period.

This blend reveals a classic value playbook: patience in holding winners, aggressive trims on laggards, and opportunistic entries into beaten-down sectors.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Sprott Physical Gold Trust (PHYS) | $25.6M | 6.4% | Buy |

| Seabridge Gold Inc. (SA) | $17.9M | 4.5% | Reduce 1.33% |

| Exxon Mobil Corporation (XOM) | $16.6M | 4.2% | Reduce 6.04% |

| Alphabet Inc. (GOOG) | $15.3M | 3.8% | Reduce 6.02% |

| Coherent, Inc. (COHR) | $14.9M | 3.7% | Reduce 9.81% |

| Lumen Technologies, Inc. (LUMN) | $14.8M | 3.7% | Reduce 0.25% |

| Berkshire Hathaway Inc. (BRK-B) (BRK-B) | $14.0M | 3.5% | Reduce 0.49% |

| Brookfield Corporation (BN) | $13.9M | 3.5% | Reduce 2.45% |

| EQT Corporation (EQT) | $12.7M | 3.2% | Add 1.22% |

The top 10 holdings represent 39.5% of the portfolio, a balanced concentration that avoids over-reliance on any single name while allowing meaningful bets like the 6.4% PHYS position. Notable reductions in XOM 6.04% and COHR 9.81% freed up capital for additions like EQT and the outright PHYS buy, demonstrating dynamic position sizing to enhance returns.

This table highlights Van Den Berg's preference for mid-sized stakes in cyclicals—gold at 6.4%, energy spread across XOM, EQT—trimming tech and legacy holdings to maintain discipline. The modest turnover supports a strategy where no position exceeds 6.4%, promoting stability in volatile markets.

Investment Lessons from Van Den Berg Management's Approach

Van Den Berg Management exemplifies patient value investing through this Q3 portfolio. Key principles include:

- Embrace Commodities as Hedges: The PHYS buy shows conviction in hard assets during uncertainty—don't ignore inflation signals.

- Trim Winners Ruthlessly: Significant cuts in GOOG and COHR demonstrate taking profits to redeploy into undervalued plays like FANG and EQT.

- Favor Long Holding Periods: 14 quarters average tenure stresses understanding businesses deeply before acting.

- Diversify Without Dilution: 106 positions with 39.5% in top 10 balance risk while sizing bets on high-conviction ideas.

- Active Management in Cyclicals: Energy shifts (XOM trim, EQT add) highlight monitoring sector rotations for asymmetric opportunities.

Looking Ahead: What Comes Next?

With turnover at 17.0% and a net reduction to 106 holdings, Van Den Berg appears poised for selective deployment into undervalued commodities and energy amid potential 2026 rate cuts. The PHYS entry suggests further gold or metals exposure if inflation persists, while energy adds like EQT and FANG position for commodity rebounds.

Cash from trims in XOM and tech could target overlooked small-caps or additional producers, especially if oil/gas prices stabilize. Current positioning—gold ballast, energy tilt—sets up well for cyclical upswings, though broader market volatility may prompt more pruning. Track updates on their portfolio page for Q4 signals.

FAQ about Van Den Berg Management Portfolio

Q: What are the biggest changes in Van Den Berg Management's Q3 2025 13F filing?

A: Key moves include a new "Buy" in PHYS 6.4%, additions to EQT (Add 1.22%) and FANG (Add 1.15%), with major trims in XOM (Reduce 6.04%) and COHR (Reduce 9.81%).

Q: Why does Van Den Berg maintain such a large number of holdings with low top-10 concentration?

A: The 106-position portfolio and 39.5% top-10 weighting reflect a diversified value strategy, spreading risk across undervalued names while allowing conviction bets like PHYS, enabling flexibility in rotating capital.

Q: What sectors dominate Van Den Berg's portfolio strategy?

A: Commodities (PHYS, SA), energy (XOM, EQT, FANG), and select tech/industrials (GOOG, COHR, LUMN), with trims favoring inflation hedges and producers over legacy giants.

Q: How can I track and follow Van Den Berg Management's portfolio?

A: Monitor quarterly 13F filings on the SEC site, noting the 45-day lag, or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/vandenberg for real-time analysis, historical changes, and visualizations.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!