Visa Stock Analysis: Undervalued Digital Payments Growth Story

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Visa Inc. (NYSE: V) sits at the core of the digital payments revolution, powering transactions for billions of consumers and businesses worldwide. With resilient earnings growth, a capital-efficient business model, and powerful network effects, Visa remains a dominant force even as fintech disruptors and regulatory changes reshape the payment landscape. In 2025, many analysts and valuation models suggest Visa stock is undervalued, offering a compelling entry point for long-term investors seeking secular growth with unmatched global scale.

Visa’s Business Model: Wide-Moat Leader in Digital Payments

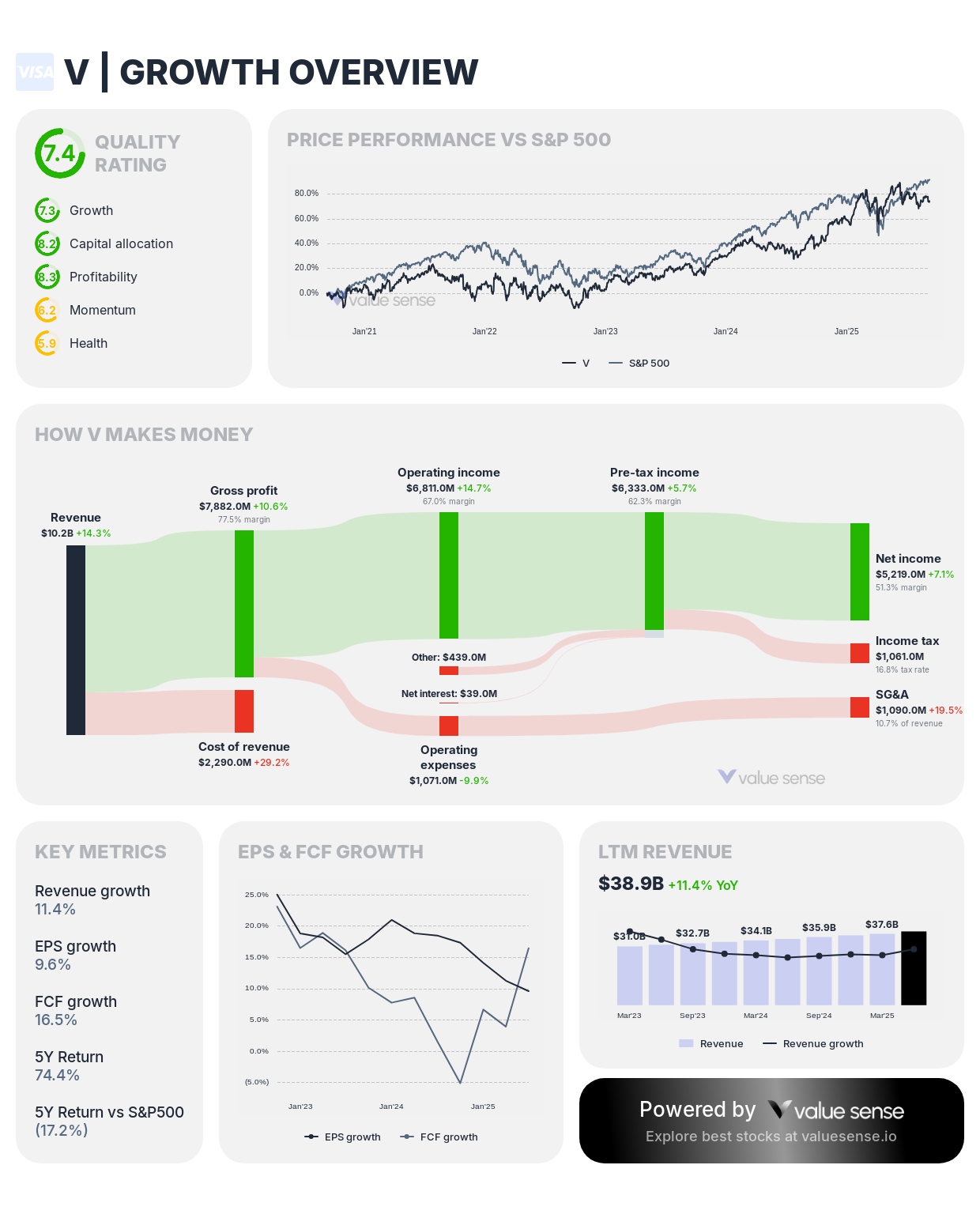

Visa operates the world's preeminent payment processing platform, facilitating over 4.8 billion cards and trillions in annual transaction value. The company earns fees on every swipe, tap, and online payment, using its VisaNet infrastructure to drive high-margin revenue from authorization, clearing, and settlement.

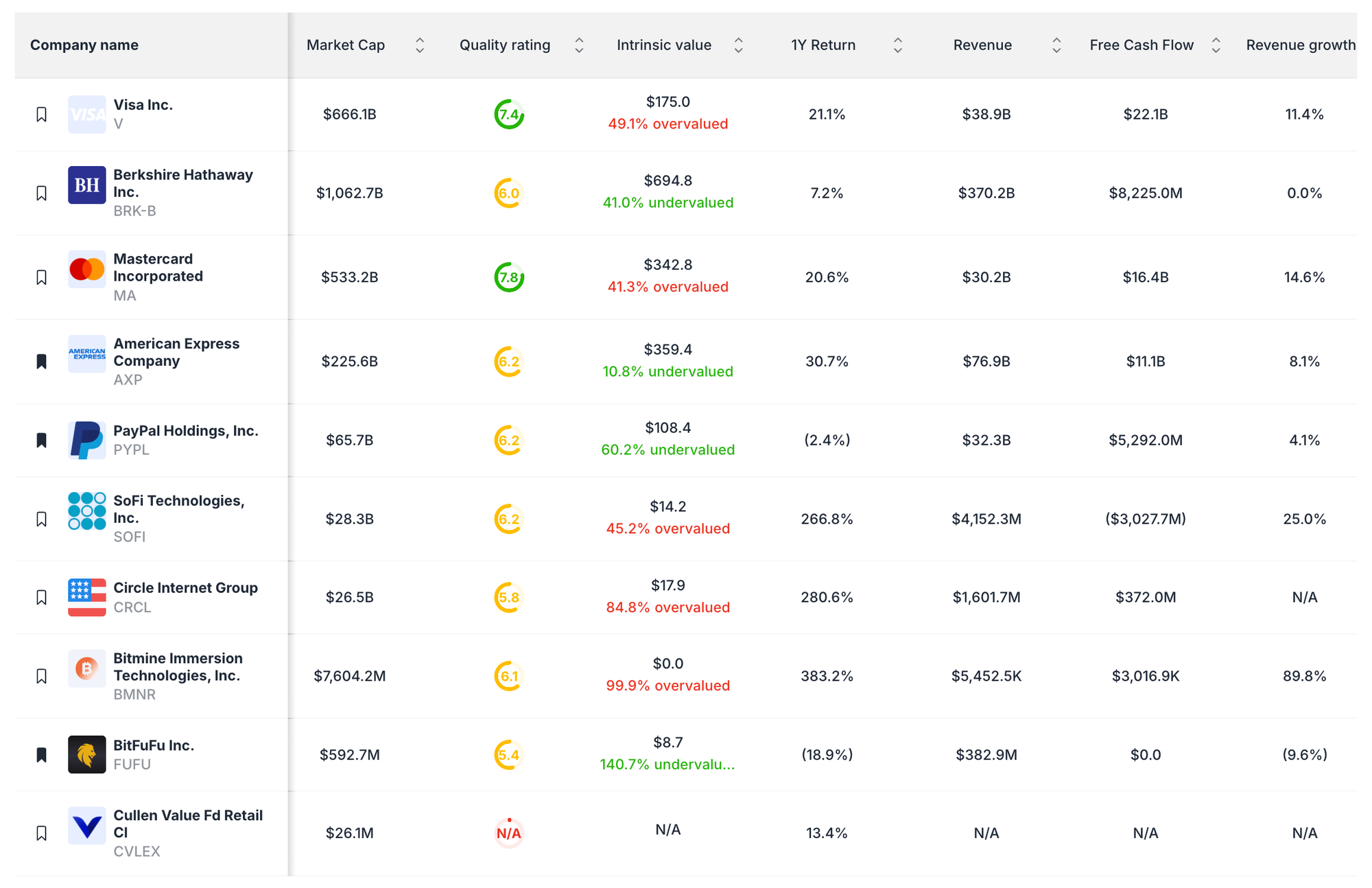

- 2025 market cap: $666B

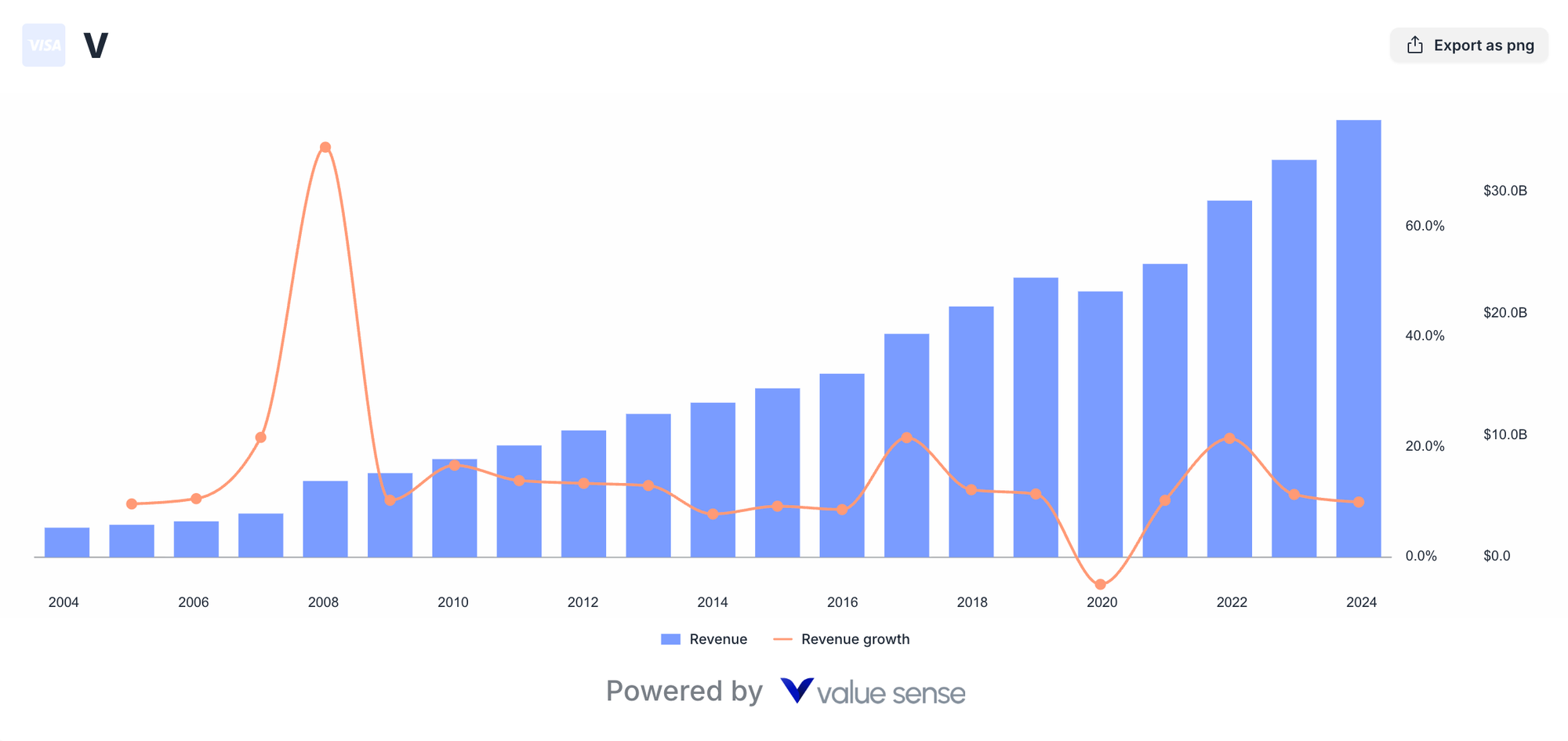

- Over 10% YOY revenue growth (2024–2025)

- Net profit margin: 52%

- Operating margin: >65%

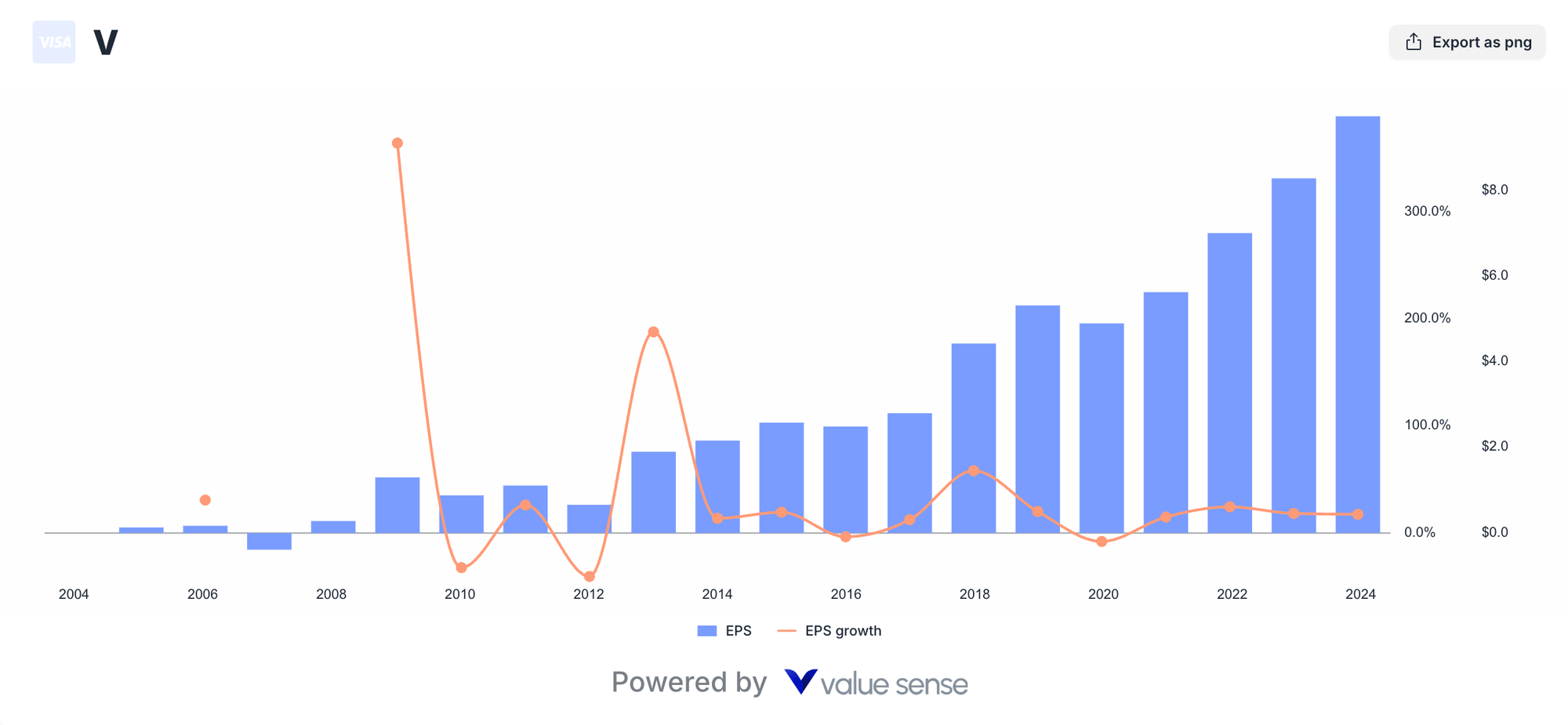

- EPS growth: 12% forecast for FY2025

Visa’s capital-light structure, recurring cash flow, and global reach create a wide economic moat that shields it from most competitive threats. While new regulations, stablecoins, and real-time rails pose risks, Visa adapts quickly by integrating new technologies into its network.

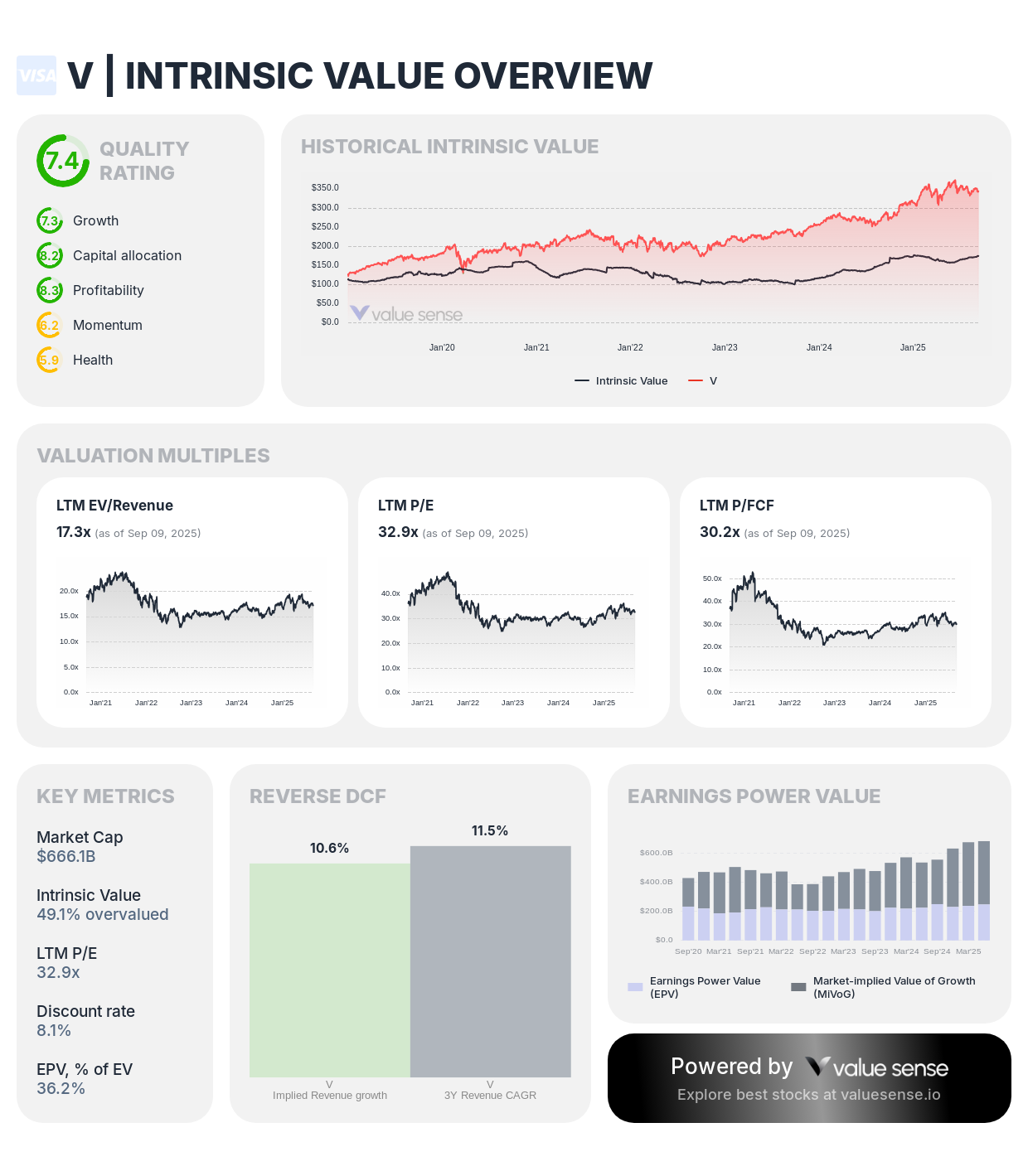

Is Visa Undervalued in 2025?

Despite periods of volatility and macro headwinds, Visa stock is undervalued relative to long-term earnings power and peer comparisons.

Valuation Metrics and Analyst Targets

- Trading at ~30.6x forward earnings (historic 10-year avg: 28.6x)

- PEG ratio: 2.37x (reflects strong growth for stable company)

- FY2025 EPS consensus: $11.42–$11.43

- Price targets: Consensus $383–$391; high estimate $430; current price ~$343

- Upside potential: ~12–25% on 1–2 year horizon

Visa’s premium multiple reflects high profitability and stable cash flow, but compared to Mastercard (36x) and PayPal (13x), Visa offers better value adjusted for risk, scale, and market share. DCF and peer benchmarks reinforce the undervalued growth story, as Visa continues to compound earnings faster than market averages.

Growth Drivers: Digital Wallets, Cross-Border, and Value-Add Services

Visa leverages its network scale to capture new growth channels:

- Value-Added Services (RiskTech, fraud protection, analytics): 60%+ Q2 revenue growth

- Visa Direct instant payments: 3.3 billion transactions in Q3 (+25% YoY)

- Cross-border volumes surge as travel rebounds

- Stablecoin and crypto integration via VisaNet

- Tap-to-phone, AI-driven fraud analytics, B2B Connect platform expansion

Visa’s ability to adapt to new payment rails, regulatory requirements, and consumer habits sets it apart from digital-native competitors. Merchants and partners continue to rely on Visa for settlement reliability, security, and broad consumer reach—critical factors amid global digitization.

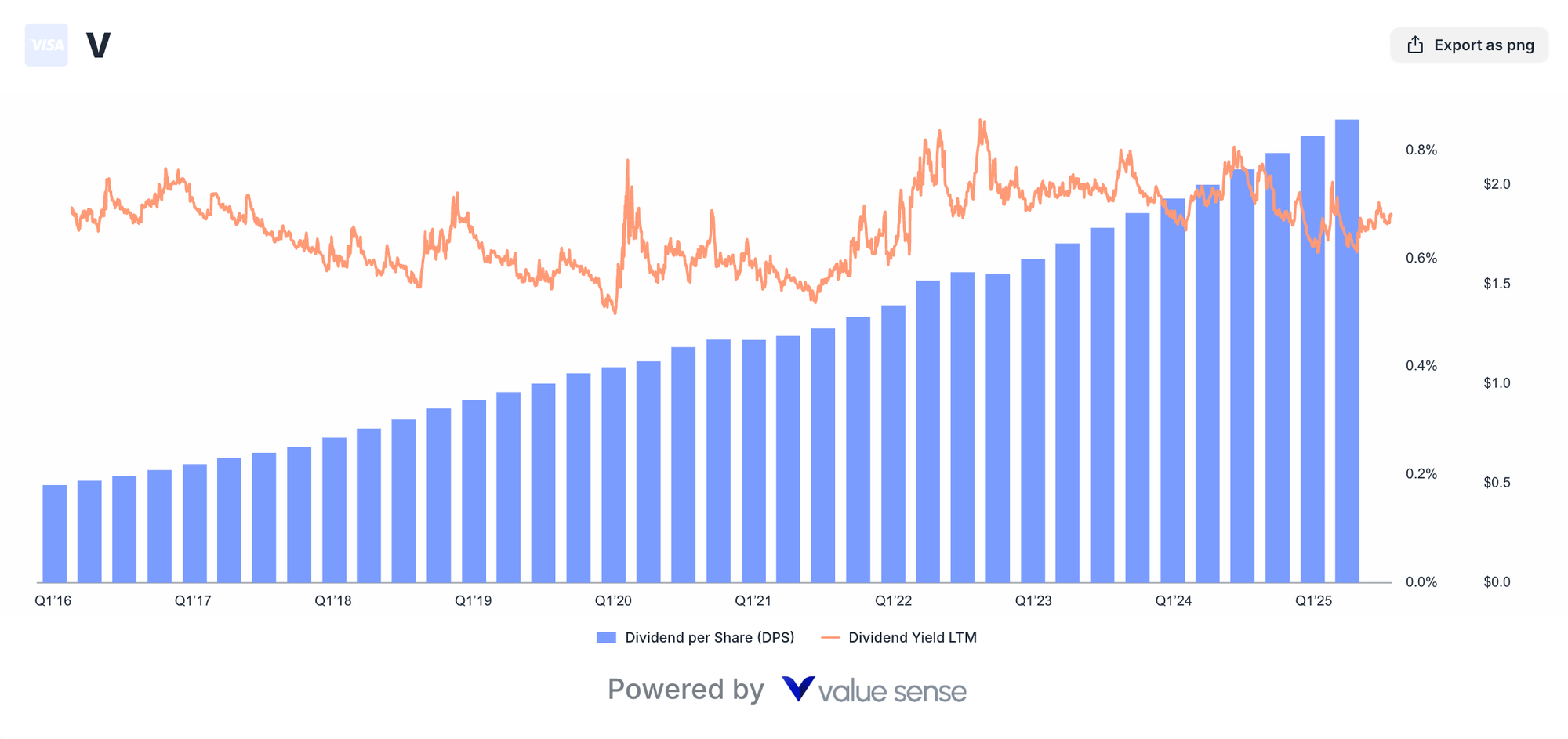

Capital Returns: Share Buybacks and Dividends

Visa emphasizes shareholder returns through aggressive buybacks and steady dividend growth:

- $30B buyback program (12.5% share reduction since 2019)

- Forward dividend yield: 0.69%

- 5-year dividend growth CAGR: +14.5%

- Dividend payout supported by robust free cash flow ($20B+ net income in fiscal 2025)

Visa’s capital allocation discipline boosts total shareholder return, driving double-digit compound annual growth for both EPS and dividends.

Competitive Position vs. Mastercard and PayPal

- Mastercard (MA) trades at a higher multiple (36x) but offers similar growth, slightly less global reach

- PayPal (PYPL) is much cheaper (13x) but faces slowing growth and weaker network effects

- Visa maintains industry leadership through network scale, reliability, and a robust regulatory compliance record

Risks: Regulation, Technology Disruption, and Macro Factors

While the payment space faces constant change, Visa’s resilience remains evident:

- Regulatory oversight: May slow growth but unlikely to destabilize moat

- Stablecoins and digital currencies: Initial market fears, yet Visa evolves to process new forms of money

- Macro slowdowns: Visa’s transaction-based revenue lets it rebound quickly as consumer activity rises

Legal risks, competition, and tech shifts require vigilance, but the broad institutional “Buy” consensus speaks to Visa’s adaptability and margin protection.

Analyst Consensus: Outlook and Price Targets

- 36/38 analysts rate Visa “Buy” or “Strong Buy”

- Price targets $383–$430 for 12–24 months ahead

- Consensus sees double-digit total return, with steady dividend increases

Growth models estimate:

- 2026: EPS $13.07; revenue $44.4B

- 2028: EPS $17.56; price target $473

- 2030: EPS $23.58; price target $522 (+48% vs. today)

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Salesforce Rule of 40 Analysis: CRM Leader's Growth Efficiency Challenge

📖 Procter & Gamble Undervalued: Consumer Staples Dividend Champion

📖 Which Gold Mining Stocks Are Undervalued in September 2025

FAQ

Q: Why is Visa considered undervalued in 2025?

A: Visa’s robust growth, stable market share, and dominant cash flow generation make its current price attractive relative to future earnings and peer multiples.

Q: Does Visa offer dividend growth?

A: Yes. Visa’s dividend yields are modest, but its 14% CAGR and massive buyback program reward patient shareholders.

Q: What’s the main growth engine for Visa?

A: Digital wallet adoption, instant payments (Visa Direct), AI fraud detection, and cross-border transaction recovery drive new growth.

Q: How does Visa compare to competitors?

A: Visa’s scale, global presence, and reliability outperform most rivals, supporting long-term margin and market dominance.

Final Verdict

Visa remains a secular winner in global finance. Its blend of defensive market leadership, double-digit growth, and increasing dividends—combined with moderate valuation multiples and upside from new payment streams—make Visa stock a strategic buy for value-focused, long-term investors in 2025.