Wallace Weitz - Weitz Large Cap Equity Fund Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Wallace Weitz - Weitz Large Cap Equity Fund continues to exemplify patient value investing through disciplined portfolio adjustments. His $1.84B portfolio in Q3 2025 shows low turnover with selective trims in high-fliers and boosts in quality compounders, maintaining a focus on durable businesses across tech, industrials, and financials.

Portfolio Snapshot: Balanced Concentration with Proven Endurance

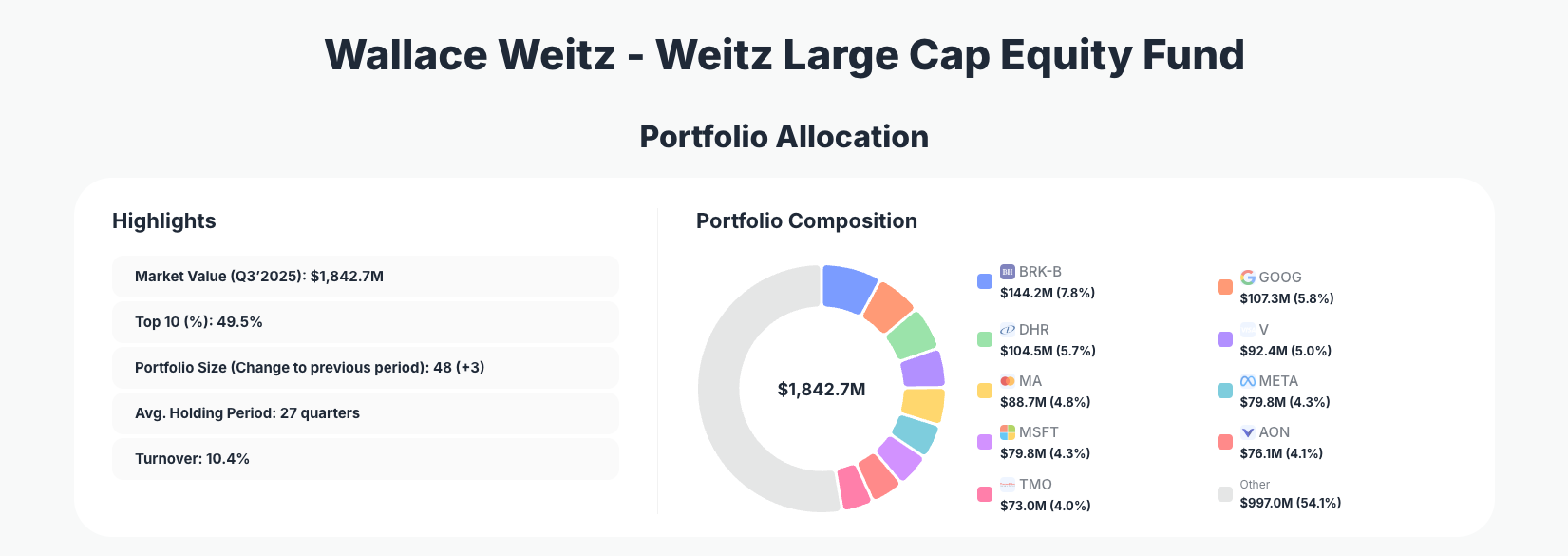

Portfolio Highlights (Q3’2025): - Market Value: $1,842.7M - Top 10 Holdings: 49.5% - Portfolio Size: 48 +3 - Average Holding Period: 27 quarters - Turnover: 10.4%

The Weitz Large Cap Equity Fund portfolio demonstrates a hallmark of Wallace Weitz's approach: meaningful concentration in top ideas without excessive risk. At 49.5% of the total portfolio, the top 10 holdings provide significant exposure to high-conviction names while the overall 48 positions offer diversification across sectors. This structure balances the power of focus with prudent spread, a strategy refined over decades.

With an impressive average holding period of 27 quarters—over six years—Weitz emphasizes long-term ownership of businesses with strong moats. The low 10.4% turnover reflects confidence in core positions, avoiding the churn that plagues many active managers. Recent net adds of three positions signal opportunistic expansion without abandoning discipline. Investors tracking this via Weitz's portfolio page can see how this setup has historically delivered through market cycles.

This Q3 filing underscores Weitz's value-oriented lens, favoring quality large-caps with predictable cash flows amid volatile markets. The portfolio's evolution highlights tactical patience: trimming overvalued names while adding to undervalued ones, positioning for sustained compounding.

Key Positions: Trims in Payments and Meta, Bets on Microsoft and Materials

Wallace Weitz made notable adjustments in Q3 2025, starting with trims across tech and payments giants. Alphabet Inc. (GOOG) at 5.8% saw a Reduce 1.12%, while Visa Inc. (V) dropped 9.22% to 5.0%, Mastercard Incorporated (MA) reduced 5.56% to 4.8%, and Meta Platforms, Inc. (META) trimmed 6.05% to 4.3%, suggesting profit-taking after strong runs.

On the addition side, Microsoft Corporation (MSFT) received a significant Add 18.92% boost to 4.3%, signaling conviction in its AI and cloud dominance. Smaller but meaningful increases included IDEX Corporation (IEX) Add 0.06% to 3.6%, Vulcan Materials Company (VMC) Add 0.38% to 3.6%, and Equifax Inc. (EFX) Add 2.02% to 3.0%. Reductions continued with CoStar Group, Inc. (CSGP) Reduce 5.98% to 3.3% and Global Payments Inc. (GPN) Reduce 1.79% to 2.5%.

Core unchanged anchors provide stability: Berkshire Hathaway Inc. (BRK-B) holds steady at 7.8%, Danaher Corporation (DHR) at 5.7%, Aon plc (AON) at 4.1%, and Thermo Fisher Scientific Inc. (TMO) at 4.0%. These moves blend tech exposure with industrials and financials, reflecting Weitz's focus on resilient franchises.

What the Portfolio Reveals: Quality Moats in a High-Valuation World

Weitz's Q3 adjustments reveal a strategy prioritizing quality businesses with economic moats over speculative growth. Heavy exposure to tech leaders like Microsoft, Alphabet, and Meta (despite trims) shows comfort with innovation-driven compounders, but the payment network reductions (Visa, Mastercard, Global Payments) suggest caution on elevated valuations.

- Sector Focus: Tech and healthcare dominate (Danaher, Thermo Fisher), with emerging industrials bets (IDEX, Vulcan Materials) diversifying into infrastructure plays amid economic shifts.

- Risk Management: Low turnover and long holding periods mitigate volatility; adds to Equifax and Microsoft target data/AI themes with defensive qualities.

- Geographic Concentration: Primarily U.S.-centric large-caps, leveraging domestic growth while avoiding international risks.

This portfolio signals disciplined value hunting: trimming winners to fund undervalued opportunities, maintaining dividend-friendly names, and emphasizing free-cash-flow machines.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Berkshire Hathaway Inc. (BRK-B) | $144.2M | 7.8% | No change |

| Alphabet Inc. (GOOG) | $107.3M | 5.8% | Reduce 1.12% |

| Danaher Corporation (DHR) | $104.5M | 5.7% | No change |

| Visa Inc. (V) | $92.4M | 5.0% | Reduce 9.22% |

| Mastercard Incorporated (MA) | $88.7M | 4.8% | Reduce 5.56% |

| Meta Platforms, Inc. (META) | $79.8M | 4.3% | Reduce 6.05% |

| Microsoft Corporation (MSFT) | $79.8M | 4.3% | Add 18.92% |

| Aon plc (AON) | $76.1M | 4.1% | No change |

| Thermo Fisher Scientific Inc. (TMO) | $73.0M | 4.0% | No change |

The top 10 command 49.5% of the $1.84B portfolio, showcasing Weitz's conviction in a handful of elite names like Berkshire Hathaway and Danaher, both unchanged for stability. Trims in payments (Visa -9.22%, Mastercard -5.56%) freed capital for aggressive adds like Microsoft +18.92%, indicating rotation toward AI leaders while dialing back on mature oligopolies.

This concentration—neither ultra-narrow nor overly diffuse—amplifies returns from winners while the remaining 38 positions provide ballast. It exemplifies risk-adjusted focus, where no single name exceeds 8%, yet top holdings drive performance.

Investment Lessons from Wallace Weitz's Value Approach

- Patience Pays: Long Holding Periods: 27 quarters average tenure teaches holding quality businesses through cycles, avoiding short-term noise.

- Trim Winners, Add to Conviction: Significant reductions in Visa and Meta funded boosts in Microsoft and industrials, showing dynamic position sizing.

- Moats Over Momentum: Emphasis on Berkshire, Danaher, and AON highlights preference for durable competitive advantages.

- Low Turnover Discipline: 10.4% rate underscores minimizing taxes and transaction costs for compounding.

- Balanced Diversification: 48 positions with 49.5% top-10 concentration balances focus and prudence.

Looking Ahead: What Comes Next?

With portfolio size expanding to 48 +3 and low turnover, Weitz appears poised for selective deployment into undervalued large-caps. Recent adds in industrials (Vulcan Materials, IDEX) and data plays (Microsoft, Equifax) suggest interest in infrastructure rebound and AI infrastructure amid moderating inflation.

Cash levels aren't disclosed in 13F but implied flexibility from trims could target healthcare or consumer staples if valuations correct. Current positioning—tech tilted but diversified—sets up well for 2026 volatility, leveraging long-duration holdings for income and growth.

FAQ about Wallace Weitz Portfolio

Q: What drove the major trims in Visa, Mastercard, and Meta during Q3 2025?

A: Weitz trimmed Visa (V) by 9.22%, Mastercard (MA) by 5.56%, and Meta (META) by 6.05%, likely locking in gains after strong rallies while reallocating to higher-conviction names like Microsoft.

Q: Why does Weitz maintain such concentration in the top 10 holdings?

A: At 49.5%, the top 10 reflect deep research into moat-heavy businesses like BRK-B and DHR, balancing high-conviction bets with 48 total positions for risk control.

Q: What sectors show the strongest conviction in Weitz's strategy?

A: Tech (Microsoft, Alphabet, Meta) and healthcare (Danaher, Thermo Fisher) lead, with growing industrials exposure via Vulcan Materials and IDEX, targeting resilient growth areas.

Q: How can I track Wallace Weitz's Weitz Large Cap Equity Fund portfolio?

A: Follow quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/weitz-investment for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!