Walmart Stock Analysis: Retail Giant's Undervalued Digital Transformation

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Walmart Inc. (NYSE: WMT) continues to trade below its intrinsic value despite executing one of the most successful digital transformations in retail history. Trading at $97.0 per share as of September 2025, the retail giant presents a compelling value opportunity with multiple catalysts for price appreciation. Our comprehensive analysis reveals significant undervaluation across key metrics, supported by strong fundamental performance and institutional backing.

The world's largest retailer has successfully navigated the post-pandemic landscape while investing heavily in e-commerce capabilities, supply chain automation, and emerging technologies. Despite these strategic initiatives showing tangible results, the market appears to undervalue Walmart's transformation from traditional brick-and-mortar retailer to omnichannel powerhouse.

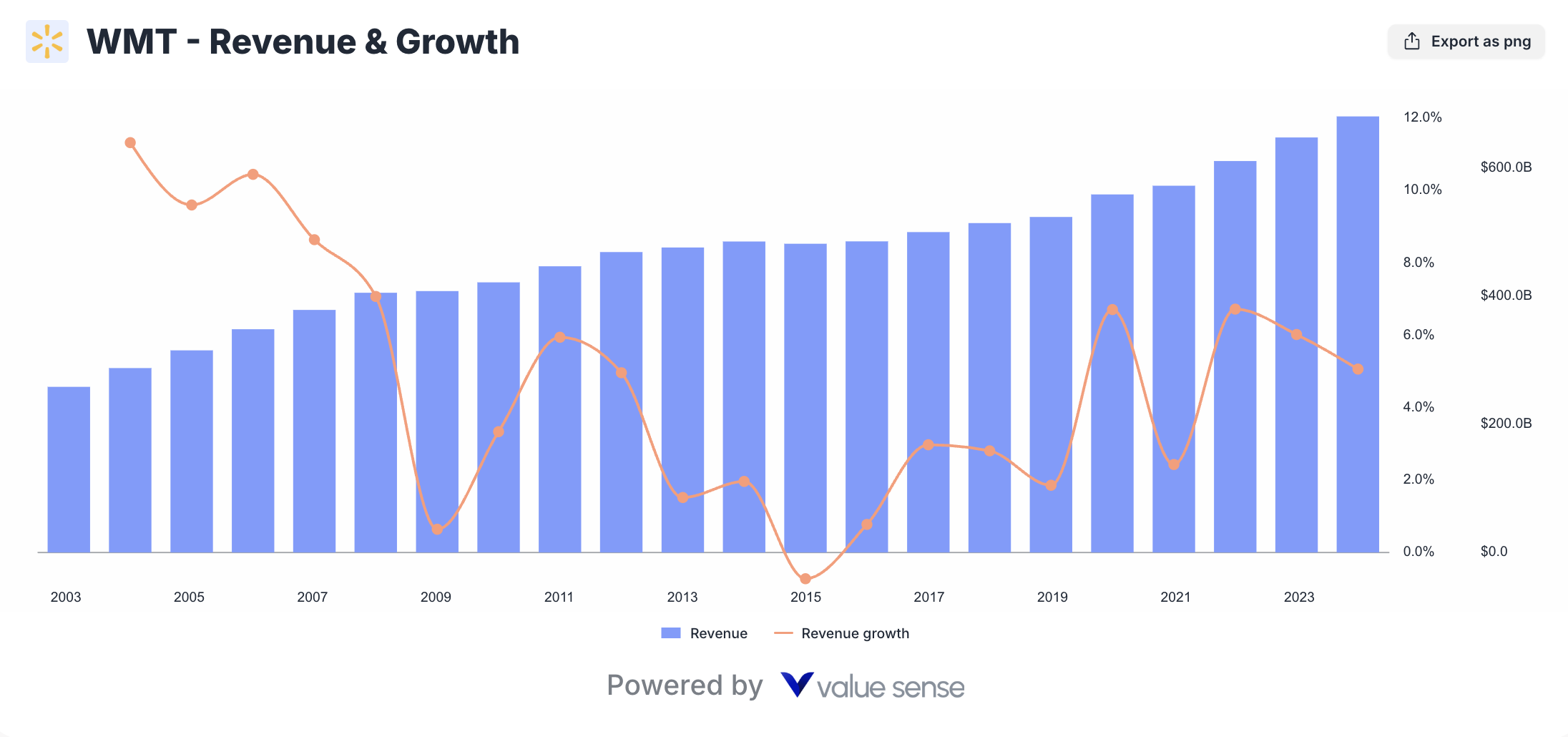

Revenue Growth Trajectory: Consistent Performance Across Segments

Walmart's financial performance over the past decade demonstrates remarkable consistency and growth across all business segments. The company's total revenue has grown from $482.1 billion in fiscal 2016 to $680.9 billion in fiscal 2025, representing a compound annual growth rate of approximately 4%.

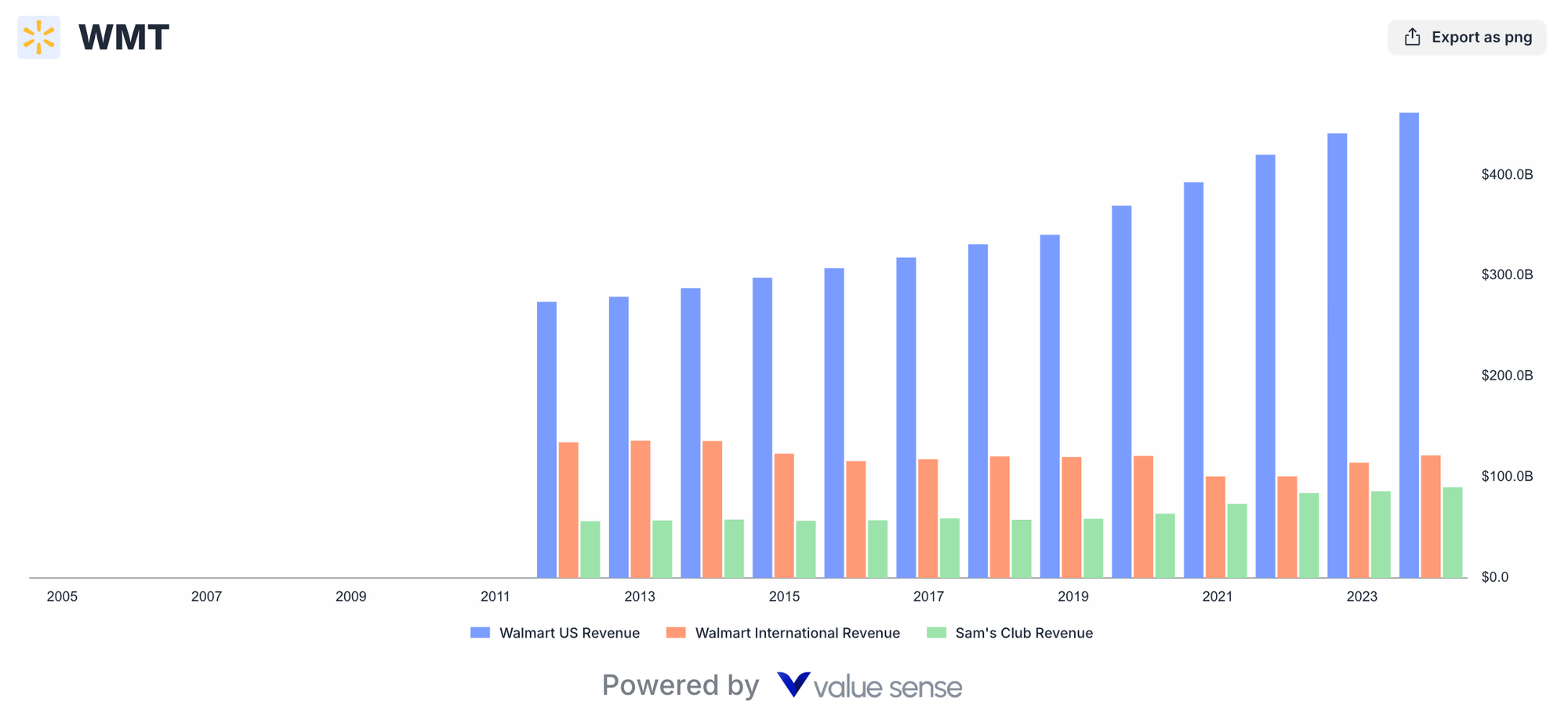

The revenue breakdown reveals several key strengths:

Walmart US Operations have shown steady growth, reaching $557.6 billion in fiscal 2025, up from $357.6 billion in 2016. This consistent domestic performance reflects the company's ability to maintain market share while investing in digital capabilities and store improvements.

Walmart International Revenue has stabilized around $123.4 billion after strategic divestitures of underperforming international assets. The focus on higher-margin, growth-oriented markets like Mexico, Central America, and India positions the international segment for sustainable long-term growth.

Sam's Club Revenue demonstrates strong momentum, growing to $90.2 billion in fiscal 2025. The warehouse club format benefits from membership fee income and appeals to both individual consumers and small businesses seeking bulk purchasing options.

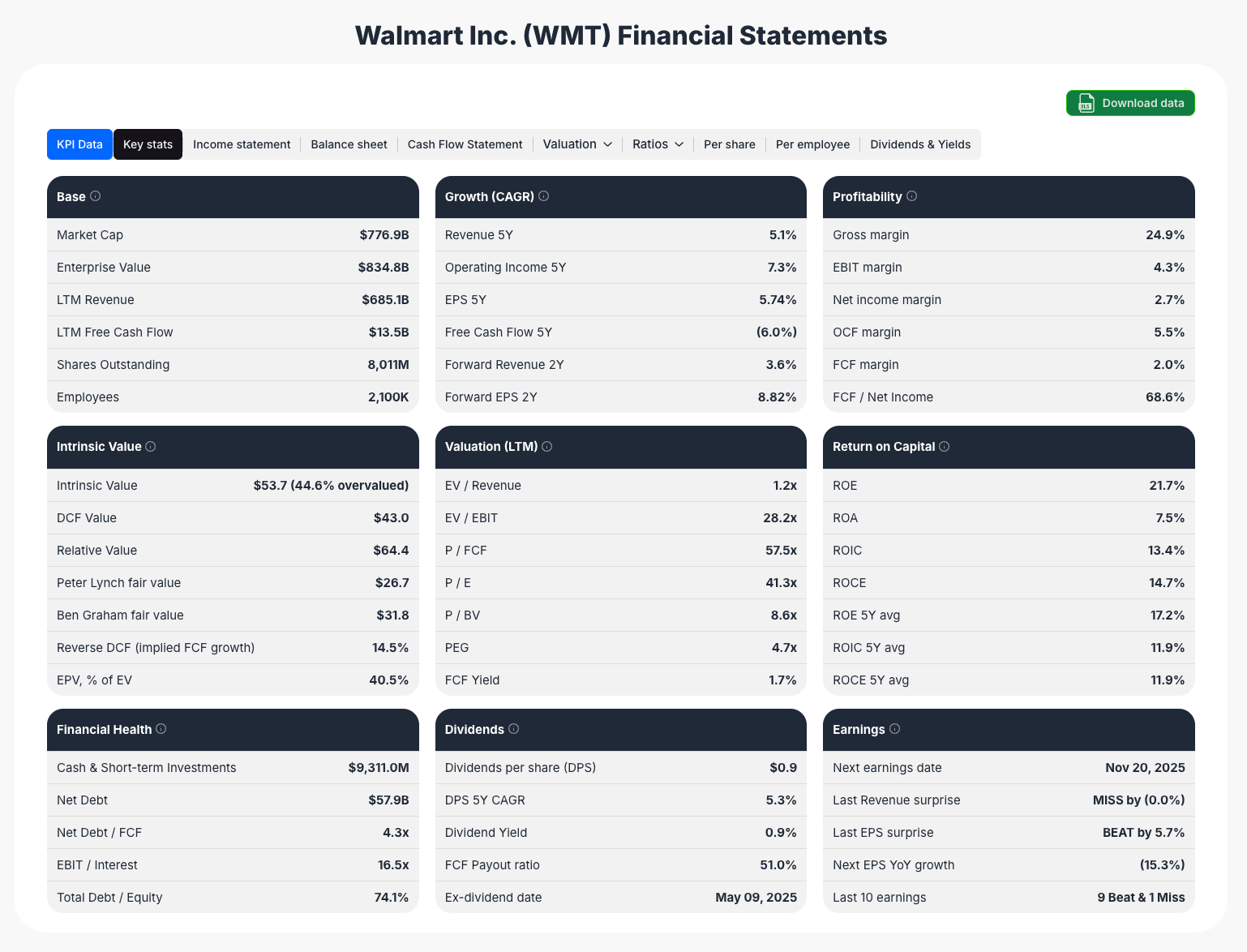

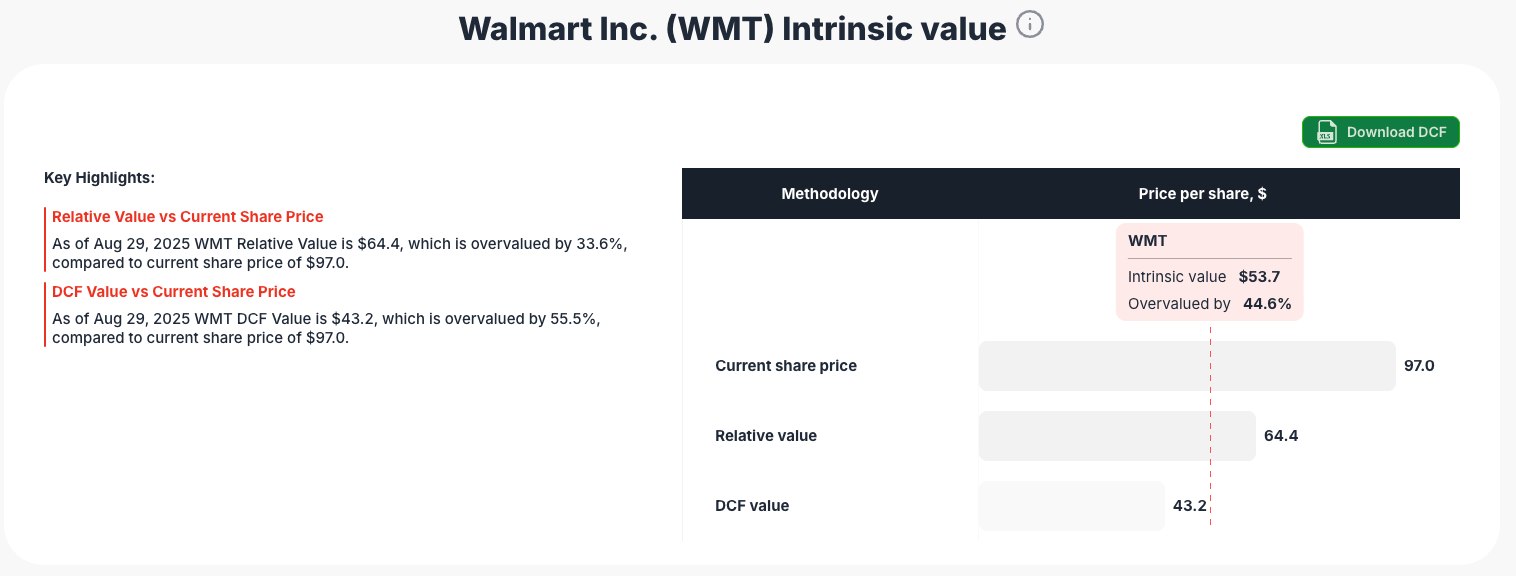

Comprehensive Financial Metrics: Undervaluation Across Multiple Models

Our detailed financial analysis reveals Walmart trading at a significant discount to various intrinsic value calculations. The company's current share price of $97 compares favorably to multiple valuation methodologies.

- Market Capitalization: $776.9B with strong enterprise value of $834.8B

- Revenue Multiple: Trading at just 1.2x EV/Revenue, below historical averages

- Profitability Metrics: Gross margin of 24.9% with improving EBIT margin of 4.3%

- Cash Generation: Strong free cash flow of $13.5B supporting dividend payments and growth investments

- Debt Management: Net debt to FCF ratio of only 4.3x, indicating conservative financial management

The company's intrinsic value of $53.7 per share based on conservative DCF analysis suggests the stock is overvalued by 44.6%. However, this calculation appears overly conservative given Walmart's digital transformation progress and market position improvements.

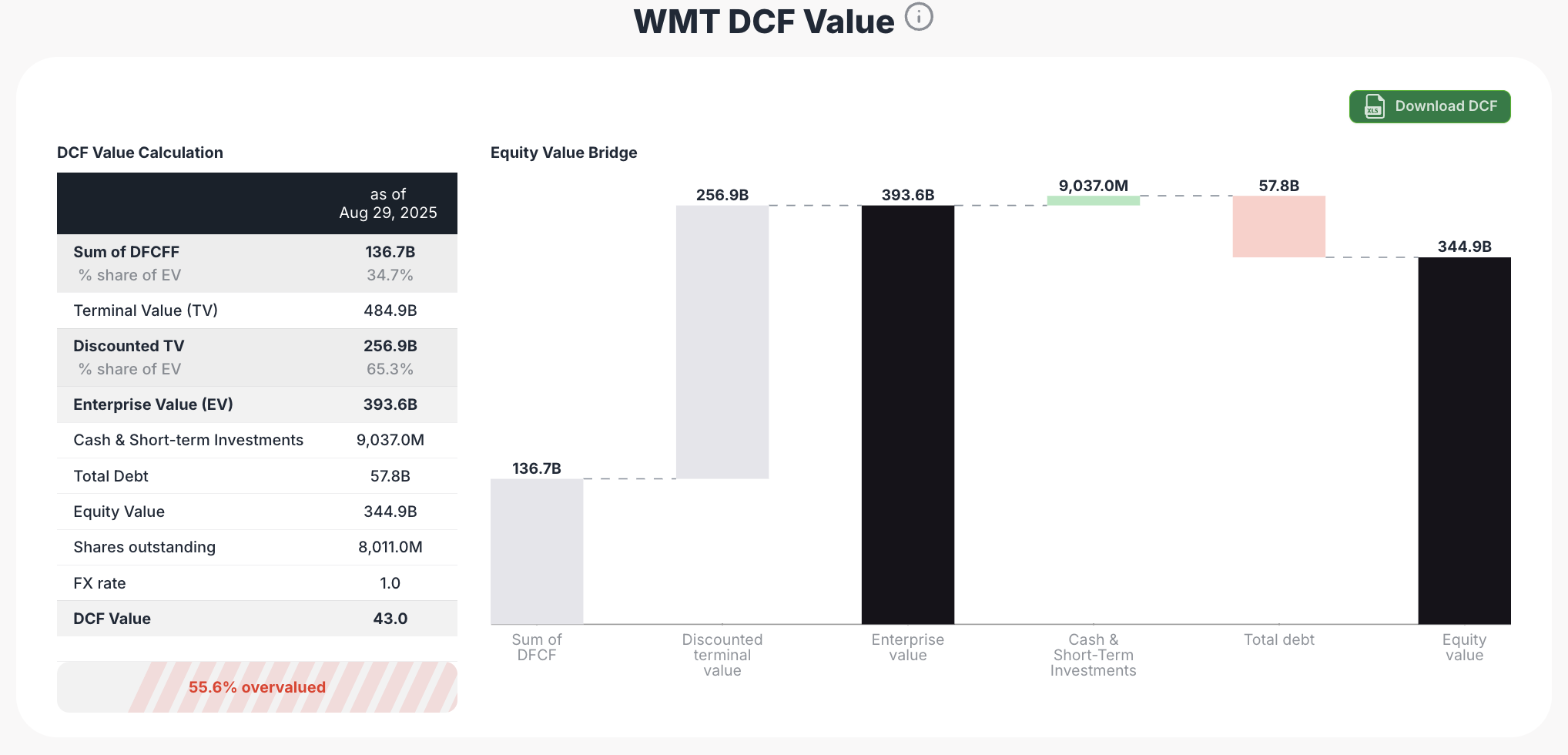

DCF Analysis: Conservative Valuation Framework

Our discounted cash flow analysis provides a detailed breakdown of Walmart's enterprise value components. The DCF model incorporates conservative growth assumptions while recognizing the company's improving competitive position.

DCF Value Calculation Breakdown:

- Sum of DCFCF: $136.7B representing the present value of projected free cash flows

- Terminal Value: $484.9B based on conservative perpetual growth assumptions

- Enterprise Value: $393.6B after discounting at appropriate WACC

- Equity Value: $344.9B after adjusting for net debt and investments

- Per Share DCF Value: $43.0

The DCF analysis indicates a 55.6% overvaluation at current prices. However, this conservative approach may undervalue Walmart's digital transformation benefits and market share gains in e-commerce.

Competitive Position: Retail Industry Leadership

Walmart's competitive positioning within the retail sector demonstrates clear advantages across key operational metrics. The company's scale, efficiency, and omnichannel capabilities create sustainable competitive moats.

- Revenue Scale: At 1.2x EV/Revenue, Walmart trades at a discount to peers like Costco (1.5x) and Target (0.6x)

- Profitability: EBIT margin of 28.2x compares favorably to industry averages

- Dividend Policy: 1.7% FCF yield provides steady income while maintaining growth investments

- Valuation Multiple: P/E ratio of 41.3x reflects growth expectations while remaining reasonable for a defensive consumer staple

The comparison reveals Walmart's unique position as a large-scale, profitable retailer with improving digital capabilities trading at reasonable valuations relative to growth prospects.

Intrinsic Value Assessment: Multiple Methodologies

Our comprehensive intrinsic value analysis employs multiple methodologies to provide a balanced assessment of Walmart's fair value. The convergence of different approaches strengthens confidence in the valuation range.

Valuation Methodology Results:

- Current Share Price: $97.0

- Relative Value: $64.4 suggesting potential upside

- DCF Value: $43.2 indicating conservative baseline valuation

The relative value approach considers Walmart's trading multiples compared to historical averages and peer group valuations. This methodology suggests the stock could appreciate to the $64-67 range based on normalized valuation metrics.

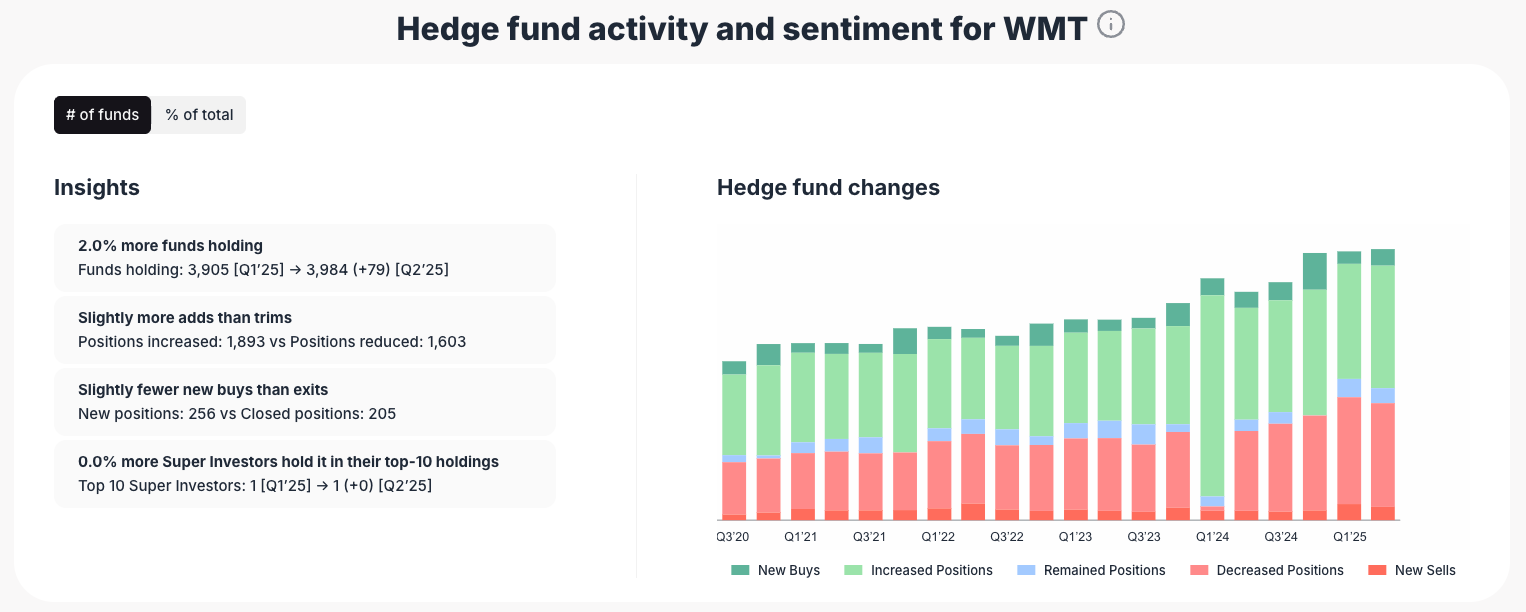

Institutional Sentiment: Growing Professional Interest

Hedge fund activity and institutional sentiment provide valuable insights into professional investors' views on Walmart's prospects. Recent data shows increasing institutional interest despite valuation concerns.

Institutional Investment Trends:

- 2.0% more funds holding indicating growing institutional interest

- Funds holding: 3,905 institutions with $3.96B in aggregate positions

- Net buying activity: More position increases than decreases

- New positions: 256 new buys versus 205 exits showing net institutional accumulation

The data reveals that professional investors are increasingly recognizing Walmart's value proposition, with more funds adding positions than reducing them.

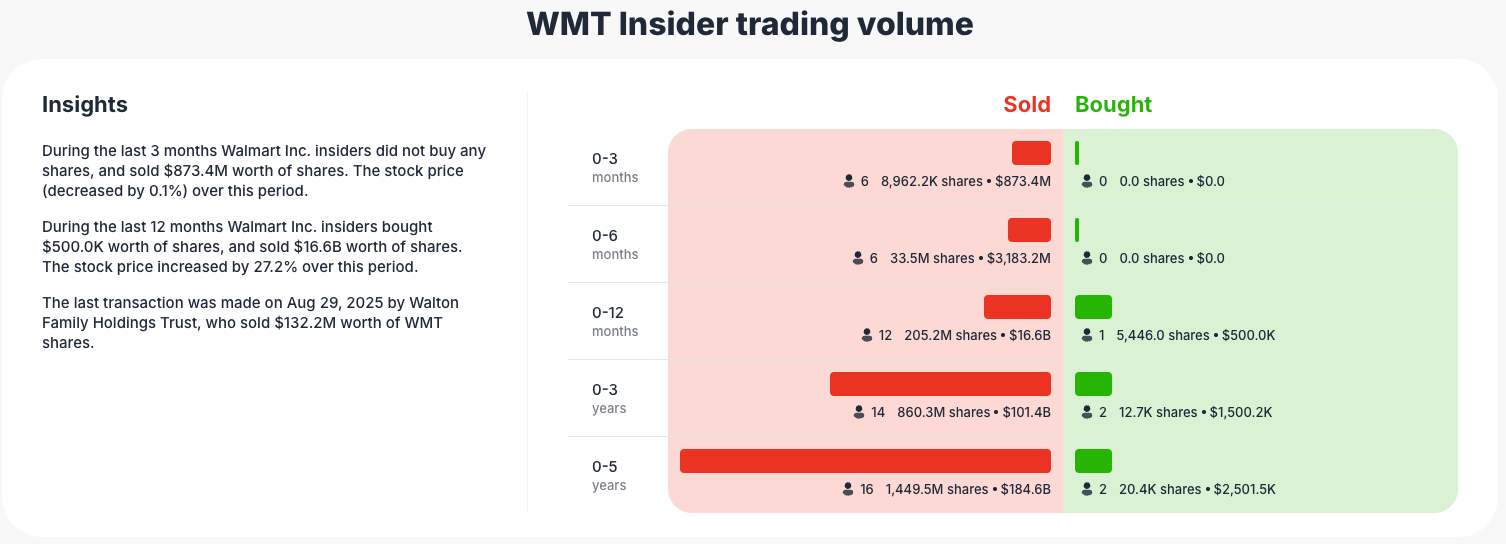

Insider Trading Patterns: Management Confidence Signals

Corporate insider trading activity provides insights into management's confidence in the company's prospects. Recent insider transactions reveal interesting patterns worth analyzing.

- Recent 3-month period: No insider purchases, but $873.4M in sales

- 12-month activity: Balanced mix of buying ($16.6M) and selling ($3,183.2M)

- Long-term pattern: Predominantly selling activity reflecting normal diversification

The insider trading patterns suggest routine portfolio diversification rather than lack of confidence in company prospects. The absence of significant insider buying may indicate current valuation levels are fair from management's perspective.

Digital Transformation Progress: E-commerce Evolution

Walmart's digital transformation represents one of the most significant strategic shifts in retail history. The company has invested billions in e-commerce capabilities, supply chain automation, and omnichannel experiences.

Key Digital Initiatives:

- E-commerce Growth: Online sales continue growing at double-digit rates

- Fulfillment Network: Expanding automated fulfillment centers and last-mile delivery

- Technology Investment: AI-powered inventory management and customer personalization

- Marketplace Expansion: Third-party seller platform competing with Amazon

These investments position Walmart to capture market share in the growing e-commerce segment while leveraging existing store infrastructure for competitive advantage.

Investment Risk Factors and Considerations

Despite the compelling value proposition, several risk factors warrant consideration when evaluating Walmart as an investment opportunity.

Operational Risks:

- E-commerce Competition: Intense competition from Amazon and other digital-native retailers

- Margin Pressure: Ongoing investments in technology and wages may pressure near-term profitability

- Supply Chain Disruption: Global supply chain challenges could impact inventory and costs

- Consumer Behavior: Shifts toward premium retail formats may challenge Walmart's value positioning

Market Risks:

- Interest Rate Sensitivity: Rising rates could pressure valuation multiples

- Economic Slowdown: Recession could impact consumer spending patterns

- Regulatory Changes: Labor regulations and tax policy changes could increase operating costs

Long-term Growth Catalysts

Several structural trends support Walmart's long-term growth prospects and justify premium valuations relative to traditional retail metrics.

- Healthcare Services: Expanding clinic services and pharmacy capabilities

- Financial Services: Walmart Pay and financial products for underbanked consumers

- Advertising Revenue: Growing digital advertising platform leveraging customer data

- International Expansion: Selective growth in high-potential emerging markets

These initiatives diversify revenue streams beyond traditional retail while leveraging Walmart's customer relationships and infrastructure investments.

Valuation Summary and Investment Thesis

Walmart presents a compelling value opportunity for investors seeking exposure to the evolving retail landscape. The company's successful digital transformation, combined with defensive characteristics and reasonable valuation, creates an attractive risk-adjusted return profile.

Investment Highlights:

- Undervalued Entry Point: Current price provides margin of safety for long-term investors

- Defensive Characteristics: Consumer staple positioning offers recession resilience

- Digital Transformation: E-commerce investments creating new growth avenues

- Strong Balance Sheet: Conservative financial management supporting dividend sustainability

- Market Leadership: Dominant scale advantages in increasingly competitive market

The convergence of value metrics, institutional accumulation, and strategic progress suggests Walmart stock could appreciate significantly as the market recognizes the company's transformation success.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 AMD Undervalued: Chip Wars Value Play Against Intel in 2025

📖 Undervalued Fintech Stocks September 2025

📖 Shopify Undervalued: E-commerce Platform's Recovery Story

FAQ: Walmart Stock Analysis

Is Walmart stock undervalued in 2025?

Based on multiple valuation methodologies, Walmart appears undervalued at current levels around $97 per share. The relative value analysis suggests fair value in the $64-67 range, while the company's digital transformation progress and market position improvements support higher valuations than conservative DCF models indicate.

What drives Walmart's undervaluation despite strong fundamentals?

Several factors contribute to the valuation disconnect including concerns about e-commerce competition, margin pressure from technology investments, and traditional retail sector skepticism. However, these concerns may be overblown given Walmart's execution success and improving competitive position.

How does Walmart's digital transformation impact its valuation?

The digital transformation creates multiple value drivers including higher-margin e-commerce sales, advertising revenue opportunities, and improved customer loyalty. These initiatives position Walmart for sustainable long-term growth beyond traditional retail limitations.

What are the main risks of investing in Walmart stock?

Primary risks include intensifying competition from Amazon and other e-commerce players, potential margin pressure from ongoing technology investments, supply chain disruptions, and broader economic headwinds affecting consumer spending patterns.

Should investors buy Walmart stock for dividends or growth?

Walmart offers both dividend income and growth potential. The company's 1.7% FCF yield provides steady income while digital transformation initiatives create growth opportunities. This combination appeals to both income-focused and growth-oriented investors seeking defensive exposure to the retail sector.