Warren Buffett - Berkshire Hathaway Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

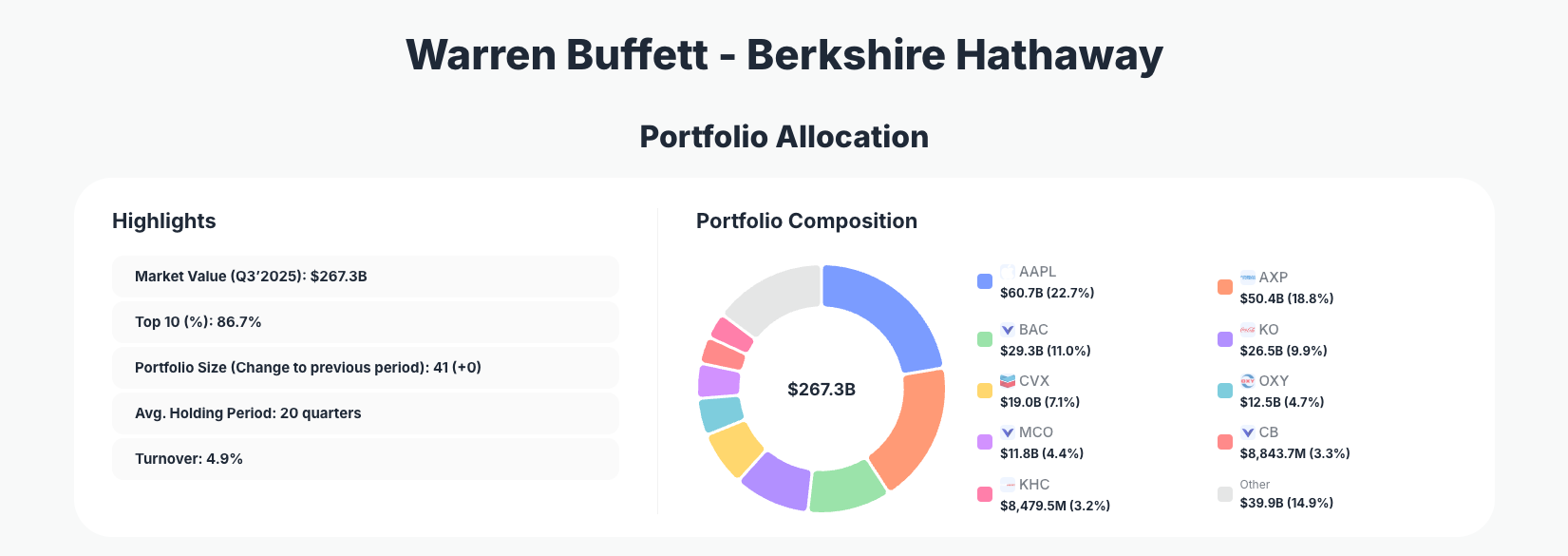

Warren Buffett - Berkshire Hathaway continues to exemplify timeless value investing principles through disciplined portfolio adjustments in his Q3 2025 portfolio, valued at $267.3B. Notable moves include significant reductions in mega-cap tech like AAPL and BAC, alongside selective additions in insurance (CB), media (SIRI), and consumer plays, signaling a rotation toward resilient, cash-generating businesses amid market highs.

Portfolio Overview: The Power of Extreme Concentration

Portfolio Highlights (Q3’2025): - Market Value: $267.3B - Top 10 Holdings: 86.7% - Portfolio Size: 41 +0 - Average Holding Period: 20 quarters - Turnover: 4.9%

Berkshire Hathaway's $267.3B portfolio maintains its hallmark ultra-concentrated structure, with the top 10 holdings commanding 86.7% of assets—a level of focus that underscores Buffett's conviction in a select few businesses he deeply understands. The low turnover of 4.9% and average holding period of 20 quarters (roughly 5 years) reflect a buy-and-hold philosophy, avoiding the churn that plagues most institutional investors. Portfolio size remains steady at 41 positions, indicating no major additions or exits at the top level.

This concentration isn't reckless; it's rooted in Berkshire's edge in analyzing consumer-facing giants with durable moats. Recent trims in overvalued positions like Apple have generated cash for opportunistic adds, while core stalwarts like American Express and Coca-Cola provide stability. Tracking these shifts via ValueSense reveals Buffett's patient capital allocation, prioritizing quality over quantity in an era of speculative fervor.

The strategy shines in its risk management: heavy weighting in financials, energy, and consumer staples offers inflation protection and dividend reliability, with turnover low enough to minimize tax drag. Investors emulating this via the Berkshire superinvestor page can see how such discipline has compounded wealth over decades.

Top Holdings Breakdown: Strategic Trims and Tactical Adds

Buffett's portfolio leads with Apple Inc. (AAPL) at 22.7% $60.7B, though reduced by 14.92%—a clear signal of valuation discipline on the tech behemoth. Bank of America (BAC) follows at 11.0% ($29.3B, Reduce 6.15%), trimming exposure to banking amid interest rate uncertainties. On the buy side, Chubb Limited (CB) rose 15.90% to 3.3% $8,843.7M, bolstering the insurance fortress.

New positions include Alphabet Inc. (GOOGL) at 1.6% ($4,338.4M, Buy), dipping into big tech advertising, while DaVita Inc. (DVA) was reduced 4.84% to 1.6% $4,273.2M. Media play Sirius XM Holdings Inc. (SIRI) added 4.20% to 1.1% $2,904.9M, and VeriSign, Inc. (VRSN) saw a sharp 32.36% cut to 0.9% $2,513.3M.

Smaller moves highlight opportunism: Domino's Pizza, Inc. (DPZ) added 13.22% to 0.5% $1,287.3M, Lennar Corporation (LEN) nudged up 0.03% to 0.3% $888.7M, and Nucor Corporation (NUE) trimmed 3.12% to 0.3% $867.8M. Steady anchors like American Express (AXP) (18.8%, No change), Coca-Cola (KO) (9.9%, No change), and Chevron (CVX) (7.1%, No change) provide ballast.

What the Portfolio Reveals About Buffett's Strategy

Buffett's Q3 moves emphasize quality over speculative growth, trimming high-flyers like AAPL and VRSN while adding to moat-heavy names like CB and GOOGL. This reflects a focus on businesses with predictable cash flows, even at moderate premiums.

Sector allocation tilts toward financials (AXP, BAC, CB, MCO) at over 37% of top holdings, energy (CVX, OXY), and consumer staples (KO, KHC), offering defense against volatility. Healthcare (DVA) and tech (AAPL, GOOGL, VRSN) round out diversification without diluting focus.

Geographic concentration stays U.S.-centric, favoring domestic leaders with global reach. Dividend strategy shines through stalwarts like KO and CVX, prioritizing yield and reinvestment. Risk management via low turnover and position sizing—nothing exceeds 23%—guards against blowups, with adds like SIRI and DPZ testing cyclical recovery plays.

The Succession Question at Berkshire

At 95, Warren Buffett's leadership transition remains a focal point, with Greg Abel poised as successor. Recent insurance bets like CB expansion suggest continuity in Berkshire's core competencies—underwriting discipline and capital allocation. The steady portfolio size (41 positions) and low turnover indicate a handover-focused stability, reassuring investors of enduring principles.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Apple Inc. (AAPL) | $60.7B | 22.7% | Reduce 14.92% |

| American Express Company (AXP) | $50.4B | 18.8% | No change |

| Bank of America Corporation (BAC) | $29.3B | 11.0% | Reduce 6.15% |

| The Coca-Cola Company (KO) | $26.5B | 9.9% | No change |

| Chevron Corporation (CVX) | $19.0B | 7.1% | No change |

| Occidental Petroleum Corporation (OXY) | $12.5B | 4.7% | No change |

| Moody's Corporation (MCO) | $11.8B | 4.4% | No change |

| Chubb Limited (CB) | $8,843.7M | 3.3% | Add 15.90% |

| The Kraft Heinz Company (KHC) | $8,479.5M | 3.2% | No change |

This table illustrates Berkshire's extraordinary concentration: five holdings exceed 7%, with the top three alone at 52.5%. Trims in AAPL and BAC freed ~$15B+ for redeployment, while CB's add shows insurance conviction. Such skew amplifies returns from winners but demands unerring selection—Buffett's edge. No changes in 70% of top positions reinforce "forever" holdings in moats like KO and CVX.

Investment Lessons from Warren Buffett

- Concentrate heavily when conviction is high: 86.7% in top 10 demands deep business understanding, not diversification for its own sake.

- Trim winners at peaks: AAPL's 14.92% cut shows selling strength to buy weakness, generating dry powder.

- Favor predictable cash cows: Financials and staples dominate for their moats and dividends over hype.

- Patience trumps turnover: 20-quarter holds and 4.9% churn prove time in quality beats timing the market.

- Succession-proof principles: Insurance adds like CB ensure the strategy outlives the Oracle.

Looking Ahead: What Comes Next?

Berkshire's trims have likely built a massive cash pile (historically $100B+), positioning for bargains in a potentially frothy 2026 market. Energy (OXY, CVX) hedges inflation, while new bets like GOOGL and DPZ eye AI/digital consumer trends. Housing (LEN) and steel (NUE) adds signal cyclical bottom-fishing. Current setup favors steady compounding if rates stabilize, with SIRI/DPZ testing consumer resilience—watch for consumer staples or Japan trades next.

FAQ about Berkshire Hathaway Portfolio

Q: What drove Buffett's major reductions in Apple and Bank of America?

A: The 14.92% AAPL trim and 6.15% BAC cut reflect valuation discipline, locking in gains from prior winners amid high multiples, freeing capital for better opportunities like insurance and new positions.

Q: Why is Berkshire's portfolio so concentrated?

A: 86.7% in top 10 stems from Buffett's circle-of-competence focus—deeply understood businesses with moats justify outsized bets, outperforming broad diversification over decades.

Q: How does Buffett's age factor into portfolio strategy?

A: Succession planning emphasizes stable, cash-rich holdings like AXP and KO, with Greg Abel's insurance expertise aligning with CB adds for continuity.

Q: Which sectors dominate and why?

A: Financials (~37%), energy, and staples lead for durable moats, cash flow, and inflation protection—avoiding speculative tech overload.

Q: How can I track Buffett's Berkshire Hathaway portfolio?

A: Follow quarterly 13F filings (45-day lag post-quarter-end) via SEC EDGAR or ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/berkshire for real-time analysis, visualizations, and change alerts.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!