Warren Buffett's Berkshire Hathaway Portfolio 2025: The Oracle's Latest Moves

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

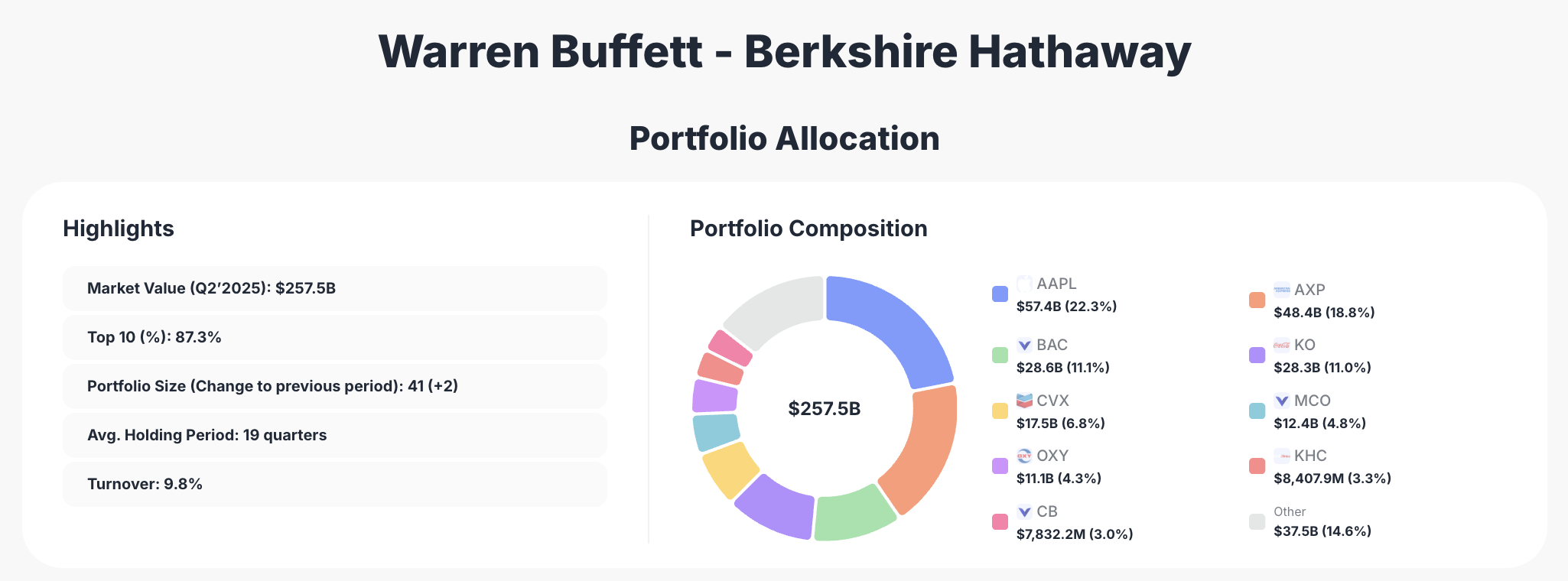

Warren Buffett just made some eyebrow-raising changes to Berkshire Hathaway's massive $257.5 billion portfolio. The Oracle of Omaha reduced his Apple stake again while quietly adding to a few unexpected positions. Let's break down what these moves tell us about Buffett's current thinking.

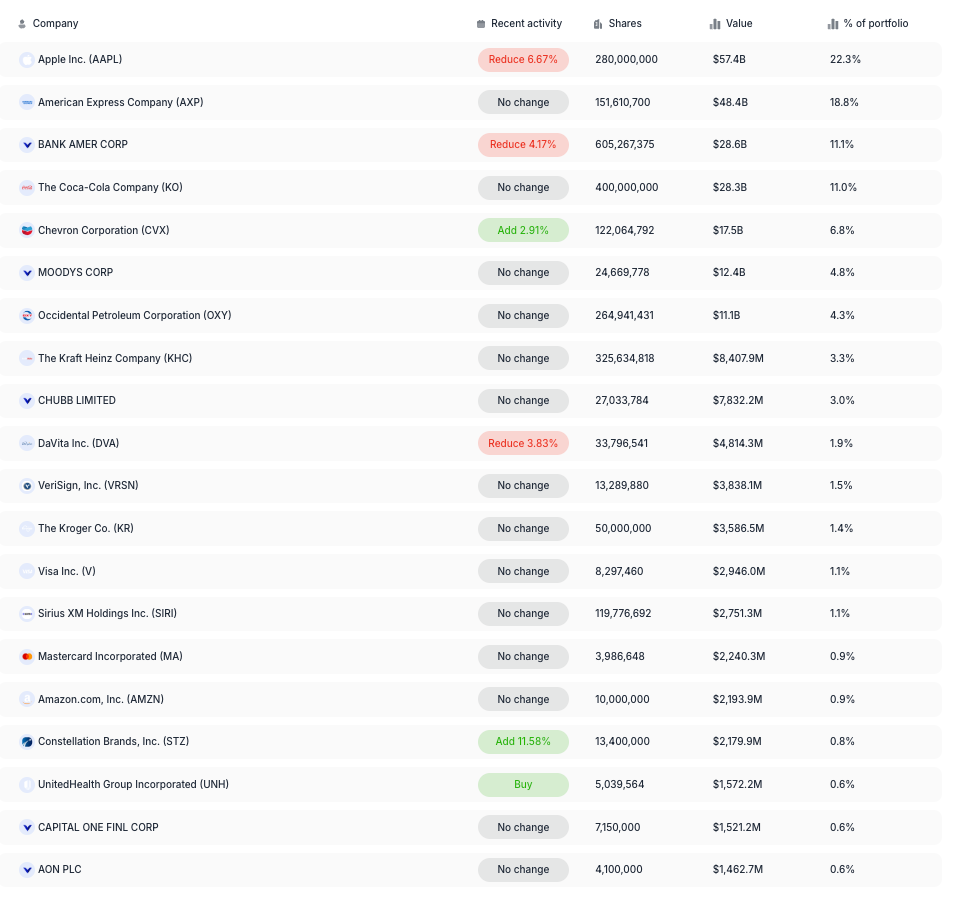

The most striking change? Apple now represents "only" 22.3% of the portfolio after another 6.67% reduction. That's still a $57.4 billion position—roughly the size of entire hedge funds—but it shows Buffett taking profits on his most successful investment ever.

The Big Picture: Portfolio Concentration Remains King

Berkshire's portfolio stays heavily concentrated in its top holdings. The top 10 positions account for 87.3% of the entire portfolio—a level of concentration that would give most portfolio managers nightmares but perfectly reflects Buffett's "put all your eggs in one basket and watch that basket" philosophy.

The current portfolio holds 41 positions, up from 39 in the previous quarter. Average holding period sits at 19 quarters—nearly five years—showing Buffett's commitment to long-term investing despite occasional trading activity.

Turnover remains remarkably low at 9.8%, confirming that Berkshire still operates more like a permanent holding company than an active trading operation.

The Apple Reduction: Profit-Taking or Strategic Shift?

Apple's reduction from roughly 47% to 22.3% of the portfolio represents one of the largest position adjustments in Berkshire's recent history. The 6.67% trimming follows previous sales, bringing the total Apple holding down to 280 million shares worth $57.4 billion.

This isn't panic selling. At current prices, Berkshire likely bought most of its Apple shares between $25-50 per share (split-adjusted). Selling at $200+ represents one of the greatest investment successes in market history.

The reduction might reflect several factors:

- Valuation concerns as Apple trades near all-time highs

- Diversification goals to reduce single-stock concentration risk

- Tax planning ahead of potential capital gains rate increases

- Cash deployment preparation for new opportunities

Even after the reduction, Apple remains Berkshire's largest holding by a wide margin. Buffett clearly still believes in the business but recognizes the importance of position sizing.

The Core Holdings: America's Best Businesses

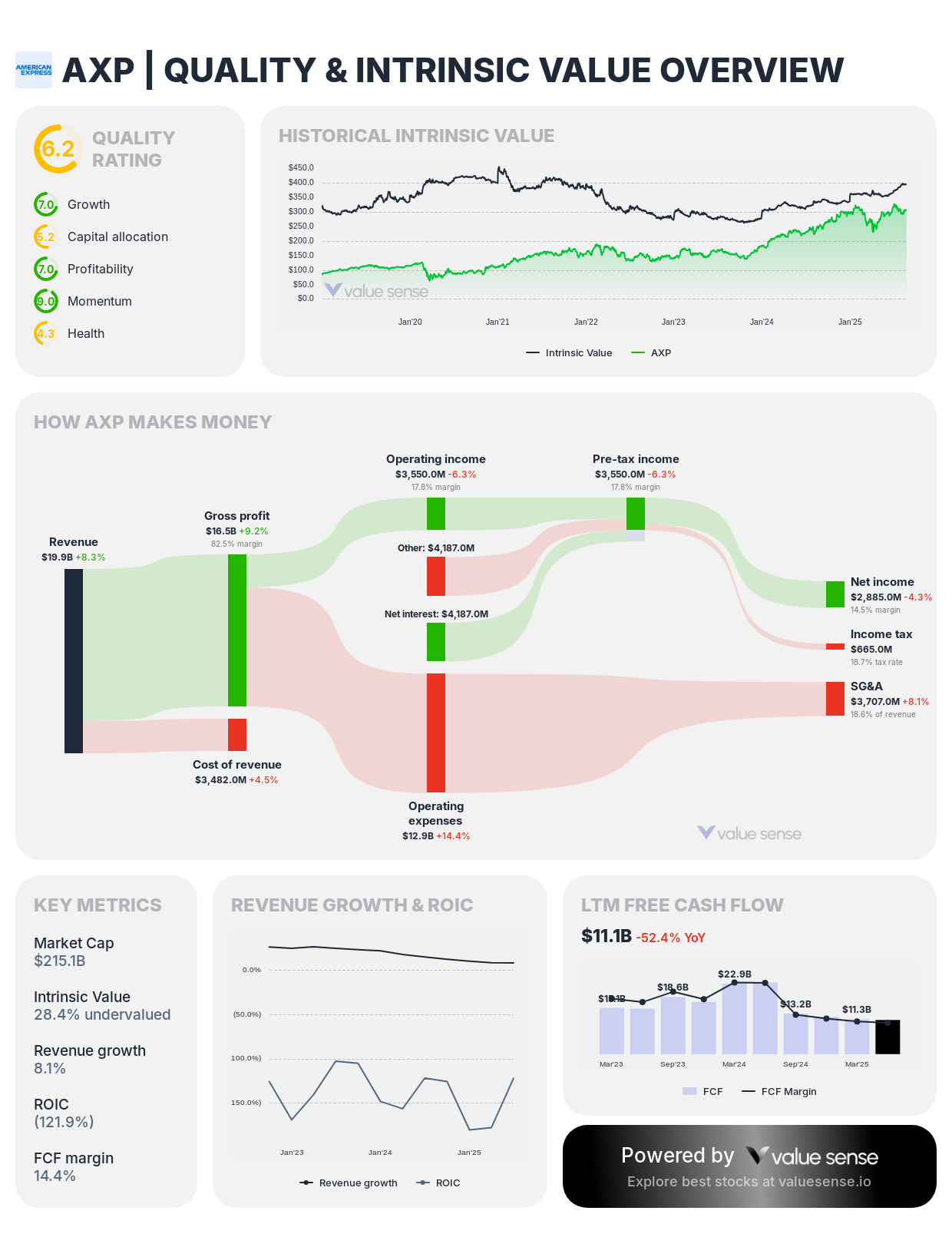

American Express (18.8% of portfolio) - The Unchanged Champion

AmEx holds steady at $48.4 billion with no recent changes. This represents one of Buffett's longest-held positions, dating back to the 1990s. The credit card giant benefits from wealthy customer demographics and closed-loop network advantages that create sustainable competitive moats.

Bank of America (11.1%) - The Selective Reduction

BAC got trimmed 4.17% but remains a core holding at $28.6 billion. Berkshire originally received Bank of America shares through preferred stock conversions during the financial crisis. The position reflects Buffett's confidence in CEO Brian Moynihan's leadership and the bank's improved risk management.

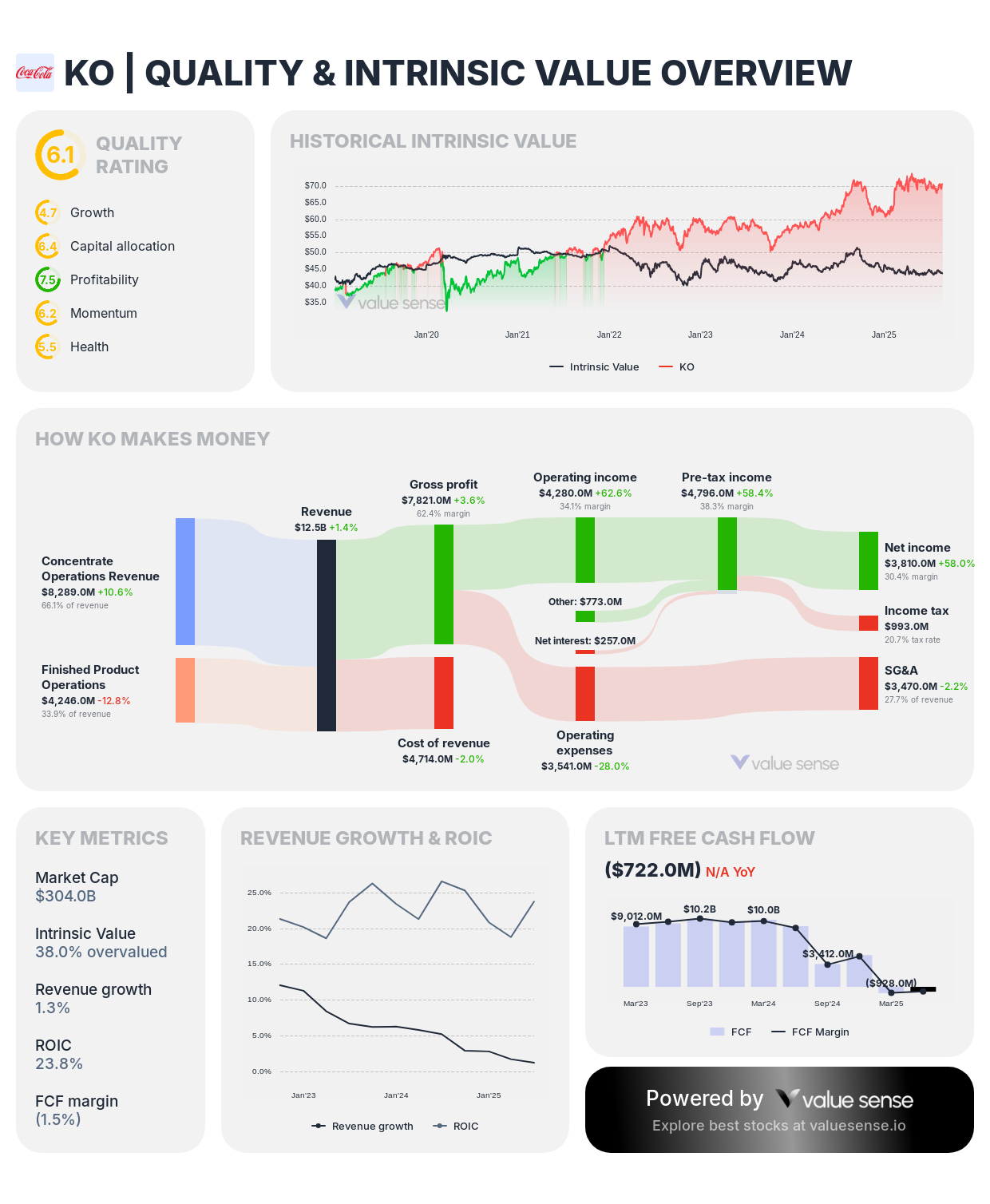

Coca-Cola (11.0%) - The Forever Hold

KO stays unchanged at 400 million shares worth $28.3 billion. Berkshire has owned Coke stock for over three decades, treating it as a bond-like investment that pays growing dividends. This position will likely never be sold as long as Buffett remains involved.

Energy and Value Plays

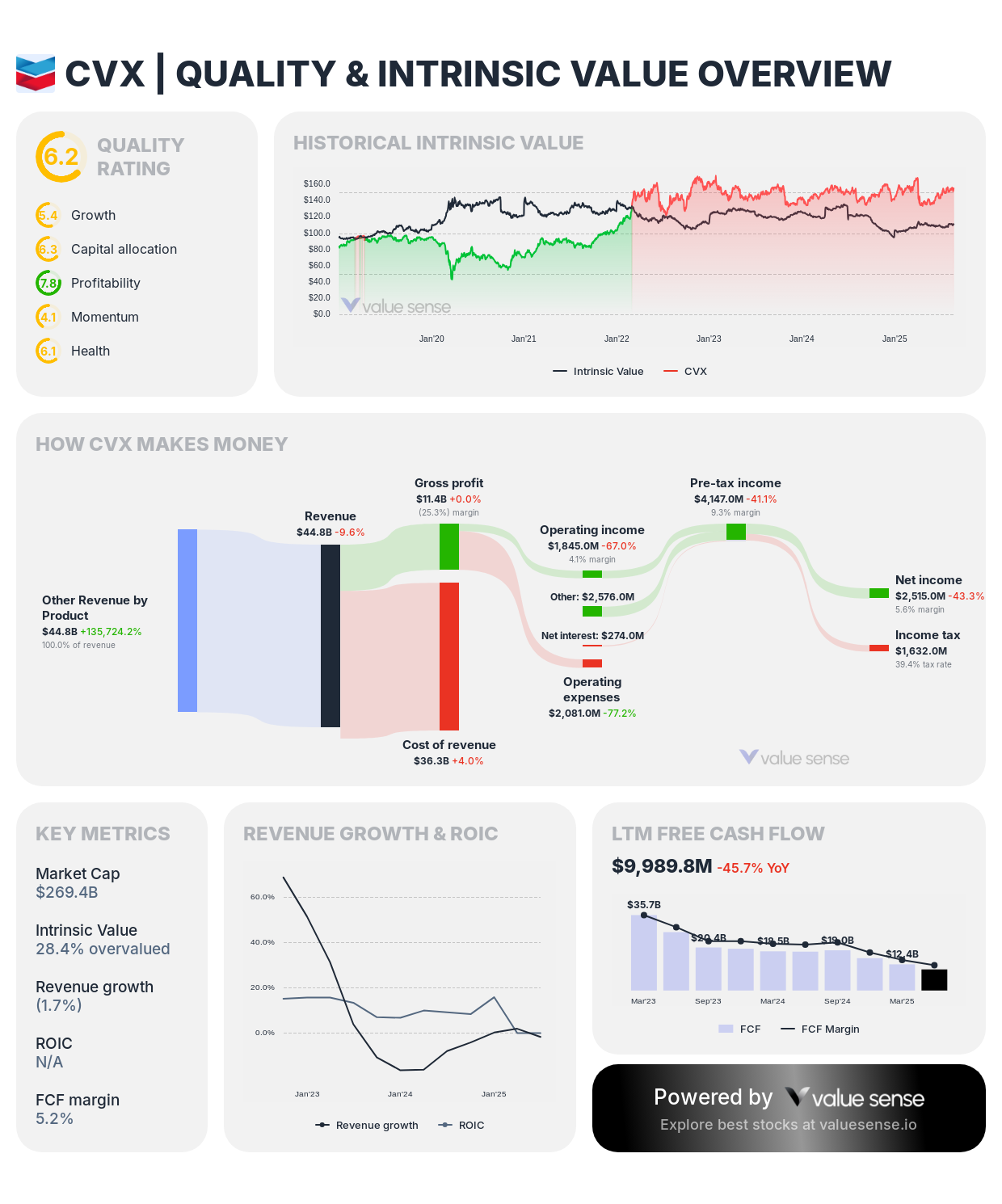

Chevron Corporation (6.8%) - The Recent Addition

CVX actually increased 2.91% to $17.5 billion, making it one of the few positions Berkshire added to during the quarter. Energy stocks fit Buffett's value-oriented approach, especially when oil companies generate massive cash flows while trading at reasonable valuations.

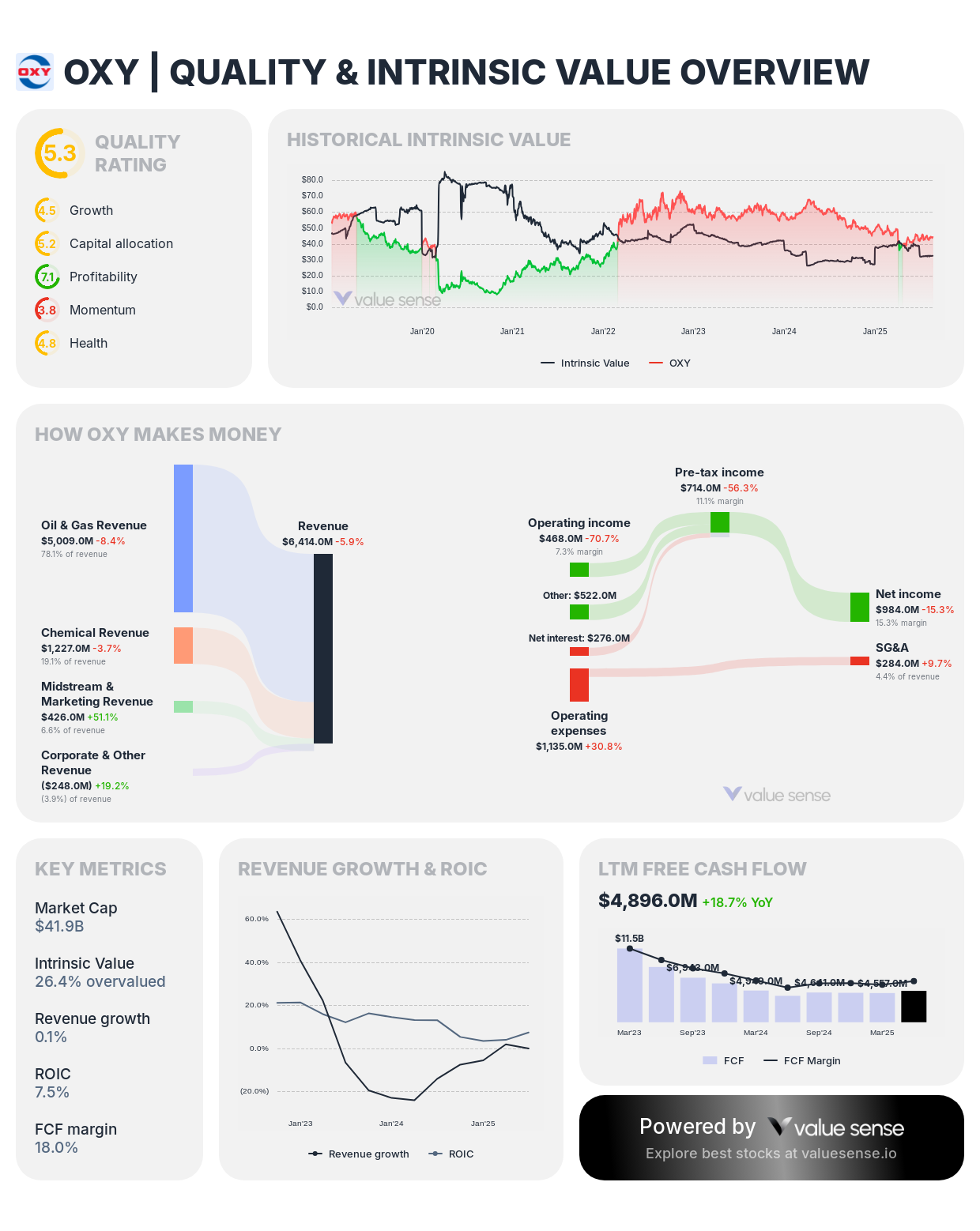

Occidental Petroleum (4.3%) - The Steady Accumulator

OXY remains unchanged at $11.1 billion, but Berkshire has been steadily building this position over multiple quarters. The oil and gas company benefits from US energy independence trends and disciplined capital allocation under CEO Vicki Hollub.

The Technology Experiment Continues

Beyond Apple, Berkshire maintains smaller technology positions that represent departures from traditional value investing:

Amazon (0.9%) - Still holding 10 million shares worth $2.2 billion, acknowledging the e-commerce giant's competitive advantages despite growth stock characteristics.

Visa (1.1%) and Mastercard (0.9%) - Payment processors that combine technology with toll-booth business models Buffett understands.

Consumer Staples and Defensive Positions

Kraft Heinz (3.3%) - The $8.4 billion position represents one of Berkshire's rare mistakes, but Buffett continues holding rather than crystallizing losses.

Coca-Cola and Kraft Heinz together represent Berkshire's consumer staples exposure, betting on brand power and distribution advantages in packaged goods.

Kroger (1.4%) - The grocery chain provides recession-resistant earnings and steady cash flows, fitting Buffett's preference for necessity-based businesses.

New Activity and Emerging Positions

Constellation Brands (0.8%) - Added 11.58% to reach $2.2 billion, suggesting Buffett sees value in the alcoholic beverage distributor.

UnitedHealth Group (0.6%) - A new "Buy" position worth $1.6 billion, representing Berkshire's healthcare sector exposure through the dominant health insurer.

These additions show Buffett remains active in finding new opportunities despite his advanced age and Berkshire's enormous size.

What the Portfolio Reveals About Current Strategy

Several themes emerge from Berkshire's current positioning:

Quality Over Growth - Most holdings generate steady cash flows rather than explosive growth. Even technology positions like Apple and Visa operate like utilities with predictable earnings.

American-Focused - Nearly all major positions involve US-based companies, reflecting Buffett's comfort with domestic businesses and regulatory environments.

Dividend Growth - Many holdings pay growing dividends that compound Berkshire's cash generation: Coke, Apple, AmEx, and the banks all return cash to shareholders regularly.

Recession Positioning - Consumer staples, utilities, and financial services provide defensive characteristics during economic downturns while maintaining growth potential during expansions.

The Succession Question

At 94, Buffett's investment decisions carry extra weight as investors wonder about Berkshire's future direction. The current portfolio reflects his established preferences while providing flexibility for successors.

Greg Abel, Berkshire's designated CEO successor, brings energy industry expertise that aligns with the Chevron and Occidental positions. The portfolio's quality bias and dividend focus should translate well regardless of management changes.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Apple | $57.4B | 22.3% | Reduced 6.67% |

| American Express | $48.4B | 18.8% | No change |

| Bank of America | $28.6B | 11.1% | Reduced 4.17% |

| Coca-Cola | $28.3B | 11.0% | No change |

| Chevron | $17.5B | 6.8% | Added 2.91% |

| Moody's | $12.4B | 4.8% | No change |

| Occidental Petroleum | $11.1B | 4.3% | No change |

| Kraft Heinz | $8.4B | 3.3% | No change |

| Chubb | $7.8B | 3.0% | No change |

| DaVita | $4.8B | 1.9% | Reduced 3.83% |

Investment Lessons from the Oracle

Berkshire's portfolio teaches several timeless investment principles:

Concentration works when you understand the businesses. Ten stocks represent nearly 90% of the portfolio, but each position reflects deep research and long-term conviction.

Holding periods matter more than trading frequency. Most positions have been held for years or decades, allowing compound growth to work its magic.

Quality businesses can justify premium prices when they possess sustainable competitive advantages and predictable cash flows.

Position sizing requires constant attention. Even great investments like Apple need trimming when they become too large relative to portfolio risk.

Looking Ahead: What Comes Next?

Berkshire sits on approximately $277 billion in cash and short-term investments, providing enormous flexibility for new investments. The Apple sales added to this war chest while recent small additions suggest Buffett continues finding opportunities.

Potential areas for deployment include:

- International expansion as valuations outside the US appear more attractive

- Technology positions beyond current holdings as digital transformation accelerates

- Energy infrastructure supporting America's transition to domestic energy independence

- Healthcare consolidation as the sector faces structural changes

The portfolio's current composition reflects both Buffett's preferences and market realities. As succession approaches, these holdings provide a solid foundation for Berkshire's next chapter while generating the cash flows needed for future opportunities.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Undervalued Growth vs Value Stocks: Which Strategy Wins in 2025?

📖 Amazon Stock Analysis: E-commerce Giant's Undervalued AWS Division

📖 Microsoft vs Google: Which Tech Giant Is More Undervalued in 2025?

FAQ about Berkshire Hathaway Portfolio

Q: Why did Buffett reduce his Apple position again?

A: The reduction likely reflects profit-taking rather than fundamental concerns about Apple's business. After buying shares at much lower prices, selling at current levels locks in extraordinary gains while reducing concentration risk. Buffett may also be preparing for tax changes or new investment opportunities.

Q: Is Berkshire's portfolio too concentrated in just a few stocks?

A: The concentration reflects Buffett's investment philosophy of owning stakes in businesses he understands deeply. While risky by conventional standards, the approach has worked for decades because each major holding possesses sustainable competitive advantages and predictable cash flows.

Q: What does the portfolio tell us about Buffett's succession plans?

A: The current holdings emphasize quality businesses with defensive characteristics that should perform well regardless of management. The energy positions align with designated successor Greg Abel's background, while the overall portfolio structure provides flexibility for future decision-makers.

Q: Why does Berkshire hold onto Kraft Heinz despite poor performance?

A: The Kraft Heinz position represents one of Buffett's rare mistakes, but selling would crystallize losses without clear investment alternatives. Buffett may believe the business will eventually recover, or he may simply prefer holding rather than admitting the error publicly.

Q: How much cash does Berkshire have available for new investments?

A: Berkshire holds approximately $277 billion in cash and short-term investments, providing enormous flexibility for new opportunities. The Apple sales and modest position adjustments continue adding to this war chest, suggesting major investments may be coming.