What I Learned About Investing from Darwin by Pulak Prasad

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

In the world of investing literature, “What I Learned About Investing from Darwin” by Pulak Prasad stands out as a unique fusion of evolutionary biology and value investing. Pulak Prasad, an accomplished investor and founder of Nalanda Capital, has spent decades refining his investment philosophy. His approach, shaped by years at McKinsey & Company and Warburg Pincus, is deeply influenced by the principles of natural selection and adaptation. Prasad’s credentials lend immense credibility to his writing, making this book a compelling read for both seasoned investors and those new to the discipline.

Published in 2023, the book arrives at a time when markets are increasingly volatile, and traditional investment wisdom is being questioned. Prasad’s central thesis is that the principles that govern biological evolution—survival, adaptation, and risk avoidance—are directly applicable to successful investing. By drawing on analogies from the natural world, he provides a fresh lens through which to view common investment challenges. The book is structured around three core tenets: avoiding big risks, buying high-quality businesses at fair prices, and embracing strategic patience—each deeply rooted in evolutionary thought.

What sets this book apart is its interdisciplinary approach. While many investment books focus on financial metrics and case studies, Prasad weaves in stories from biology, ecology, and behavioral science. He demonstrates how lessons from bumblebees, bacteria, and even sea urchins can inform better investment decisions. The writing is accessible yet profound, distilling complex concepts into actionable insights without resorting to jargon. Prasad’s narrative is enriched by real-world examples from his own investment career, making the book both instructive and engaging.

This book is considered essential reading for anyone seeking to build a resilient investment strategy. It appeals to value investors, behavioral finance enthusiasts, and even those interested in the broader intersection of science and finance. The book’s emphasis on risk management and quality investing resonates in all market conditions, while its advocacy for strategic “laziness” challenges the hyperactivity that often plagues modern investors. Prasad’s willingness to question conventional wisdom—such as the blind reliance on discounted cash flow models—adds a contrarian flavor that is both refreshing and practical.

Ultimately, “What I Learned About Investing from Darwin” is more than a treatise on stock selection; it’s a philosophical guide to navigating uncertainty. The book’s unique value lies in its ability to connect the dots between evolutionary success and investment survival. By grounding his advice in the time-tested processes of nature, Prasad offers readers a toolkit for enduring the inevitable ups and downs of the market. For those willing to think differently and embrace patience, this book is a roadmap to long-term investment success.

Key Themes and Concepts

At its core, “What I Learned About Investing from Darwin” is a meditation on how the principles of evolution can be harnessed to build a robust investment strategy. Prasad identifies recurring themes that run throughout the book, each illustrated with vivid examples from both nature and the world of business. The book’s structure is less about rigid financial formulas and more about cultivating an adaptive mindset—one that can withstand the randomness and uncertainty inherent in markets.

The main themes—risk management, quality investing, strategic laziness, evolutionary insights, behavioral finance, and long-term thinking—are not just theoretical constructs. They are woven into the practical advice and stories that fill each chapter. By examining these themes, readers gain a holistic understanding of how to approach investing as a process of continuous adaptation, much like evolution itself.

- Risk Management: Prasad’s first and most important theme is the avoidance of catastrophic losses. Drawing from the natural world, he shows how survival is predicated on minimizing fatal mistakes—what he calls “type I errors.” For example, a prey animal that fails to avoid a predator rarely gets a second chance; similarly, investors who suffer large permanent losses may never recover. Throughout the book, Prasad urges readers to prioritize risk management over chasing returns, using real-life investment failures as cautionary tales. The practical takeaway is clear: focus on preserving capital, even if it means forgoing some upside.

- Quality Investing: The book’s second major theme is the pursuit of high-quality businesses at fair prices. Prasad leverages evolutionary biology to frame what makes a business “fit” for survival—sustainable competitive advantages, strong cash flows, and resilient business models. He draws analogies to species that have thrived due to unique adaptations, arguing that investors should seek companies with similar enduring traits. This theme is especially relevant in a world where many investors chase short-term trends rather than long-term quality. Prasad provides tools for identifying such businesses and cautions against overpaying, even for the best companies.

- Strategic Laziness: One of the book’s most counterintuitive themes is the value of inactivity. Prasad argues that, much like certain animals conserve energy and avoid unnecessary risks, investors too should resist the urge to trade frequently. He introduces the concept of “strategic laziness”—being very deliberate and patient, letting investments compound over time. This theme is supported by data showing that excessive trading often leads to underperformance. The message is simple but powerful: sometimes, the best action is no action at all.

- Evolutionary Insights: Prasad’s approach is deeply informed by evolutionary theory. He uses examples from biology—such as the adaptability of bacteria or the resilience of bumblebees—to illustrate how investors can learn from nature’s playbook. This theme encourages readers to think probabilistically, embrace randomness, and adapt strategies as conditions change. Prasad’s evolutionary lens helps demystify why some businesses succeed while others fail, and why flexibility is a key to survival in both nature and investing.

- Behavioral Finance: The book delves into the psychological pitfalls that plague investors, drawing parallels with animal behavior. Prasad discusses the dangers of Pavlovian responses—reacting reflexively to market stimuli without critical thought. He uses examples from behavioral science to show how emotions and cognitive biases can lead to poor decisions. By understanding these tendencies, investors can cultivate greater self-awareness and discipline, leading to more rational investment choices.

- Long-term Thinking: A recurring message in the book is the power of compounding and the importance of a long-term horizon. Prasad draws on evolutionary theories such as punctuated equilibrium to explain why long periods of inactivity, punctuated by occasional bursts of change, can be beneficial. He provides empirical evidence that long-term holders often outperform more active traders, and he encourages readers to adopt a mindset that values patience and persistence over short-term gains.

- Adaptation and Resilience: While not always explicitly stated, the underlying current of the book is the need for adaptability and resilience. Prasad shows that both in nature and investing, those who can adapt to changing environments are the ones most likely to survive and thrive. This means being open to new information, learning from mistakes, and continuously refining one’s approach. The practical application is to build a portfolio—and a mindset—that can weather both expected and unexpected storms.

Book Structure: Major Sections

Part 1: Avoid Big Risks

This section, covering the opening chapter, is unified by the theme of risk avoidance—a concept Prasad considers the bedrock of both evolutionary and investment success. By drawing parallels between the survival strategies of species and the perils faced by investors, Prasad establishes the necessity of minimizing catastrophic errors. The section opens with vivid stories from nature, such as the bumblebee’s evolutionary tactics, to highlight the high stakes of risk management.

Key concepts include the differentiation between type I and type II errors, with a strong emphasis on the former—errors that result in irreversible harm. Prasad illustrates how, in both nature and investing, avoiding these “fatal mistakes” is more important than maximizing returns. He provides examples of investors who suffered large, permanent losses due to overconfidence or neglecting risk controls. The lessons are reinforced with data showing that portfolios that survive downturns outperform those that chase high returns but are exposed to tail risks.

For investors, the practical application is to adopt a defensive mindset: prioritize capital preservation, set strict loss limits, and avoid situations with asymmetric downside. Prasad recommends tools such as stop-loss orders, diversification, and rigorous due diligence as ways to mitigate big risks. He also stresses the importance of humility—accepting that not every risk can be foreseen, but many can be avoided through discipline and preparation.

In today’s volatile markets, the relevance of this section is profound. The recent spate of market shocks—from the COVID-19 crash to geopolitical tensions—has underscored the importance of risk management. Prasad’s evolutionary perspective reminds readers that survival, not maximization, should be the primary goal. As economic environments change rapidly, the ability to avoid ruin becomes the ultimate competitive advantage.

Part 2: Buy High Quality at a Fair Price

Spanning chapters 2 through 7, this section delves into the identification, assessment, and valuation of high-quality businesses. The unifying theme is that, just as certain species thrive due to unique adaptations, some businesses endure because of their inherent strengths. Prasad uses evolutionary analogies to explain what constitutes “quality” in a business context and how to avoid common valuation pitfalls.

Key concepts include the identification of durable competitive advantages—economic moats, consistent cash flows, and resilient business models. Prasad offers practical frameworks for distinguishing true quality from mere appearance, warning against the dangers of overpaying even for the best companies. He critiques traditional valuation methods, such as discounted cash flow (DCF) models, arguing that they often fail to capture the unpredictability and randomness inherent in business. The section is rich with examples, from the misidentification of business potential (the “green frog vs. guppy” analogy) to the unpredictability of success (the “bacteria replay” experiment).

Investors are encouraged to focus on businesses with proven track records, strong management, and sustainable advantages. Prasad suggests using qualitative filters—such as industry structure, competitive dynamics, and management integrity—alongside quantitative metrics. He also advocates for patience in waiting for fair prices, rather than chasing momentum or hype. The practical advice is to build a watchlist of quality companies and act only when valuations are reasonable.

This section’s modern relevance is clear in an era of speculative bubbles and rapid technological change. As new business models emerge and old ones fade, the ability to discern true quality—and to pay a fair price for it—remains a timeless skill. Prasad’s evolutionary approach offers a robust framework for navigating both old-economy stalwarts and disruptive newcomers.

Part 3: Don't Be Lazy—Be Very Lazy

The final section, covering chapters 8 through 10, champions the virtues of patience and strategic inactivity. The unifying theme is that, much like certain animals survive by conserving energy and avoiding unnecessary risks, investors too can benefit from “doing nothing” most of the time. Prasad challenges the conventional wisdom that activity equals productivity, arguing instead for deliberate, long-term holding.

Key concepts include the compounding power of long-term investment horizons, the dangers of overtrading, and the psychological benefits of patience. Prasad draws on evolutionary theories such as punctuated equilibrium to explain why long periods of inactivity, punctuated by rare but decisive actions, can lead to superior outcomes. He uses data to show that frequent trading often erodes returns, while patient investors benefit from lower transaction costs and greater compounding.

For practitioners, the advice is to construct portfolios with businesses that can be held for years, if not decades, and to resist the urge to react to every market fluctuation. Prasad recommends setting clear investment criteria, reviewing portfolios infrequently, and focusing on long-term goals. He also suggests cultivating a mindset that values boredom—a sign that the strategy is working, not a cue for action.

In the age of algorithmic trading and 24/7 financial news, this section’s message is more relevant than ever. The temptation to trade frequently is omnipresent, but as Prasad shows, the most successful investors are often those who master the art of waiting. By aligning investment behavior with evolutionary principles, readers can achieve both peace of mind and superior returns.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

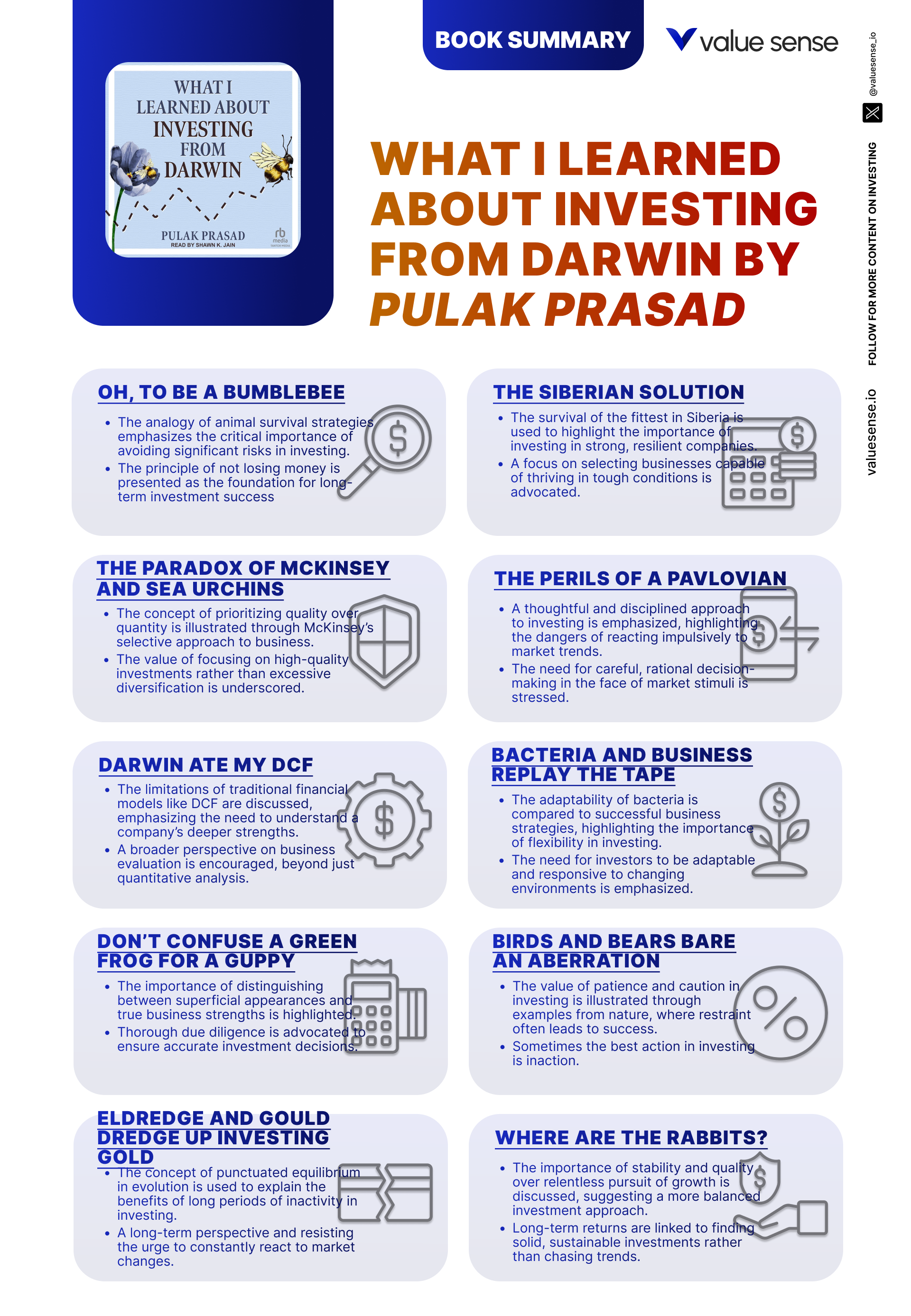

Chapter 1: Oh, to Be a Bumblebee

This opening chapter is foundational, setting the stage for the entire book by anchoring Prasad’s investment philosophy in the concept of risk avoidance. The bumblebee, a creature that has survived for millions of years through cautious adaptation, becomes a metaphor for the prudent investor. Prasad argues that the primary objective in both evolution and investing is not to maximize returns but to avoid catastrophic losses. This principle, often neglected in the pursuit of alpha, is the cornerstone of his approach.

Prasad illustrates this with examples from both nature and financial markets. He explains how bumblebees have evolved to minimize exposure to predators and environmental risks, ensuring survival across generations. Similarly, he recounts stories of investors who suffered irreversible losses by ignoring risk management principles—such as over-leveraging or concentrating portfolios in speculative assets. The chapter includes data on how portfolios that avoid large drawdowns consistently outperform those that chase high returns but endure significant losses. Prasad quotes, “In evolution, as in investing, the penalty for fatal mistakes is extinction.”

Investors can apply these lessons by instituting strict risk controls: diversifying portfolios, setting stop-losses, and avoiding investments with asymmetric downside. Prasad suggests conducting pre-mortems—imagining worst-case scenarios before committing capital. He also recommends focusing on process over outcome, recognizing that good decisions can sometimes lead to bad results, but consistent risk management reduces the likelihood of ruin.

Historically, this approach has proven effective. The global financial crisis of 2008 is cited as a cautionary tale, with many investors wiped out due to excessive risk-taking. In contrast, those who prioritized capital preservation weathered the storm and emerged stronger. Prasad’s evolutionary analogy reinforces that survival, not maximization, is the ultimate measure of success in both nature and investing.

Chapter 2: The Siberian Solution

This chapter introduces the theme of quality investing, using the harsh Siberian environment as a metaphor for the business world. Prasad argues that, just as only the most adaptable species survive Siberia’s brutal winters, only the highest-quality businesses endure economic cycles. The chapter is important because it shifts the focus from risk avoidance to the identification of enduring competitive advantages—a key determinant of long-term investment success.

Prasad provides detailed criteria for assessing business quality, such as consistent cash flows, strong management, and sustainable moats. He draws parallels between evolutionary adaptations—like thick fur in Siberian animals—and business traits that confer resilience. The chapter includes case studies of companies that have thrived due to unique strengths, as well as those that faltered due to lack of adaptability. Prasad quotes, “In investing, as in Siberia, only the fit survive.” He also critiques the tendency to chase “hot” sectors, emphasizing that true quality often lies in less glamorous industries.

Investors are advised to develop a checklist for quality, incorporating both quantitative and qualitative factors. Prasad suggests using industry analysis, competitive positioning, and management interviews to gauge resilience. He also warns against overpaying for quality, noting that even the best businesses can become poor investments if bought at inflated prices. The practical takeaway is to wait patiently for opportunities to buy great companies at fair valuations.

Historically, quality investing has outperformed in both bull and bear markets. Companies with strong competitive advantages tend to recover faster from downturns and compound returns over time. Prasad’s evolutionary framework provides a systematic way to identify such businesses, making this chapter a must-read for investors seeking durable wealth creation.

Chapter 3: The Paradox of McKinsey and Sea Urchins

This chapter explores the paradoxical nature of investment decisions, using the example of sea urchins—creatures that have thrived for eons despite their apparent vulnerability. Prasad draws an analogy to consulting firms like McKinsey, which succeed by balancing innovation with stability. The chapter is important because it challenges conventional wisdom about what constitutes business quality and highlights the need for nuanced assessment.

Prasad presents data showing that some of the most successful companies are not the most innovative, but those that excel at incremental improvement and risk management. He uses the sea urchin’s evolutionary strategy—slow, steady adaptation over millions of years—as a metaphor for businesses that avoid dramatic change but consistently deliver value. The chapter includes quotes such as, “Sometimes, survival is about doing just enough, not the most.” Prasad also discusses the dangers of chasing fads or overvaluing disruptive innovation.

For investors, the lesson is to look beyond surface-level metrics and assess the underlying drivers of business success. Prasad recommends studying long-term track records, understanding industry dynamics, and evaluating management’s approach to risk. He also suggests being wary of companies that pursue growth at any cost, as this often leads to increased volatility and risk.

Historically, companies that combine stability with adaptability—such as Procter & Gamble or Johnson & Johnson—have delivered superior returns. Prasad’s analogy to sea urchins encourages investors to value consistency and resilience over flashiness. In a world obsessed with disruption, this chapter offers a timely reminder of the enduring power of steady progress.

Chapter 4: The Perils of a Pavlovian

This chapter addresses the dangers of reactive investing, drawing on behavioral science and animal psychology. Prasad uses the concept of Pavlovian responses—automatic, conditioned reactions—to illustrate how investors often make poor decisions in response to market stimuli. The chapter is critically important because it exposes the psychological traps that can undermine even the most well-constructed investment strategies.

Prasad provides examples of investors who panic during market downturns or chase momentum during rallies, only to suffer losses. He cites studies showing that emotional decision-making leads to suboptimal outcomes, and he uses animal behavior experiments to explain why these tendencies are hardwired. The chapter includes quotes such as, “In investing, as in life, reflexes can be dangerous.” Prasad also discusses the role of media and social proof in amplifying reactive behavior.

To counteract these tendencies, Prasad recommends developing a disciplined investment process, setting predefined rules for buying and selling, and maintaining a long-term perspective. He suggests keeping a decision journal to track emotional triggers and outcomes, and he advocates for regular reflection to identify patterns of reactive behavior. The practical advice is to slow down, think critically, and avoid knee-jerk reactions.

Real-world examples abound, from the dot-com bubble to the 2020 pandemic selloff, where investors who acted reflexively often locked in losses. Prasad’s insights are supported by behavioral finance research, which shows that disciplined, process-driven investors consistently outperform those who react emotionally. This chapter is essential reading for anyone seeking to build psychological resilience in the face of market volatility.

Chapter 5: Darwin Ate My DCF

In this provocative chapter, Prasad critiques the widespread reliance on discounted cash flow (DCF) models, using evolutionary analogies to highlight their limitations. He argues that, much like predicting the exact path of evolution is impossible, forecasting future cash flows with precision is fraught with uncertainty. This chapter is important because it challenges one of the most sacrosanct tools in the investor’s toolkit.

Prasad provides examples of companies whose actual performance deviated significantly from DCF projections, often due to unforeseen competitive or regulatory changes. He uses the analogy of evolutionary branching—where small mutations lead to vastly different outcomes—to illustrate the unpredictability of business environments. The chapter includes quotes such as, “In evolution, as in investing, the future is unknowable.” Prasad also discusses the dangers of false precision and the tendency to anchor on specific numbers.

Investors are encouraged to use DCF models as rough guides rather than precise instruments. Prasad suggests focusing on scenario analysis, sensitivity testing, and margin of safety, rather than relying on single-point forecasts. He also advocates for qualitative assessments—such as management quality and industry structure—to complement quantitative models. The practical takeaway is to embrace uncertainty and build flexibility into investment decisions.

Historically, many high-profile investment failures have been attributed to overconfidence in models. Prasad’s evolutionary perspective provides a healthy skepticism of forecasting, encouraging investors to prepare for a range of outcomes. In a world where change is the only constant, this chapter offers a pragmatic approach to valuation.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Bacteria and Business Replay the Tape

This chapter delves into the unpredictability of business success, using the famous “replay the tape” experiment from evolutionary biology. Prasad explains how, just as bacteria evolve along unpredictable paths, businesses too are subject to randomness and chance. The chapter is important because it highlights the limits of foresight and the need for humility in investment decision-making.

Prasad recounts experiments where identical bacterial populations, placed in the same environment, evolved in dramatically different ways. He draws parallels to businesses that, despite similar starting conditions, experience divergent outcomes due to luck, timing, or unforeseen events. The chapter includes quotes such as, “The tape of business, like the tape of life, never plays out the same way twice.” Prasad also discusses the role of optionality and adaptability in navigating uncertainty.

Investors are advised to build portfolios that can withstand a wide range of scenarios. Prasad suggests diversifying across industries, geographies, and business models, and maintaining a cash buffer to take advantage of unexpected opportunities. He also recommends being open to changing one’s mind as new information emerges. The practical lesson is to expect surprises and plan for resilience, rather than betting on a single outcome.

Real-world examples include the rise of unexpected market leaders and the fall of once-dominant firms. Prasad’s evolutionary analogy underscores the importance of adaptability and the folly of overconfidence. In today’s rapidly changing business landscape, this chapter provides a sobering reminder of the role of chance in investment success.

Chapter 7: Don’t Confuse a Green Frog for a Guppy

This chapter focuses on the risks of misidentifying business potential, using the analogy of mistaking a green frog for a guppy. Prasad argues that superficial similarities can be misleading, and that careful analysis is required to distinguish true opportunities from impostors. The chapter is important because it addresses the common pitfall of investing based on incomplete or misleading information.

Prasad provides examples of companies that appeared attractive on the surface but lacked the underlying qualities necessary for long-term success. He discusses the dangers of relying on headline metrics or industry hype, and he uses case studies to illustrate the consequences of misjudgment. The chapter includes quotes such as, “In both nature and investing, appearances can be deceiving.” Prasad also explains the importance of due diligence and skepticism.

Investors are encouraged to dig deeper, conducting thorough research on business models, competitive dynamics, and management integrity. Prasad recommends triangulating information from multiple sources and seeking out dissenting opinions. He also suggests using checklists to avoid cognitive biases and ensure comprehensive analysis. The practical takeaway is to never take things at face value and to always verify assumptions.

Historically, many investment blowups have resulted from misidentification—whether it’s a tech company masquerading as a high-growth business or a cyclical firm mistaken for a compounder. Prasad’s analogy to evolutionary mimicry reinforces the need for vigilance and skepticism. In a world awash with information, this chapter is a timely warning against complacency.

Chapter 8: Birds and Bears Bare an Aberration

This chapter introduces the concept of strategic laziness, using examples from animal behavior to advocate for patience and inactivity in investing. Prasad argues that, much like certain species conserve energy by doing less, investors can achieve superior results by resisting the urge to act constantly. The chapter is important because it challenges the prevailing belief that more activity leads to better outcomes.

Prasad provides data showing that frequent traders underperform long-term holders, primarily due to higher transaction costs and behavioral errors. He uses examples of animals that survive harsh winters by hibernating or reducing activity, drawing parallels to investors who benefit from holding steady during market turbulence. The chapter includes quotes such as, “Sometimes, the best action is inaction.” Prasad also discusses the psychological benefits of boredom and patience.

Investors are advised to construct portfolios of high-quality businesses that can be held for years, minimizing the need for frequent rebalancing. Prasad recommends setting clear investment criteria and sticking to them, even when market noise tempts action. He also suggests scheduling periodic (rather than constant) portfolio reviews to avoid overreacting to short-term fluctuations. The practical message is to embrace boredom as a sign of a sound strategy.

In today’s hyperactive financial markets, this chapter’s message is more relevant than ever. The proliferation of trading apps and real-time news creates constant temptation to act, but as Prasad shows, the most successful investors are often those who master the art of waiting. The evolutionary analogy provides a compelling rationale for strategic laziness.

Chapter 9: Eldredge and Gould Dredge Up Investing Gold

This chapter explores the benefits of long-term investment holding, drawing on the evolutionary theory of punctuated equilibrium proposed by Eldredge and Gould. Prasad argues that, much like species experience long periods of stability punctuated by sudden change, investors should adopt a similar approach—holding investments for extended periods and acting only when necessary. The chapter is important because it provides a scientific basis for long-term thinking and the power of compounding.

Prasad presents data showing that long-term holders outperform more active traders, benefiting from lower taxes, reduced transaction costs, and the compounding of returns. He uses examples of successful investors—such as Warren Buffett—who have built fortunes by holding quality businesses for decades. The chapter includes quotes such as, “Wealth is built during the wait, not the chase.” Prasad also discusses the psychological challenges of staying the course during periods of underperformance.

Investors are encouraged to develop the discipline to hold through market cycles, focusing on the underlying business rather than short-term price movements. Prasad recommends setting long-term goals, reviewing performance annually, and resisting the urge to tinker with portfolios. He also suggests using historical case studies to build conviction in the strategy. The practical lesson is that patience is not just a virtue—it’s a source of alpha.

Historically, the most successful investors have been those who embraced long-term thinking. Prasad’s evolutionary framework provides a compelling rationale for this approach, showing that compounding and stability are the keys to enduring wealth creation. In a world obsessed with instant gratification, this chapter is a powerful reminder of the benefits of patience.

Chapter 10: Where Are the Rabbits?

This concluding chapter synthesizes the book’s themes, emphasizing the importance of strategic patience and deliberate inaction. Prasad uses the analogy of waiting for rabbits—knowing when to act and when to wait—as a metaphor for disciplined investing. The chapter is important because it encapsulates the core message of the book: that success comes from avoiding mistakes, buying quality at fair prices, and being patient.

Prasad recounts stories of investors who achieved superior returns by waiting for the right opportunities, rather than chasing every potential investment. He discusses the psychological challenges of waiting—fear of missing out, impatience, and the pressure to act—and provides strategies for overcoming them. The chapter includes quotes such as, “Sometimes, the best investment decision is to do nothing.” Prasad also revisits the evolutionary analogies that frame the book, reinforcing the lessons learned.

Investors are advised to develop a watchlist of quality companies, set clear criteria for action, and wait patiently for opportunities that meet those criteria. Prasad recommends regular self-reflection to ensure that decisions are driven by process, not emotion. He also suggests building a support network of like-minded investors to reinforce discipline. The practical message is to embrace waiting as an active choice, not a passive default.

In the modern era of instant information and constant noise, this chapter’s message is more relevant than ever. The ability to wait for the right opportunity—to “hunt rabbits” rather than chase every moving target—is a hallmark of successful investors. Prasad’s synthesis of evolutionary and investment principles provides a timeless guide for navigating uncertainty.

Practical Investment Strategies

- 1. Prioritize Risk Management Above All Else: Begin every investment decision by asking, “What could go wrong?” Use strict position sizing, diversify across industries and geographies, and set stop-losses to cap potential losses. Conduct pre-mortems for each investment, imagining worst-case scenarios and planning responses in advance. Avoid leverage unless the downside is fully understood and controlled. This approach ensures that even in the face of unpredictable market events, your portfolio is protected from catastrophic losses.

- 2. Build a Portfolio of High-Quality Businesses: Focus on companies with durable competitive advantages—economic moats, consistent cash flows, and proven management. Use qualitative filters such as brand strength, customer loyalty, and regulatory barriers alongside quantitative metrics like return on capital and free cash flow yield. Construct a watchlist of such businesses and monitor them for opportunities to buy at fair prices. This strategy reduces the risk of permanent capital loss and increases the odds of long-term compounding.

- 3. Wait for Fair Prices—Don’t Overpay for Quality: Even the best businesses can be poor investments if bought at excessive valuations. Use valuation tools such as price-to-earnings, price-to-free-cash-flow, and enterprise value-to-EBITDA multiples to assess fair value. Set target buy ranges and exercise patience—wait for market corrections or temporary setbacks to create attractive entry points. Avoid the temptation to chase momentum or buy into hype; instead, let the market come to you.

- 4. Embrace Strategic Laziness and Long Holding Periods: Once you’ve built a portfolio of quality businesses, resist the urge to trade frequently. Set a review schedule—quarterly or annual reviews are sufficient for most investors. Avoid reacting to short-term market noise; instead, focus on the underlying business fundamentals. Historical data shows that long-term holders benefit from compounding, lower taxes, and reduced transaction costs. Embrace boredom as a sign that your strategy is working.

- 5. Use Evolutionary Principles to Guide Adaptation: Recognize that markets, like ecosystems, are constantly evolving. Stay open to new information and be willing to adapt your strategy as conditions change. Periodically review your portfolio for signs of “species extinction”—businesses that have lost their competitive edge or face disruptive threats. Be willing to exit positions that no longer meet your criteria, and use lessons from both successes and failures to refine your approach.

- 6. Guard Against Behavioral Biases: Develop self-awareness around common psychological traps such as loss aversion, confirmation bias, and herd mentality. Maintain a decision journal to track the reasoning behind each investment and review outcomes objectively. Use checklists to ensure comprehensive analysis and avoid impulsive decisions. When emotions run high—whether due to greed or fear—step back and revisit your investment process before taking action.

- 7. Diversify for Resilience, Not Just Return: Diversification is not just about maximizing returns; it’s about ensuring survival in unpredictable environments. Spread investments across sectors, geographies, and asset classes to reduce the impact of any single adverse event. Use scenario analysis to stress-test your portfolio against various economic shocks. This evolutionary approach to diversification increases the odds of long-term survival and success.

- 8. Focus on Process Over Outcome: Accept that even the best decisions can sometimes lead to poor outcomes due to randomness. Judge your investment process, not just short-term results. Set clear criteria for buying, holding, and selling, and stick to them regardless of market sentiment. Regularly review and refine your process based on new evidence and lessons learned. Over time, a robust process will yield superior results, even in the face of inevitable setbacks.

Modern Applications and Relevance

The principles outlined in “What I Learned About Investing from Darwin” are strikingly relevant in today’s fast-paced and unpredictable markets. While the book draws heavily from evolutionary biology, its lessons are timeless—applicable to both traditional industries and the new frontiers of technology, biotech, and digital assets. Prasad’s emphasis on risk management, quality investing, and patience offers a counterpoint to the culture of instant gratification and speculative trading that dominates the current financial landscape.

Since the book’s publication, the investment world has witnessed unprecedented events: the COVID-19 pandemic, rapid technological disruption, and a surge in retail trading activity driven by social media. These changes have only heightened the need for robust risk management and adaptability. Prasad’s advice to avoid catastrophic losses and build resilience resonates strongly in an environment where black swan events can upend entire sectors overnight. The book’s evolutionary analogies provide a framework for understanding why some companies—and investors—survive such shocks while others do not.

What remains timeless is the power of compounding and the importance of long-term thinking. Despite the proliferation of algorithmic trading and high-frequency strategies, the most successful investors continue to be those who buy quality businesses and hold them through cycles. Prasad’s advocacy for strategic laziness is supported by data showing that excessive trading erodes returns and increases behavioral errors. In an era of constant information overload, the ability to wait patiently for the right opportunity is a rare and valuable skill.

Modern examples abound. Companies like Apple, Microsoft, and Nestlé have thrived by building durable competitive advantages and adapting to changing environments—mirroring the evolutionary success stories described in the book. Meanwhile, the rapid rise and fall of meme stocks and speculative assets underscore the dangers of reactive investing and the importance of process discipline. Prasad’s lessons on behavioral finance are particularly relevant as investors navigate the psychological challenges of volatility and uncertainty.

To adapt the book’s classic advice to current conditions, investors should leverage new tools—such as AI-powered screeners, alternative data sources, and advanced risk analytics—while remaining grounded in the fundamentals of quality, patience, and adaptability. The evolutionary perspective encourages continuous learning and iteration, ensuring that strategies remain robust in the face of constant change. In sum, Prasad’s insights offer a blueprint for thriving in both today’s markets and whatever the future may bring.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Begin with a Risk Audit: Start by conducting a comprehensive risk assessment of your current portfolio. Identify concentrated positions, leverage, and exposures to sectors or geographies prone to volatility. Use scenario analysis to stress-test your holdings against adverse events such as recessions, regulatory changes, or technological disruption. Document potential “type I errors”—investments that could cause permanent capital loss—and set explicit loss limits for each position. This foundational step ensures that your portfolio is built to survive, not just to perform.

- Develop a Quality Watchlist (1-2 months): Over the next several weeks, research and compile a list of high-quality businesses that meet your investment criteria. Focus on companies with durable competitive advantages, strong cash flows, and proven management teams. Use both quantitative metrics (e.g., return on invested capital, free cash flow yield) and qualitative factors (e.g., brand strength, regulatory barriers). Regularly update this watchlist as new information emerges and as you refine your understanding of what constitutes “quality.”

- Construct a Resilient Portfolio (3-6 months): Allocate capital across a diversified set of high-quality businesses, ensuring that no single position dominates the portfolio. Set position sizes based on conviction and risk profile, with larger allocations to your highest-conviction ideas. Incorporate diversification across sectors, geographies, and business models to reduce vulnerability to idiosyncratic risks. Use cash or liquid alternatives as a buffer to take advantage of market dislocations. Document your investment thesis for each holding and set clear criteria for review and exit.

- Implement Strategic Laziness and Ongoing Management (Ongoing, with quarterly/annual reviews): Adopt a disciplined review schedule—quarterly or annual reviews are sufficient for most portfolios. During reviews, focus on changes in business fundamentals rather than short-term price movements. Resist the urge to trade frequently; only act when a position no longer meets your criteria or when a compelling new opportunity arises. Use checklists and decision journals to maintain process discipline and guard against behavioral biases. Embrace periods of inactivity as a sign of a well-constructed portfolio.

- Pursue Continuous Improvement (Ongoing, with regular learning): Dedicate time each month to learning from both successes and failures. Review past decisions, analyze what worked and what didn’t, and update your investment process accordingly. Leverage resources such as investment books, podcasts, and research platforms like Value Sense to stay abreast of new developments and best practices. Engage with a community of like-minded investors to share insights and reinforce discipline. Over time, this commitment to learning and adaptation will enhance both your process and your results.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About What I Learned About Investing from Darwin

1. What is the central message of "What I Learned About Investing from Darwin"?

The book’s central message is that the principles of evolution—risk avoidance, adaptation, and patience—are directly applicable to investing. Pulak Prasad argues that investors should prioritize avoiding catastrophic losses, focus on buying high-quality businesses at fair prices, and embrace strategic inactivity. By learning from nature’s playbook, investors can build more resilient portfolios and achieve superior long-term results.

2. How does Pulak Prasad use evolutionary biology to inform investment decisions?

Prasad draws analogies between survival strategies in nature and successful investment practices. He uses examples such as bumblebees, bacteria, and sea urchins to illustrate concepts like risk management, quality assessment, and adaptability. These evolutionary insights help investors understand why some companies thrive while others fail, and why flexibility and resilience are crucial in navigating uncertain markets.

3. What practical strategies does the book recommend for individual investors?

The book recommends several actionable strategies: prioritize risk management, build portfolios of high-quality businesses, wait for fair prices, and embrace long-term holding periods. Prasad also advises using checklists, maintaining diversification, and guarding against behavioral biases. The emphasis is on process discipline and patience, rather than chasing short-term gains or reacting to market noise.

4. Is this book suitable for beginners or only experienced investors?

While the book contains sophisticated concepts, it is written in an accessible style that makes it suitable for both beginners and experienced investors. Prasad explains complex ideas using vivid analogies and real-world examples, making the lessons easy to grasp. Beginners will benefit from the foundational focus on risk management, while seasoned investors will appreciate the nuanced insights into quality assessment and behavioral finance.

5. How can investors apply the lessons from the book in today’s markets?

Investors can apply the book’s lessons by conducting regular risk audits, building watchlists of quality businesses, and setting clear investment criteria. The principles of strategic laziness and long-term thinking are especially relevant in today’s volatile and information-rich markets. By staying disciplined, focusing on process over outcome, and adapting to new information, investors can navigate uncertainty and build enduring wealth.