William Von Mueffling - Cantillon Capital Management Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

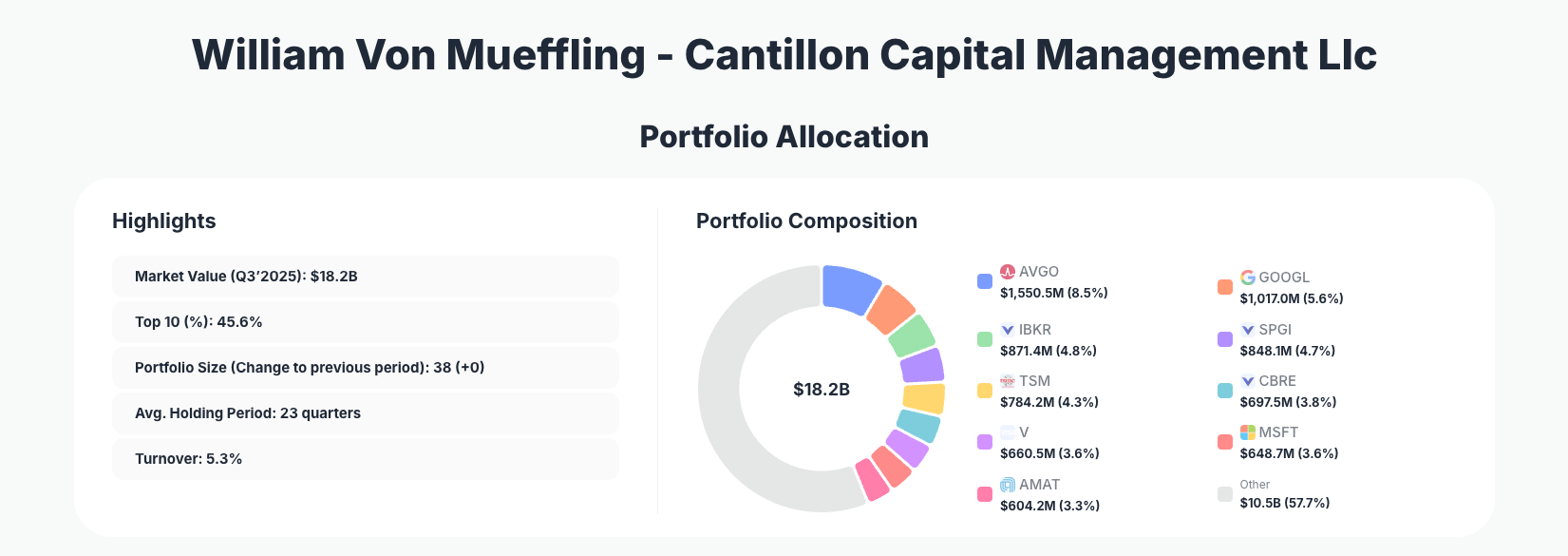

William Von Mueffling - Cantillon Capital Management Llc continues to showcase a disciplined, low-turnover approach to long-only equity investing. Their Q3’2025 portfolio comes in at $18.2B of reported U.S. equity holdings spread across 38 positions, with subtle trims in several core compounders rather than dramatic repositioning—highlighting a focus on valuation-sensitive risk management rather than wholesale strategy shifts.

The Big Picture: Calm Stewardship, Patient Compounding

Portfolio Highlights (Q3’2025): - Market Value: $18.2B

- Top 10 Holdings: 45.6% of the portfolio

- Portfolio Size: 38 +0 positions

- Average Holding Period: 23 quarters

- Turnover: 5.3%

Cantillon’s latest portfolio underscores its reputation as a patient, fundamentals-driven manager. With 45.6% of capital in the top 10 positions and an average holding period of nearly six years (23 quarters), this is a classic “own great businesses for the long term” playbook—far from a trading-oriented approach.

Turnover of 5.3% signals only modest tweaks at the margin rather than a wholesale rethink of the firm’s opportunity set. Instead of chasing short-term narratives, the Cantillon Capital portfolio shows a disciplined pattern of trimming winners such as semiconductors, software, and payments when valuations stretch, while retaining large exposures that still meet their quality and durability thresholds.

With 38 positions and no net change in count this quarter, William Von Mueffling is clearly optimizing around sizing and risk rather than expanding the investable universe. The result is a focused but not ultra-concentrated portfolio that balances conviction with diversification—especially across technology, financial infrastructure, and high-quality service businesses.

Top Holdings Snapshot: Trimming the Tech & Fintech Compounders

The Q3’2025 filing shows 10 core names with meaningful activity, all via reductions—suggesting valuation discipline and risk control after strong performance rather than a loss of faith in the underlying franchises.

The largest disclosed change is in Broadcom Inc., where Cantillon continues to treat the position as a core but actively sized holding. Broadcom (AVGO) remains a heavyweight at 8.5% of the portfolio and $1,550.5M of market value, yet it was “Reduce 14.25%”, indicating a significant trim after a sharp run-up while still retaining high conviction.

Alphabet’s dominant digital advertising and cloud engine remains another pillar. Alphabet (GOOGL) sits at 5.6% of the portfolio, worth $1,017.0M, but Cantillon opted to “Reduce 1.09%”, a fine-tuning move rather than a structural exit. The slight trim suggests sensitivity to position size and valuation while preserving a large exposure.

In capital markets infrastructure, Interactive Brokers (IBKR) is a key holding at 4.8% and $871.4M, again marked as “Reduce 1.09%”. The same pattern holds for S&P GLOBAL INC, which represents 4.7% of the portfolio and $848.1M, also “Reduce 1.09%”—a consistent signal that Cantillon is trimming but not abandoning its financial data and brokerage ecosystem theme.

Semiconductors remain central through Taiwan Semiconductor Manufacturing Company Limited. TSMC (TSM) accounts for 4.3% of the portfolio at $784.2M, with a “Reduce 1.09%” adjustment. This modest cut mirrors the fine-tuning visible in other top names, rather than a sector call against semis.

Real estate and services exposure comes via CBRE Group (CBRE), a 3.8% position worth $697.5M, again slightly “Reduce 1.09%”. Cantillon appears comfortable maintaining sizable service and property-related exposure while gently tightening risk.

Global payment rails continue to feature prominently. Visa (V) stands at 3.6% of the portfolio with $660.5M invested and a “Reduce 1.09%” label, mirroring the trimming across other compounders. Similarly, software giant Microsoft (MSFT) holds 3.6% and $648.7M, with a “Reduce 1.09%” action—once again keeping a major winner while slowly crystallizing gains.

In semiconductor equipment, Applied Materials (AMAT) is a 3.3% position at $604.2M, also marked “Reduce 1.09%”. Rounding out the set of notable moves, asset-management powerhouse BlackRock (BLK) represents 3.3% of the portfolio and $595.1M, with Cantillon again opting for a “Reduce 1.09%” tweak.

Taken together, these 10 holdings—spanning chips, big tech, payments, financial data, and asset management—illustrate a clear pattern: no new additions, no outright sales, just carefully calibrated trims in long-term winners to manage risk and maintain flexibility.

What the Portfolio Reveals About Cantillon’s Current Strategy

Cantillon’s Q3’2025 13F paints a consistent picture of its investing philosophy:

- Quality over growth-at-any-price

Every highlighted position—AVGO, GOOGL, TSM, MSFT, V, AMAT, IBKR, S&P GLOBAL INC, CBRE, BLK—is a well-established, cash-generative business with durable competitive advantages. The firm clearly prefers moaty, system-critical companies over speculative growth. - Thematic focus on financial and information infrastructure

A large share of the trimmed names sit at the core of global financial plumbing and information rails: rating agencies, trading platforms, asset managers, and payment networks. This aligns with a view that the infrastructure of markets and digital payments is a secular compounder, even if near-term valuations require occasional trimming. - Global and sector diversification with a tech tilt

While the portfolio is not tech-only, it is heavily exposed to technology and tech-adjacent infrastructure—semis, software, and data—balanced by financials, real estate services, and asset management. Global exposure is expressed through U.S.-listed multinationals like TSM and international revenue-heavy franchises. - Risk management via trims, not wholesale exits

The consistent “Reduce 1.09%” tag across many positions and a larger “Reduce 14.25%” in AVGO shows a methodical rebalancing framework. Gains are realized progressively, keeping position sizes aligned with risk tolerances while preserving core exposure to the businesses.

Portfolio Concentration Analysis

Using the reported top 10 holdings data from the Q3’2025 13F:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Broadcom Inc. (AVGO) | $1,550.5M | 8.5% | Reduce 14.25% |

| Alphabet Inc. (GOOGL) | $1,017.0M | 5.6% | Reduce 1.09% |

| Interactive Brokers Group, Inc. (IBKR) | $871.4M | 4.8% | Reduce 1.09% |

| S&P GLOBAL INC | $848.1M | 4.7% | Reduce 1.09% |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $784.2M | 4.3% | Reduce 1.09% |

| CBRE Group, Inc. (CBRE) | $697.5M | 3.8% | Reduce 1.09% |

| Visa Inc. (V) | $660.5M | 3.6% | Reduce 1.09% |

| Microsoft Corporation (MSFT) | $648.7M | 3.6% | Reduce 1.09% |

| Applied Materials, Inc. (AMAT) | $604.2M | 3.3% | Reduce 1.09% |

With 45.6% of the portfolio concentrated in the top 10, Cantillon demonstrates high but not extreme concentration: large enough to matter, diversified enough to mitigate idiosyncratic risk. The fact that every top line item is tagged “Reduce” (with varying magnitudes) underlines a quarter dominated by position sizing and risk control, not new idea generation.

The standout is AVGO, where a 14.25% reduction suggests both outsized prior gains and a desire to avoid overexposure to a single semiconductor name, even one Cantillon still clearly favors at 8.5% of capital.

Investment Lessons from William Von Mueffling and Cantillon Capital

Cantillon’s Q3’2025 13F offers several actionable takeaways for individual investors studying the William Von Mueffling – Cantillon Capital approach:

- Let winners run, but rebalance when necessary

Cantillon shows how to continue owning dominant franchises like GOOGL, MSFT, V, and AVGO while trimming to keep risk and valuation in check. - Focus on durable moats, not just growth rates

Many key holdings are “infrastructure” style businesses (rating agencies, semis, payment rails, data platforms) that benefit from scale, network effects, and high switching costs—traits that often matter more than headline growth. - Low turnover can be a competitive edge

An average holding period of 23 quarters and 5.3% turnover shows that most of the work is done upfront in selecting businesses. Compounding is allowed to work by not constantly trading. - Position sizing is an ongoing process

The near-uniform “Reduce 1.09%” adjustments reveal a rules-based mindset toward risk: even if the thesis is intact, positions are right-sized as markets move. - Diversify by business model and economic role

Even with a tech and financial tilt, Cantillon spreads exposure across semiconductors, software, brokers, ratings, payments, real estate services, and asset management—different parts of the economic stack, each with its own cycle and revenue drivers.

Looking Ahead: What Comes Next for Cantillon’s Portfolio?

Based on this Q3’2025 positioning, several forward-looking themes stand out:

- Dry powder via trims, not cash hoarding

The broad-based reductions across winners suggest Cantillon is quietly building optionality—either in the form of modestly higher cash or room to add to laggards and new ideas if volatility returns. - Core exposure to global tech and financial plumbing remains intact

With large stakes still in AVGO, TSM, AMAT, MSFT, and financial infrastructure names like S&P GLOBAL INC, IBKR, V, and BLK, the firm remains positioned for long-term growth tied to data, chips, and capital markets activity. - Potential for selective additions if markets correct

Given the modest but wide-ranging trims, Cantillon could be preparing to redeploy into either:- Existing core positions at better prices, or

- New high-quality names that meet its stringent criteria but were previously too expensive.

- Stable strategy, flexible execution

No change in total position count 38, combined with low turnover, implies that any future shifts are likely to be evolutionary, not revolutionary—consistent with a long-term compounding mindset.

FAQ about William Von Mueffling – Cantillon Capital Portfolio

Q: What was the biggest move in Cantillon’s Q3’2025 13F portfolio?

The largest reported change was in Broadcom (AVGO), a top position at 8.5% of the portfolio and $1,550.5M, where Cantillon chose to “Reduce 14.25%” while still keeping it as a core holding.

Q: How concentrated is William Von Mueffling’s Cantillon Capital portfolio?

Cantillon runs a focused but not hyper-concentrated book: 45.6% of capital is in the top 10 holdings, and there are 38 total positions with no net change this quarter, reflecting a long-term, high-conviction style that still respects diversification.

Q: Did Cantillon make any major strategic shifts this quarter?

No. The Q3’2025 filing shows no new positions or outright exits in the highlighted data—only trims across key holdings such as GOOGL, IBKR, S&P GLOBAL INC, TSM, CBRE, V, MSFT, AMAT, and BLK.

Q: How does the 45-day 13F reporting lag affect following Cantillon’s moves?

13F filings are typically released up to 45 days after quarter-end, so Cantillon’s real-time positions may differ from the Q3’2025 snapshot. Investors should treat the data as a strategic view of holdings and sizing, not a real-time trading feed.

Q: How can I track William Von Mueffling’s Cantillon Capital portfolio over time?

You can monitor Cantillon’s holdings, top positions, and quarter-over-quarter changes using the ValueSense superinvestor tracker. Visit the dedicated page for Cantillon at Cantillon Capital’s portfolio to see updated 13F data, historical trends, and position-level insights.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!