Yacktman Asset Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Yacktman Asset Management continues its disciplined value investing approach, methodically trimming positions across its core holdings in the latest 13F filing. Their $7.3B portfolio shows widespread reductions in top names, signaling a cautious stance amid market highs while maintaining focus on high-quality, long-duration businesses.

Portfolio Overview: Disciplined Concentration with Proven Patience

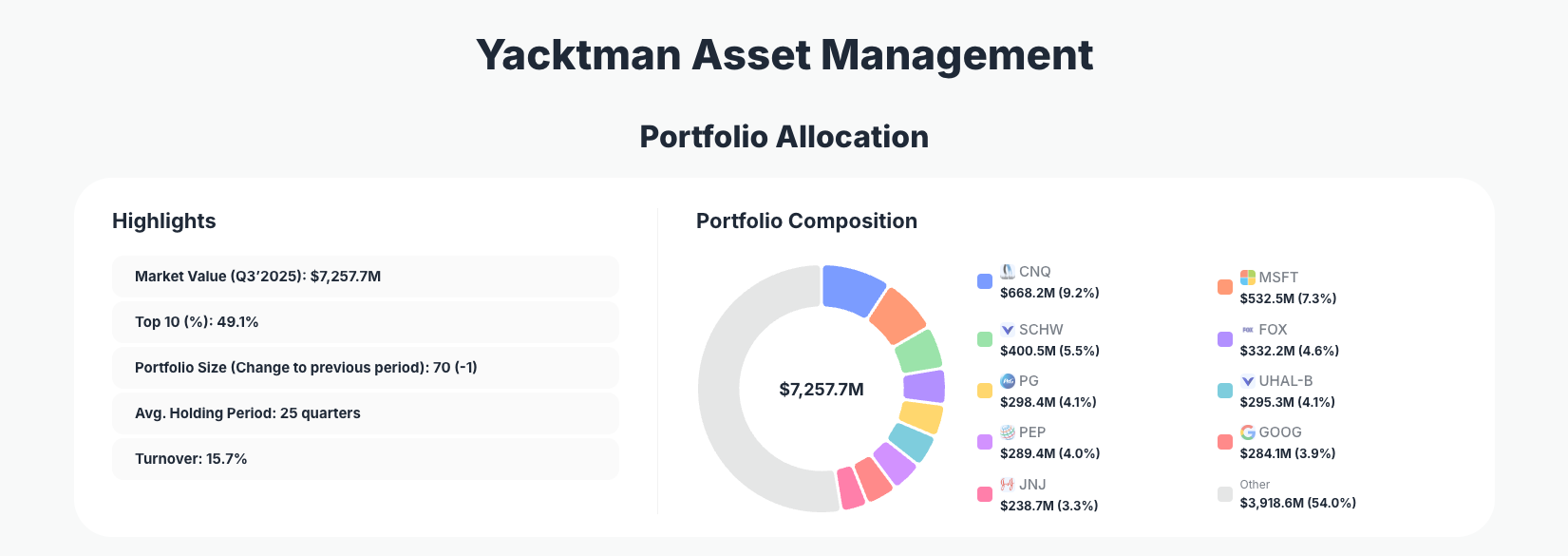

Portfolio Highlights (Q3’2025): - Market Value: $7,257.7M - Top 10 Holdings: 49.1% - Portfolio Size: 70 -1 - Average Holding Period: 25 quarters - Turnover: 15.7%

Yacktman Asset Management's portfolio exemplifies classic value investing with a balanced concentration—nearly half the $7.3 billion value locked in just 10 positions across 70 total holdings. The slight reduction to 69 positions (from 71) reflects ongoing portfolio hygiene, trimming smaller or underperforming names while the average 25-quarter holding period underscores conviction in durable businesses. Turnover at 15.7% indicates measured activity, not reactive trading.

This structure allows Yacktman to weather volatility through quality names in consumer staples, energy, tech, and financials, blending dividend payers with growth compounds. The top 10's 49.1% weighting shows comfort with concentration when opportunities align with their free cash flow and management quality criteria, as tracked on their ValueSense superinvestor page. Recent trims suggest profit-taking after strong runs, preserving dry powder for undervalued entries.

Top Holdings: Widespread Reductions Signal Profit-Taking Discipline

The Yacktman portfolio features systematic reductions across its leading positions. Canadian Natural Resources (CNQ) holds at 9.2% $668.2M after a Reduce 5.51% trim, maintaining energy exposure. Microsoft (MSFT) follows at 7.3% $532.5M with a Reduce 6.99% cut, balancing tech growth.

Charles Schwab (SCHW) sits at 5.5% $400.5M, reduced by 8.12%, while Fox (FOX) weighs in at 4.6% $332.2M after Reduce 6.87%. Consumer giants like Procter & Gamble (PG) (4.1%, $298.4M, Reduce 3.80%) and PepsiCo (PEP) (4.0%, $289.4M, Reduce 2.23%) anchor stability. Alphabet (GOOG) at 3.9% $284.1M saw the sharpest cut at Reduce 8.95%, alongside Johnson & Johnson (JNJ) (3.3%, $238.7M, Reduce 5.60%).

Further changes include News Corporation (NWSA) at 3.1% ($227.9M, Reduce 8.59%) and U-Haul Holding Class B (4.1%, $295.3M, Reduce 3.09%), rounding out a pattern of prudent scaling back in familiar winners.

What the Portfolio Reveals About Yacktman's Strategy

Yacktman's Q3 moves highlight a risk-management focus on quality compounders with strong free cash flow, even at the expense of short-term gains. The uniform reductions across energy, tech, financials, and staples suggest valuation discipline—locking in profits after rallies while sectors like commodities via CNQ provide inflation hedges.

Key themes include: - Quality over momentum: Emphasis on dividend aristocrats like PG, PEP, and JNJ for resilient earnings. - Sector balance: Tech (MSFT, GOOG) tempers with energy and media diversification. - Long-term geographic tilt: U.S.-centric with Canadian energy exposure for resource plays. - Turnover as discipline: 15.7% rate enables trims without abandoning theses.

This approach prioritizes downside protection in elevated markets.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Canadian Natural Resources Limited | $668.2M | 9.2% | Reduce 5.51% |

| Microsoft Corporation | $532.5M | 7.3% | Reduce 6.99% |

| The Charles Schwab Corporation | $400.5M | 5.5% | Reduce 8.12% |

| Fox Corporation | $332.2M | 4.6% | Reduce 6.87% |

| The Procter & Gamble Company | $298.4M | 4.1% | Reduce 3.80% |

| U-Haul Holding Company Class B | $295.3M | 4.1% | Reduce 3.09% |

| PepsiCo, Inc. | $289.4M | 4.0% | Reduce 2.23% |

| Alphabet Inc. | $284.1M | 3.9% | Reduce 8.95% |

| Johnson & Johnson | $238.7M | 3.3% | Reduce 5.60% |

The table reveals Yacktman's hallmark concentration, with the top 10 commanding 49.1% of the portfolio despite broad trims averaging 5-9% reductions. No single position exceeds 10%, showcasing diversification within conviction—CNQ's energy anchor balances tech volatility from MSFT and GOOG. This pruning across ranks 2-10 freed capital while retaining exposure to battle-tested names, aligning with their 25-quarter average hold signaling patience over speculation.

Investment Lessons from Yacktman Asset Management

Yacktman's Q3 portfolio demonstrates timeless value principles tailored to their free cash flow focus: - Trim winners methodically: Reductions like SCHW 8.12% and GOOG 8.95% show profit-taking preserves gains without exiting quality. - Prioritize holding period: 25 quarters average tenure proves patience in PG and PEP yields superior compounding. - Balance sectors for resilience: Energy (CNQ), tech, and staples mitigate risks. - Concentration with 70 holdings: 49.1% top 10 weighting demands deep business understanding. - Low turnover discipline: 15.7% rate avoids churn, focusing on intrinsic value.

Looking Ahead: What Comes Next?

With portfolio size down to 70 and widespread trims generating liquidity, Yacktman appears positioned for opportunistic buys in undervalued free cash flow generators. The 15.7% turnover and one-position exit suggest cash deployment into overlooked industrials, more staples, or energy if valuations correct. Current holdings like JNJ and CNQ hedge inflation and recession, setting up well for 2026 volatility. Monitor their superinvestor page for Q4 signals amid potential rate cuts.

FAQ about Yacktman Asset Management Portfolio

Q: Why the widespread reductions in Yacktman's Q3 2025 top holdings?

A: The trims, like Reduce 8.95% in GOOG and 8.12% in SCHW, reflect profit-taking after strong performance, freeing capital while holding core quality names—classic Yacktman valuation discipline.

Q: What does Yacktman's 49.1% top 10 concentration reveal about their strategy?

A: It underscores focused conviction in free cash flow machines across sectors, balanced by 70 total holdings for risk control, with 25-quarter average tenure prioritizing long-term compounding over short-term trades.

Q: What sectors dominate Yacktman's portfolio?

A: Energy (CNQ), technology (MSFT), financials (SCHW), and consumer staples (PG, PEP) lead, offering dividend stability and growth.

Q: How can I track Yacktman Asset Management's portfolio changes?

A: Follow quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/yacktman-asset for real-time analysis, visualizations, and historical data—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!