YouTube Valuation 2025: Why Google's $472 Billion Hidden Gem Is Massively Undervalued

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

While Wall Street obsesses over AI and cloud computing, YouTube's $472 billion valuation remains buried within Alphabet's portfolio - representing one of the most significant investment opportunities in big tech today. Our comprehensive analysis reveals why YouTube trades at a massive discount compared to streaming rivals like Netflix.

YouTube's Explosive Growth Trajectory in 2025

Revenue Dominance Accelerating

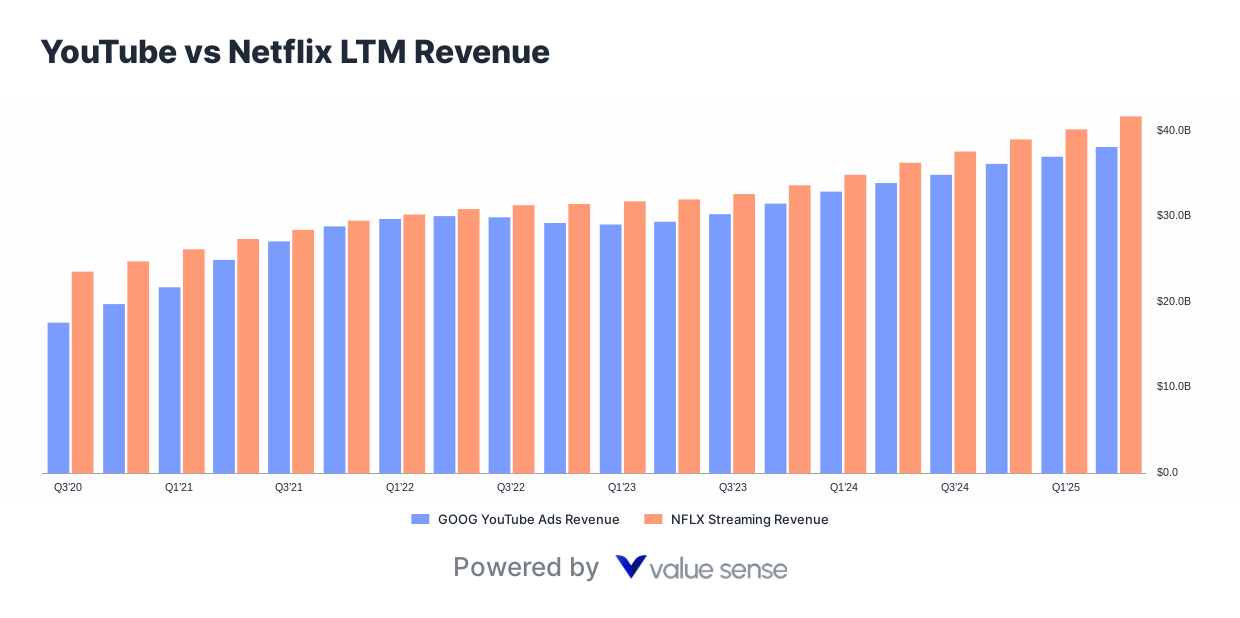

YouTube has generated $36.1 billion in annual revenue, representing a staggering 400% growth since 2017. The platform's momentum has continued with Q2 2025 delivering $9.8 billion in quarterly revenue - a 13% year-over-year increase that significantly beat analyst expectations.

Source: Alphabet Q2 2025 Earnings, ValueSense $GOOG Q2 2025 Earnings

TV Viewership Revolution

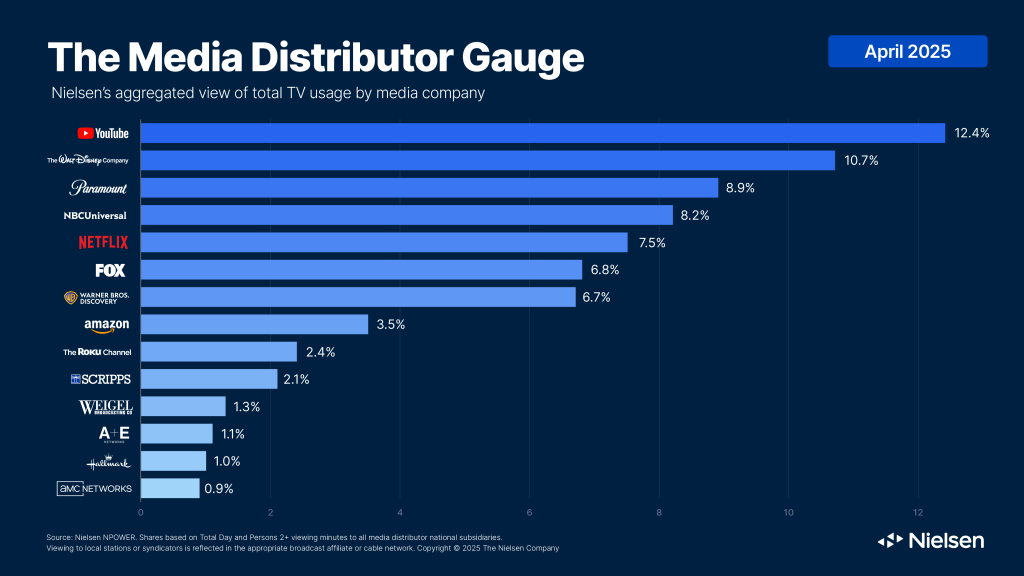

According to Nielsen's latest Media Distributor Gauge, YouTube now commands 12.5% of all US television viewing - officially surpassing Netflix (7.6%) and Disney+ combined. This milestone makes YouTube the first streaming platform to crack double-digit TV viewership share.

The platform's TV dominance extends across demographics:

- Average daily viewers: 7 million watching on TV sets

- Prime-time competition: Tight margins with Netflix's 4.7 million daily average

- Youth engagement: Nearly 30% of viewers aged 2-17

Source: Nielsen TV Measurement Report 2025

Subscription Revenue Surge

YouTube Premium has reached 125 million subscribers with subscription revenue growing faster than advertising income—proving successful diversification beyond traditional ad-supported models.

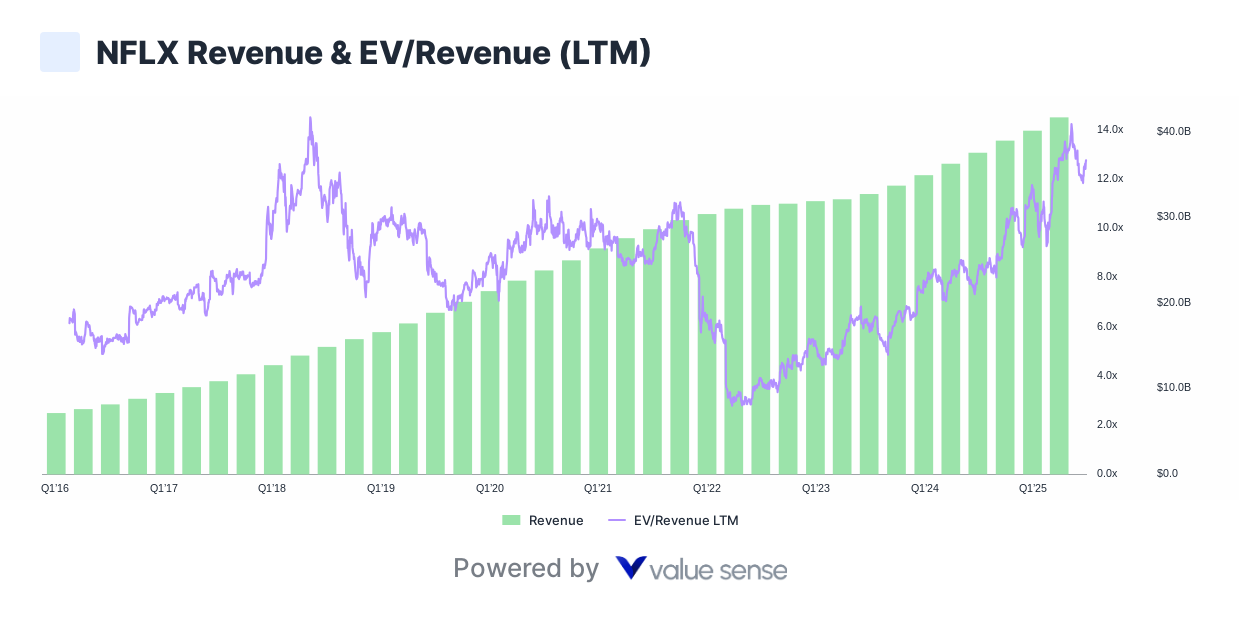

The Netflix Valuation Reality Check

Multiple Comparison Analysis

| Platform | Revenue Multiple | Annual Revenue | Growth Rate | Content Costs |

|---|---|---|---|---|

| Netflix | 12.4x EV/Revenue | $39.2B | Single-digit | $15B+ originals |

| YouTube | 6.5x EV/Revenue* | $38.1B | 13% YoY | Creator sharing model |

Applied Netflix's 12.4x multiple = $472B valuation

Superior Business Model Fundamentals

YouTube operates with significant competitive advantages over Netflix:

✅ Multiple Revenue Streams

- Advertising revenue: $36.1B (latest twelve months)

- YouTube Premium subscriptions: Growing faster than ads

- YouTube TV: $8B+ annual run rate

- Creator economy monetization

✅ Lower Content Acquisition Costs Netflix spends $15+ billion annually on original content, while YouTube's creator-sharing model provides cost-effective content at scale.

✅ Larger Addressable Market

- Global reach: 2.74 billion monthly users vs Netflix's 300M subscribers

- Free tier advantage: Lower barrier to entry drives massive scale

- Platform diversity: Mobile, desktop, TV, gaming integration

Investment Thesis: The $472 Billion Opportunity

For Alphabet (GOOGL) Investors

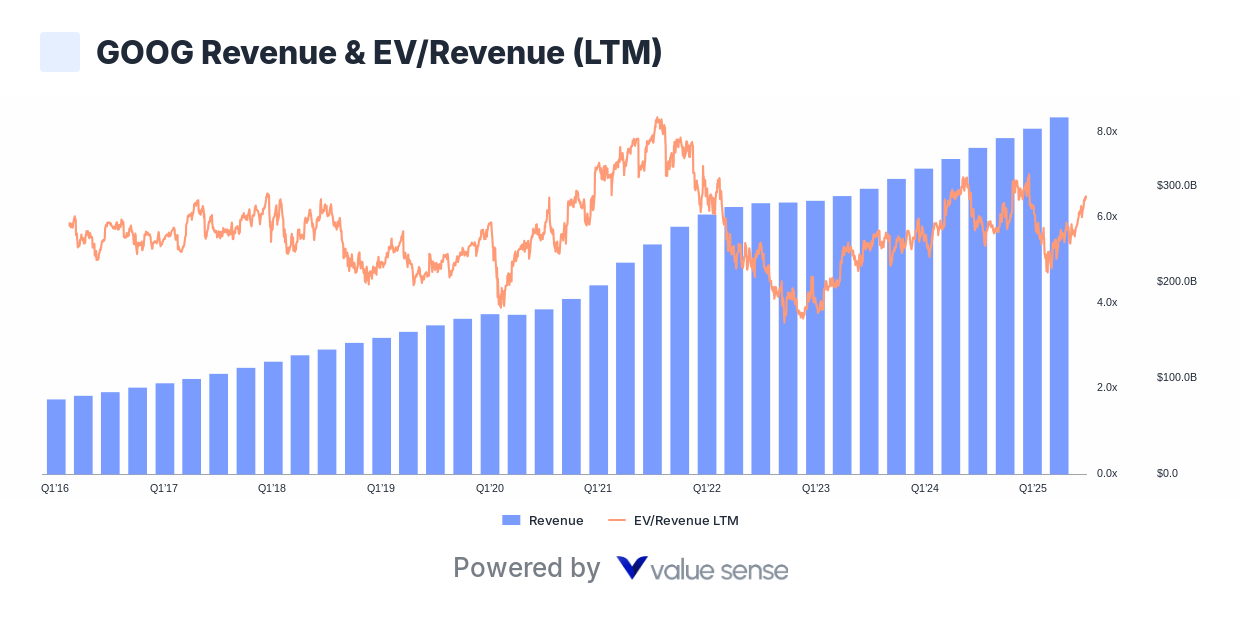

YouTube provides AI-disruption insurance while trading at a massive discount. The $472 billion standalone valuation suggests Google shares are deeply undervalued at only 6.5x revenue—compared to streaming pure-plays trading at 12x+ multiples.

Key Investment Catalysts:

- Potential YouTube spinoff creating $400B+ value unlock

- AI integration accelerating recommendation engine performance

- Live sports deals expanding premium subscriber base

- International expansion in untapped markets

Media Industry Transformation

Analysts predict YouTube becomes the #1 media company by revenue in 2025, surpassing Disney's entire media division ($28.7B). This shift represents the largest disruption in entertainment industry history.

Market Position Comparison (Current Annual Revenue):

- YouTube: $42.5B (projected to lead market)

- Netflix: $39.2B

- Disney Media: $28.7B

- Warner Bros Discovery: $21.8B

Why YouTube's Valuation Remains Hidden

Alphabet's Conglomerate Discount

YouTube's value gets obscured within Alphabet's broader portfolio including:

- Google Search ($175B+ revenue)

- Google Cloud ($35B+ revenue)

- Android ecosystem

- Hardware divisions

Accounting Treatment

Unlike Netflix's transparent standalone reporting, YouTube's financials are consolidated within "Google Services," making direct comparisons challenging for investors.

Market Psychology

Wall Street currently focuses on:

- AI/LLM development costs and competition

- Cloud computing growth rates

- Regulatory pressures on search dominance

This creates a value perception gap where YouTube's streaming dominance gets underweighted in GOOGL's valuation.

2025 Outlook: Catalysts for Recognition

Regulatory Pressure May Force Separation

Ongoing antitrust scrutiny could force Alphabet to spin off YouTube, immediately unlocking $400-500B in shareholder value through sum-of-the-parts recognition.

Competitive Landscape Shifts

As traditional media companies struggle with streaming losses, YouTube's profitable growth model becomes increasingly attractive to investors seeking refuge from the "streaming wars" casualties.

AI-Enhanced Monetization

Advanced recommendation algorithms and AI-powered ad targeting are driving:

- Higher CPMs through improved relevance

- Increased watch time per user

- Better creator monetization tools

Bottom Line: Getting YouTube "For Free"

While markets obsess over AI capabilities, YouTube quietly dominates media consumption with a $472 billion valuation hidden inside Google's portfolio.

The ValueSense analysis proves investors are essentially getting YouTube for free when buying GOOGL shares—representing one of the most compelling value opportunities in large-cap technology stocks today.

For investors seeking:

- ✅ Streaming exposure without Netflix's content cost burden

- ✅ AI-disruption hedging through content platform ownership

- ✅ Undervalued big tech position with multiple expansion potential

YouTube within Alphabet offers the ultimate "hidden gem" opportunity in 2025's market environment.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Leopold Aschenbrenner's AI Revolution Portfolio

📖 Michael Burry's Portfolio Analysis

📖 Data-Driven Value Investing: Why Fundamentals Still Matter