Analyzing Warren Buffett's Portfolio: The Intrinsic Value of His Key Investments in 2025

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Warren Buffett, often called the "Oracle of Omaha," has built his $167+ billion fortune through a disciplined value investing approach that revolves around one core concept: intrinsic value. Unlike market price, which fluctuates based on investor sentiment, intrinsic value represents what a business is truly worth based on its fundamentals.

As Buffett demonstrates in his investment decisions, determining intrinsic value requires looking beyond current market trends to evaluate a company's long-term potential, competitive advantages, and ability to generate consistent returns.

Buffett's Current Investments: Intrinsic Value Analysis

According to ValueSense's analysis, here's how Buffett's key investments stack up in terms of intrinsic value:

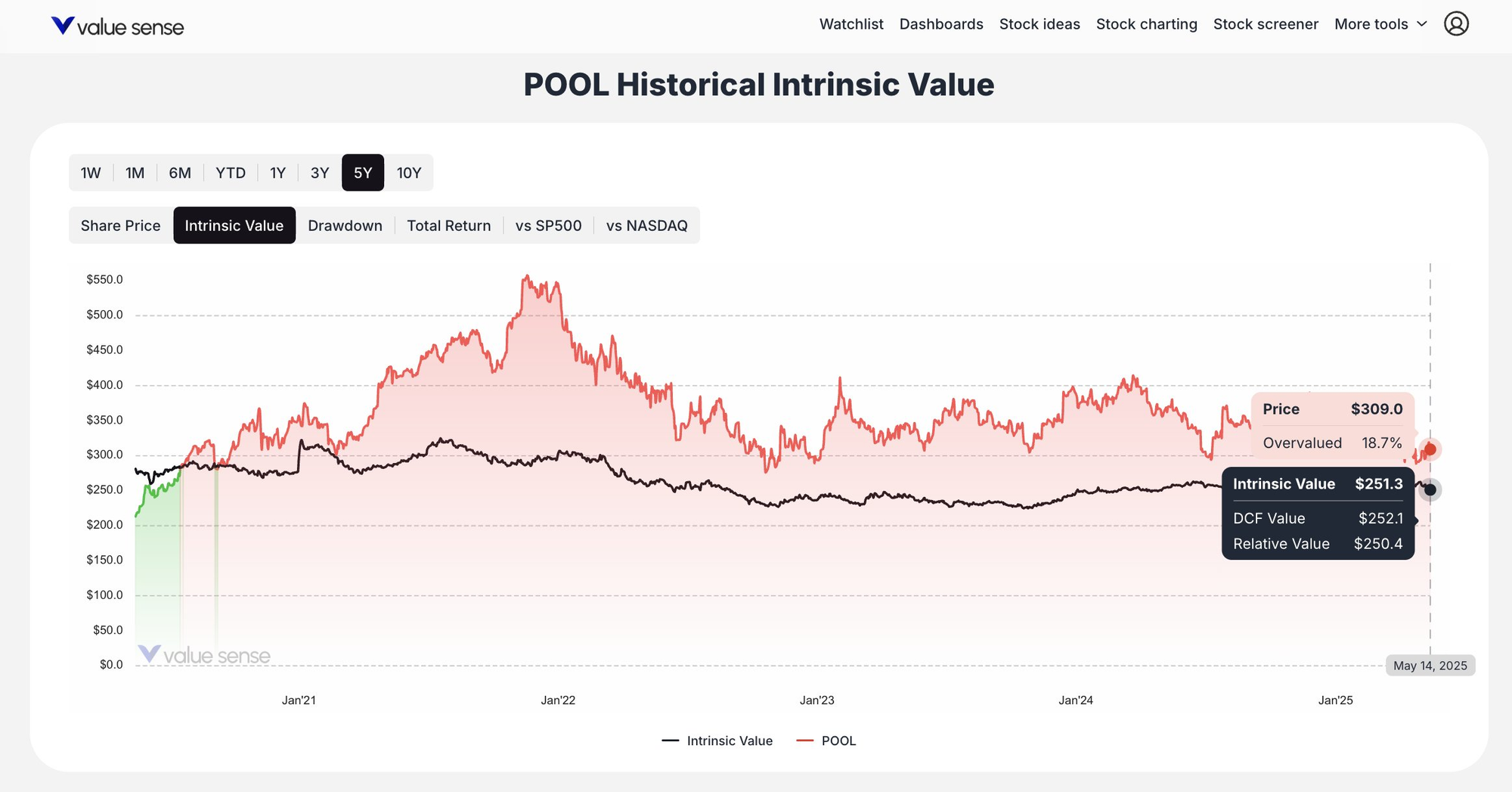

1. Pool Corporation ($POOL)

- Current Price: $309.0

- Intrinsic Value: $251.2

- Overvaluation: 18.7%

- Status: Overvalued

Pool Corporation, the world's largest distributor of swimming pool supplies and equipment, despite its strong market position, is currently trading above its intrinsic value. The chart shows that historically, the stock price has often exceeded the company's intrinsic value.

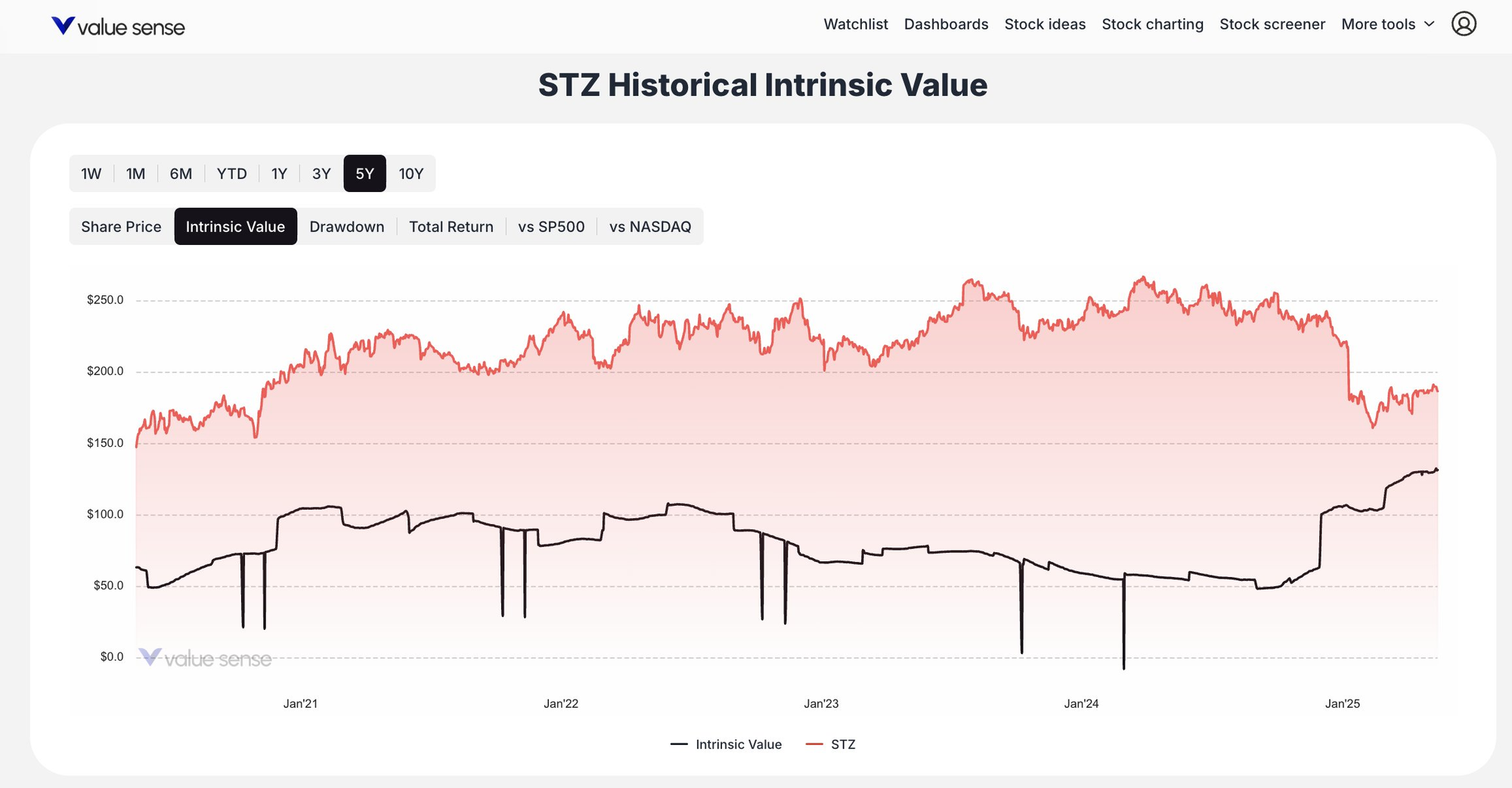

2. Constellation Brands ($STZ)

- Status: Volatile relative to intrinsic value

- History: Significant fluctuations around the intrinsic value line

Constellation Brands, owner of popular beer brands including Corona and Modelo, shows an interesting dynamic where the market price frequently crosses the intrinsic value line both from above and below, creating opportunities for position entry.

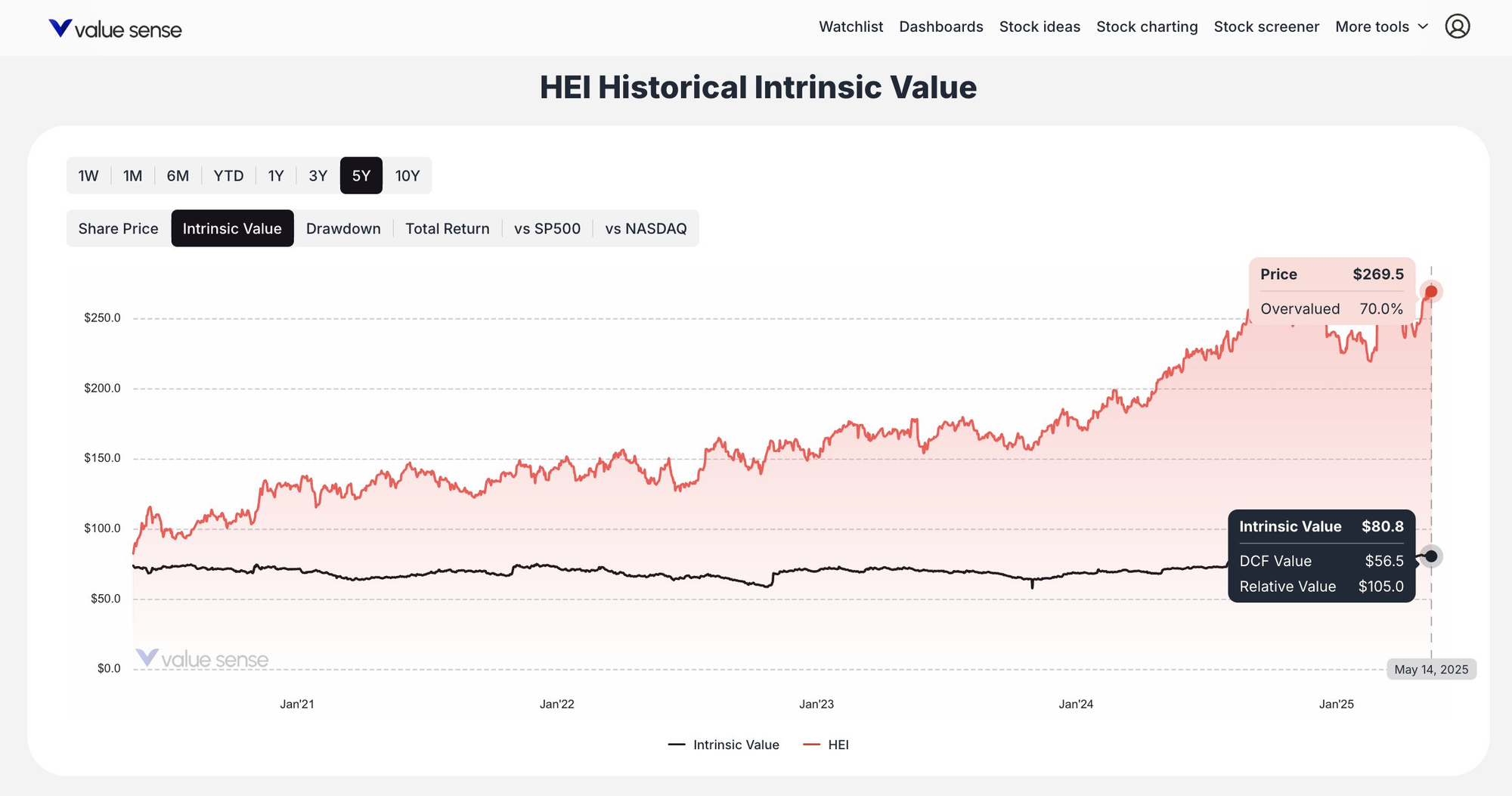

3. HEICO ($HEI)

- Current Price: $269.5

- Intrinsic Value: $80.2

- Overvaluation: 70.0%

- Status: Significantly overvalued

HEICO, an aerospace and electronics company, shows the most significant gap between current price and intrinsic value among all the investments examined, which may indicate a risk of potential correction.

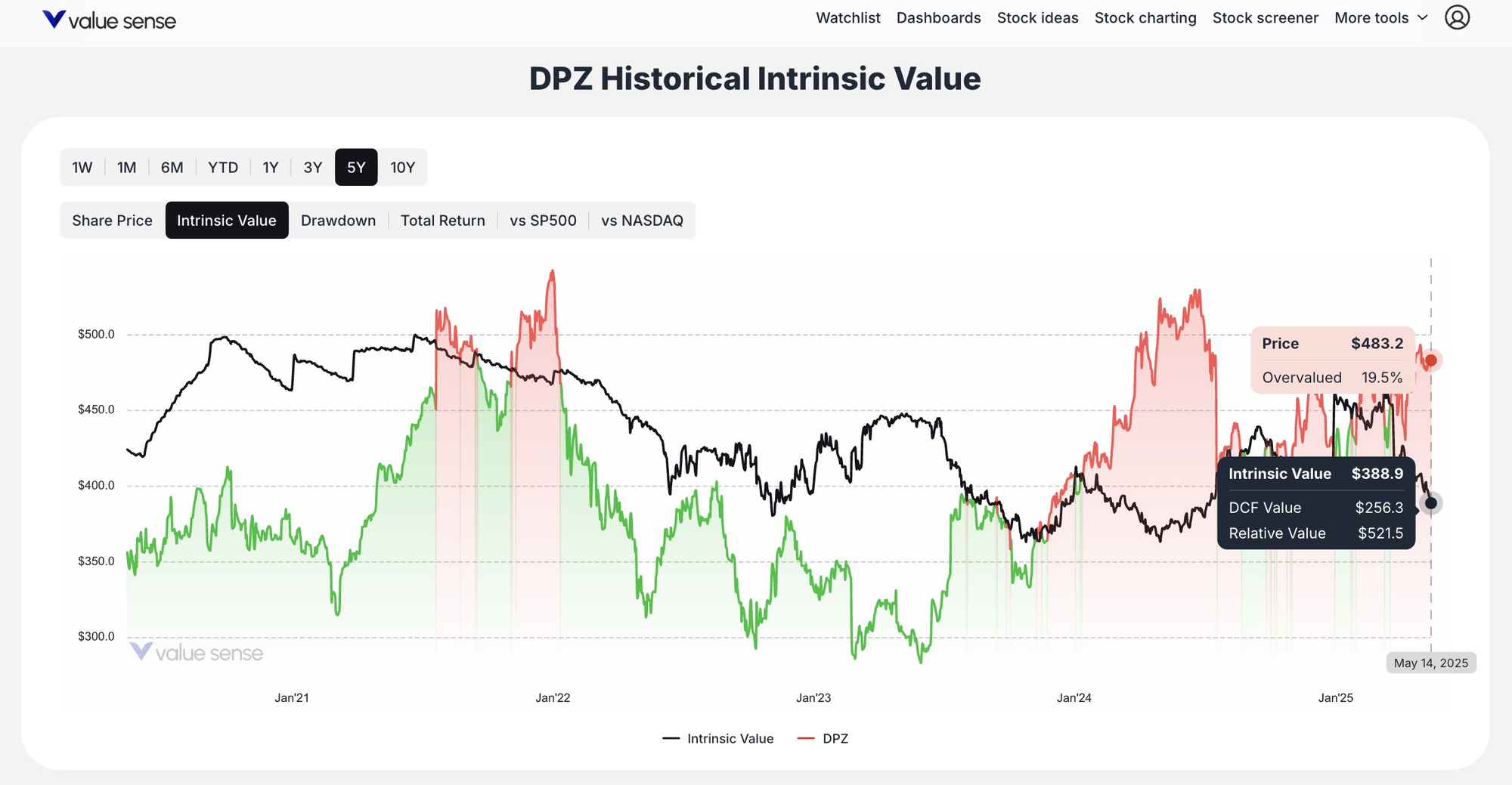

4. Domino's Pizza ($DPZ)

- Current Price: $482.2

- Intrinsic Value: $398.0

- Overvaluation: 19.5%

- Status: Overvalued

Domino's Pizza, with over 20,000 locations in more than 90 countries, trades at a premium to its intrinsic value. The chart shows a history of significant price fluctuations relative to intrinsic value, reflecting volatility in the fast-food sector.

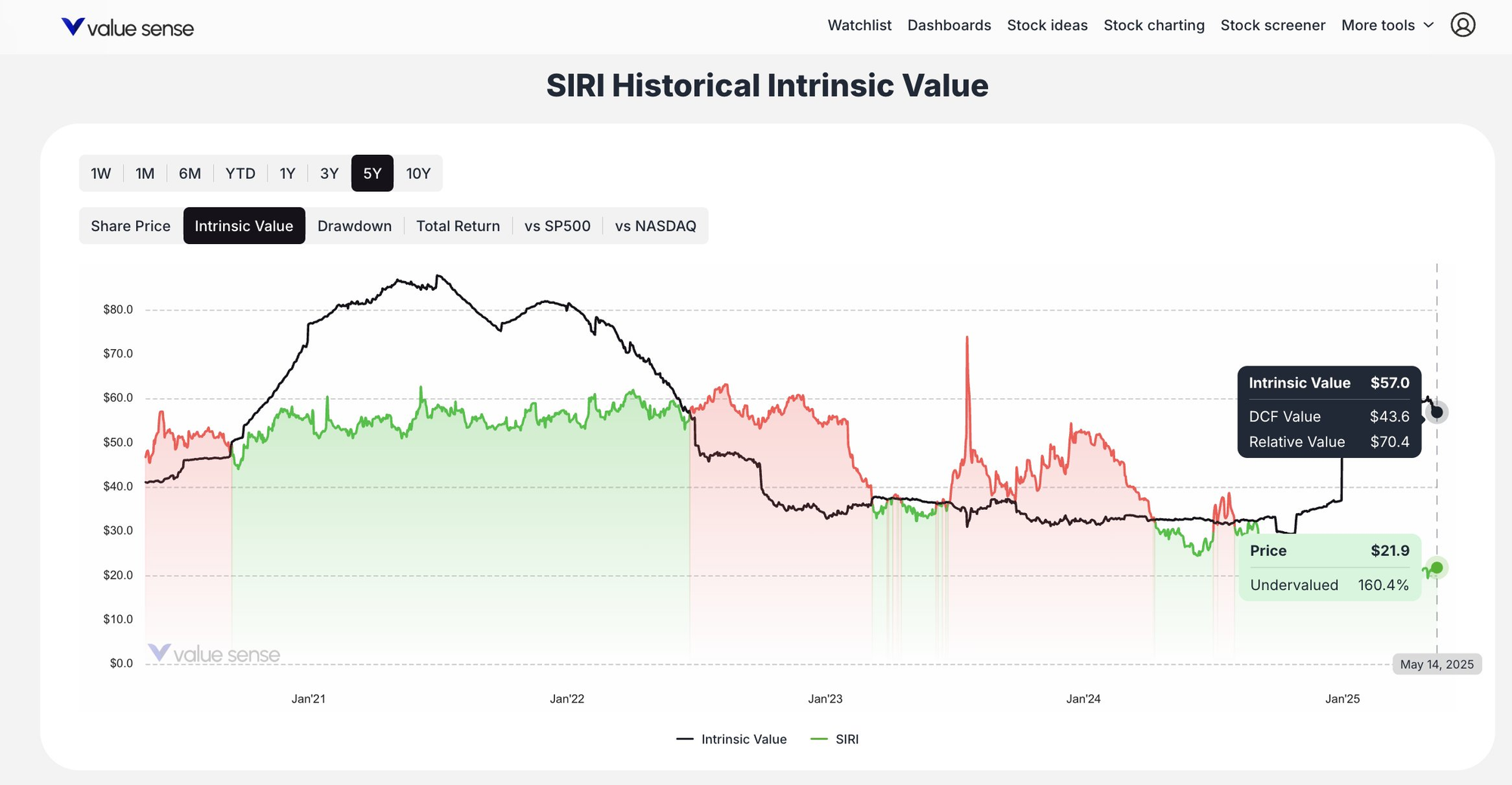

5. Sirius XM ($SIRI)

- Current Price: $21.0

- Intrinsic Value: $27.0

- Undervaluation: 100.6%

- Status: Substantially undervalued

Sirius XM represents a rare case in the portfolio where the company trades significantly below its intrinsic value. This makes it potentially attractive from Buffett's value-based approach.

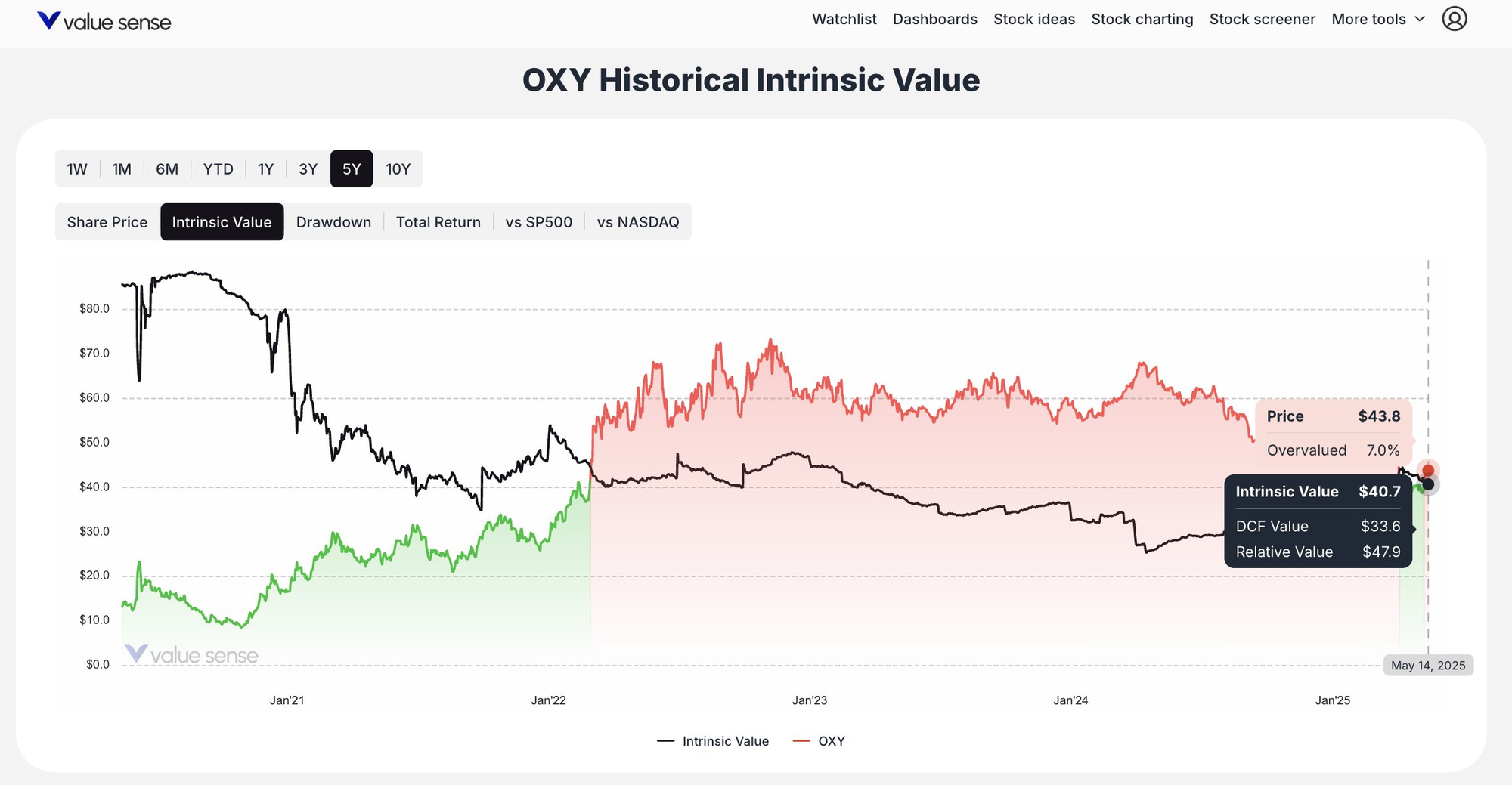

6. Occidental Petroleum ($OXY)

- Current Price: $42.9

- Intrinsic Value: $40.7

- Overvaluation: 7.0%

- Status: Slightly overvalued

Occidental Petroleum trades only slightly above its intrinsic value, which may indicate that Buffett considers this energy company to be close to fair valuation given the long-term prospects of the oil and gas sector.

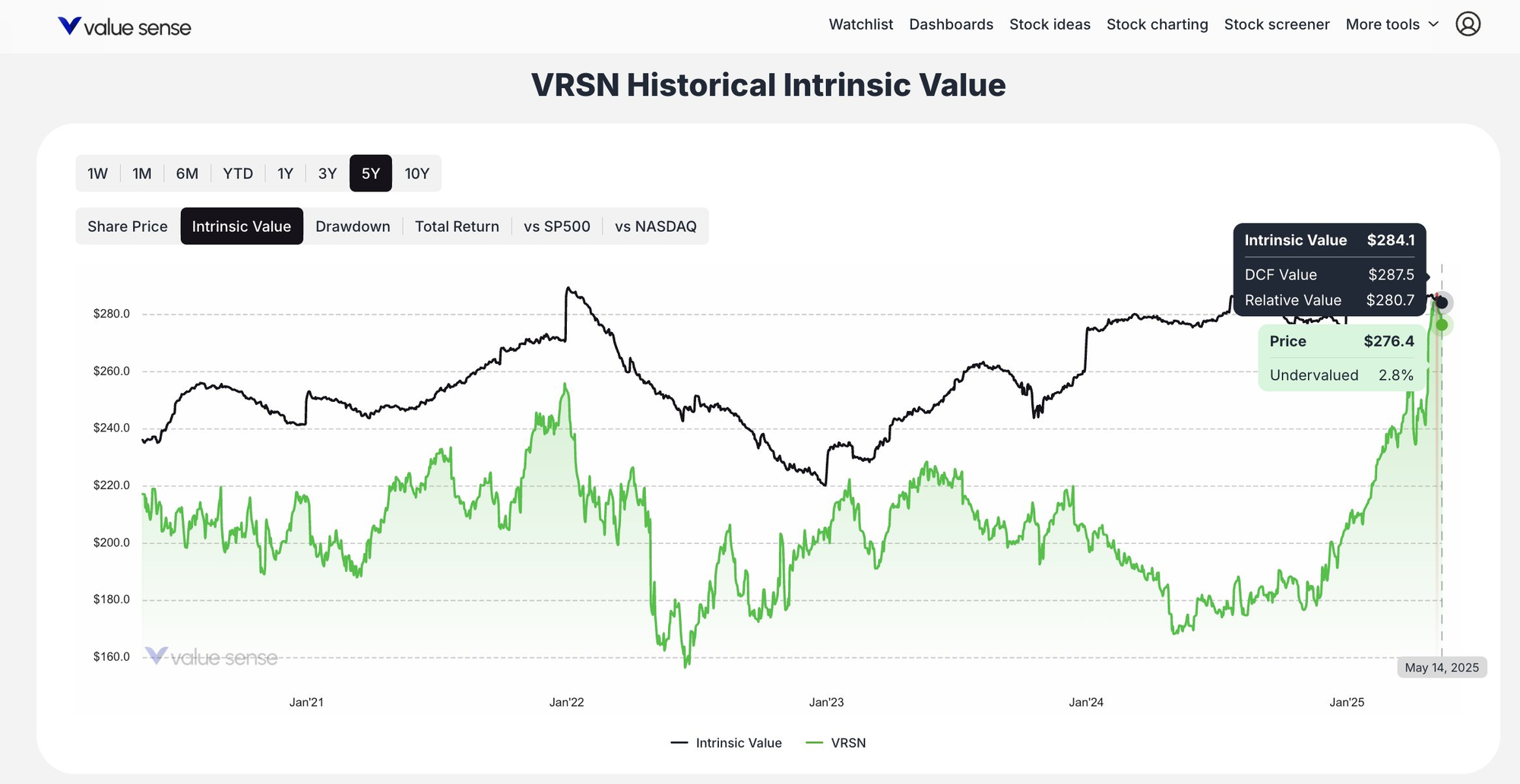

7. VeriSign ($VRSN)

- Current Price: $276.4

- Intrinsic Value: $284.1

- Undervaluation: 2.8%

- Status: Slightly undervalued

VeriSign, a provider of domain name registry services, trades slightly below its intrinsic value, making it moderately attractive from a value-based perspective.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 How Big Tech Makes Money

📖 5 Most Undervalued Chip Stocks Right Now

📖 15 High ROIC Stocks With 5%+ FCF Yields

FAQ: Buffett's Current Investments

What is Warren Buffett's method for calculating intrinsic value?

Warren Buffett calculates intrinsic value by estimating all future cash flows a business will generate over its lifetime and then discounting them back to present value using an appropriate discount rate. His approach typically involves analyzing a company's earnings power, competitive advantages (economic moats), growth potential, and management quality. While Buffett doesn't publicly share his exact formula, he generally uses a discount rate based on the 10-year Treasury yield plus a 3-4% risk premium, applies conservative growth assumptions, and insists on a significant margin of safety before investing.

Which stocks in Warren Buffett's 2025 portfolio are currently undervalued?

Based on the ValueSense analysis of Warren Buffett's 2025 portfolio, Sirius XM ($SIRI) stands out as significantly undervalued with a 100.6% discount to its intrinsic value ($21.0 market price vs $27.0 intrinsic value). VeriSign ($VRSN) is also slightly undervalued at 2.8% below its intrinsic value ($276.4 market price vs $284.1 intrinsic value). These undervalued positions align with Buffett's philosophy of seeking companies trading below their true worth, creating potential buying opportunities for value investors.

How does Buffett determine when to buy and sell stocks based on intrinsic value?

Buffett typically buys stocks when they trade significantly below his calculated intrinsic value, preferring a 20-30% discount as his "margin of safety." This approach is illustrated in the "Buy Zone" concept shown in the ValueSense charts. For selling, Buffett is known for his "forever" holding philosophy, famously stating that his "favorite holding period is forever." However, he will sell when: 1) the company's fundamentals deteriorate permanently, 2) he finds significantly better investment opportunities, 3) the stock becomes substantially overvalued relative to intrinsic value, or 4) he needs to raise cash for larger acquisitions.

What are the key differences between market price and intrinsic value in Buffett's investment strategy?

In Buffett's investment strategy, market price represents what investors are currently willing to pay for a stock based on market sentiment, momentum, and short-term factors. In contrast, intrinsic value represents a company's actual worth based on its long-term earnings power, competitive position, and fundamental business attributes. Buffett famously views the market as a "voting machine" in the short run (reflecting popularity) but a "weighing machine" in the long run (measuring true value). This distinction is central to his approach—he exploits situations where emotional market participants create significant gaps between price and value, allowing him to buy quality businesses at a discount.

How can individual investors apply Buffett's intrinsic value approach to their own portfolios in 2025?

Individual investors can apply Buffett's intrinsic value approach in 2025 by: 1) Focusing on businesses they understand within their "circle of competence," 2) Analyzing companies' financial statements to assess earnings power and competitive advantages, 3) Using conservative DCF (discounted cash flow) models with appropriate discount rates based on current Treasury yields, 4) Maintaining watchlists of quality companies and waiting patiently for prices to fall below calculated intrinsic values, 5) Ignoring short-term market noise and focusing on long-term business fundamentals, and 6) Diversifying appropriately while still maintaining conviction in their best ideas. Free online tools and spreadsheet templates are available to help with intrinsic value calculations, making Buffett's approach accessible even to non-professional investors.