The Rule of 40: How Top-Performing Stocks Are Crushing Market Expectations

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

The Rule of 40: How Top-Performing Stocks Are Crushing Market Expectations

In the world of investment analysis, finding companies with sustainable competitive advantages is the holy grail for investors. While many metrics exist to evaluate company performance, the "Rule of 40" has emerged as a powerful tool for identifying businesses with exceptional operational efficiency and growth potential. This metric, which combines revenue growth and free cash flow margin, offers a comprehensive view of a company's financial health and long-term prospects. In this article, we'll explore what the Rule of 40 means and examine ten remarkable companies that don't just meet this standard but vastly exceed it.

What is the Rule of 40?

The Rule of 40 is a performance metric primarily used to evaluate software and technology companies. It states that a healthy company's combined revenue growth rate and free cash flow margin should exceed 40%. For example, if a company has 30% revenue growth and a 15% free cash flow margin, its Rule of 40 score would be 45% - exceeding the benchmark and indicating strong performance.

This metric is powerful because it balances two critical aspects of business success:

- Growth (Revenue Growth): The ability to expand and capture market share

- Profitability (Free Cash Flow Margin): The ability to generate meaningful cash returns

Companies that can maintain a Rule of 40 score above 40% typically demonstrate sustainable business models with significant competitive advantages. However, the companies we'll examine below don't just exceed the threshold—they shatter it with scores above 70%, showcasing extraordinary business execution.

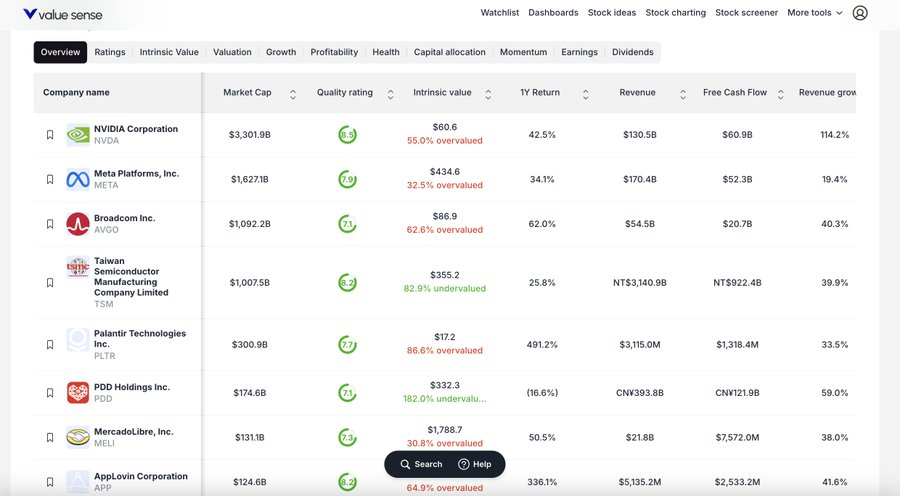

Top 10 Stocks with Legendary Rule of 40 Scores

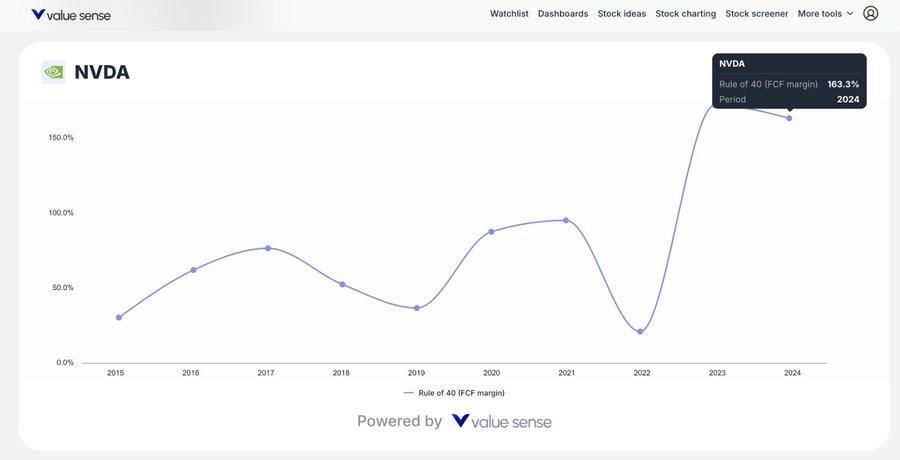

NVIDIA (NVDA)

- Quality Rating: 8.5 (Great)

- Revenue Growth: 114.2%

- FCF Margin: 46.6%

- Rule of 40 Score: 163.3%

NVIDIA's astonishing Rule of 40 score of 163.3% is driven by explosive revenue growth combined with impressive free cash flow generation. The company's dominance in the AI chip market has propelled it to exceptional financial performance, with growth metrics that far outpace most public companies.

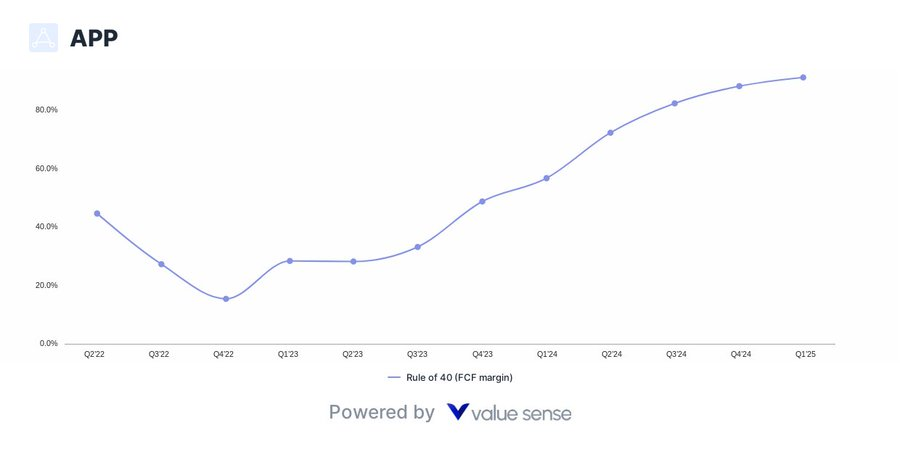

AppLovin (APP)

- Quality Rating: 8.2 (Great)

- Revenue Growth: 41.6%

- FCF Margin: 49.3%

- Rule of 40 Score: 91.4%

AppLovin's mobile app technology platform has enabled it to achieve remarkable financial results. With a nearly balanced contribution from both growth and profitability, its 91.4% Rule of 40 score demonstrates the effectiveness of its business model in the competitive mobile technology space.

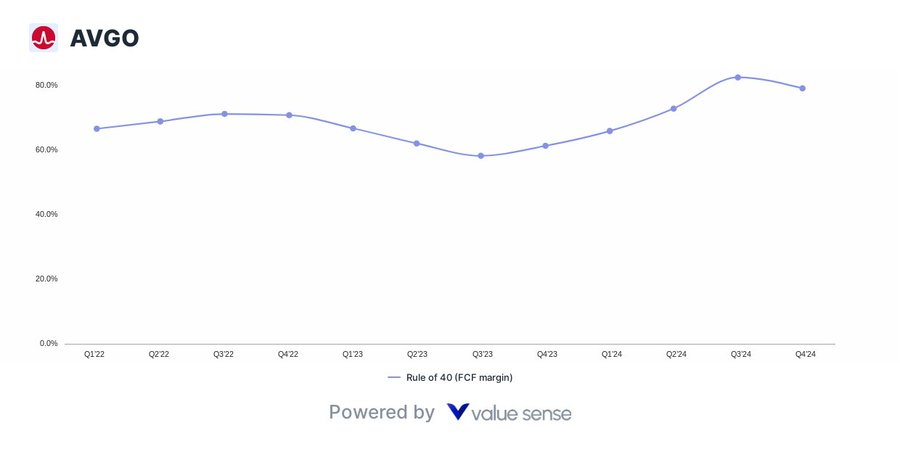

Broadcom (AVGO)

- Quality Rating: 7.1 (Great)

- Revenue Growth: 40.3%

- FCF Margin: 38.0%

- Rule of 40 Score: 79.3%

Broadcom's semiconductor and infrastructure software solutions continue to drive impressive growth and profitability. The company's balanced approach to expanding revenue while maintaining strong cash flow has resulted in a Rule of 40 score nearly twice the threshold.

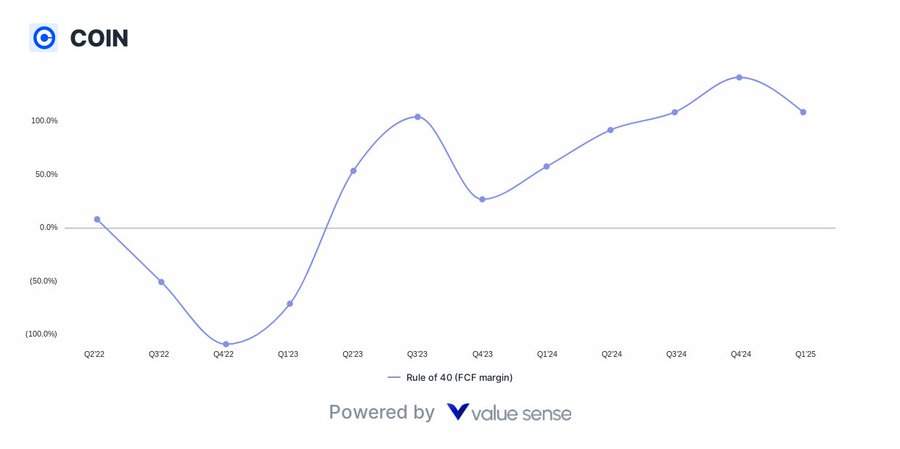

Coinbase (COIN)

- Quality Rating: 7.5 (Great)

- Revenue Growth: 80.0%

- FCF Margin: 28.8%

- Rule of 40 Score: 108.8%

Despite operating in the volatile cryptocurrency market, Coinbase has achieved remarkable financial metrics. Its 108.8% Rule of 40 score is primarily driven by extraordinary revenue growth, complemented by solid free cash flow generation.

Robinhood (HOOD)

- Quality Rating: 6.8 (Great)

- Revenue Growth: 58.3%

- FCF Margin: 33.0%

- Rule of 40 Score: 92.3%

Robinhood's disruptive approach to financial services has translated into impressive revenue growth and cash flow generation. With a Rule of 40 score of 92.3%, the company demonstrates that its business model is not just growing but increasingly profitable.

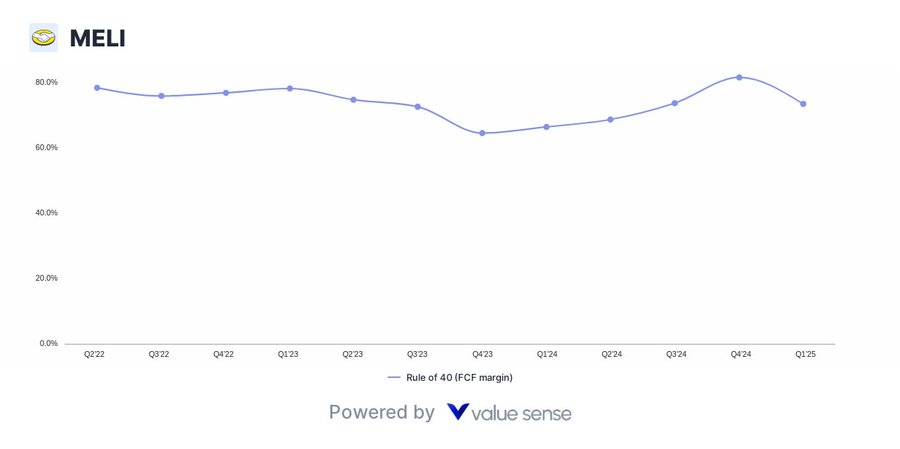

Mercado Libre (MELI)

- Quality Rating: 7.3 (Great)

- Revenue Growth: 38.0%

- FCF Margin: 34.8%

- Rule of 40 Score: 73.5%

As Latin America's leading e-commerce and fintech platform, Mercado Libre continues to expand while generating substantial cash flow. Its balanced performance across both growth and profitability metrics results in a robust 73.5% Rule of 40 score.

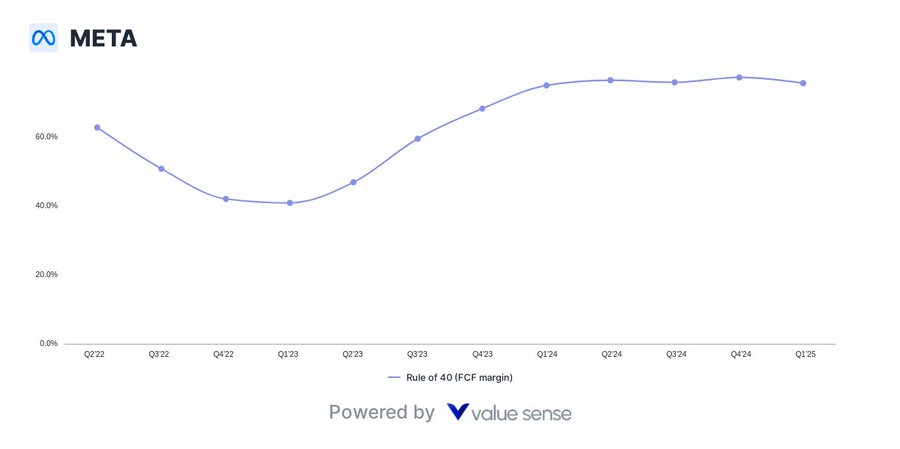

Meta (META)

- Quality Rating: 7.9 (Great)

- Revenue Growth: 19.4%

- FCF Margin: 30.7%

- Rule of 40 Score: 75.8%

Meta's mature business model now delivers more modest growth than some tech peers, but its extraordinary free cash flow margins help it achieve a 75.8% Rule of 40 score. This demonstrates how established tech giants can still deliver exceptional financial performance.

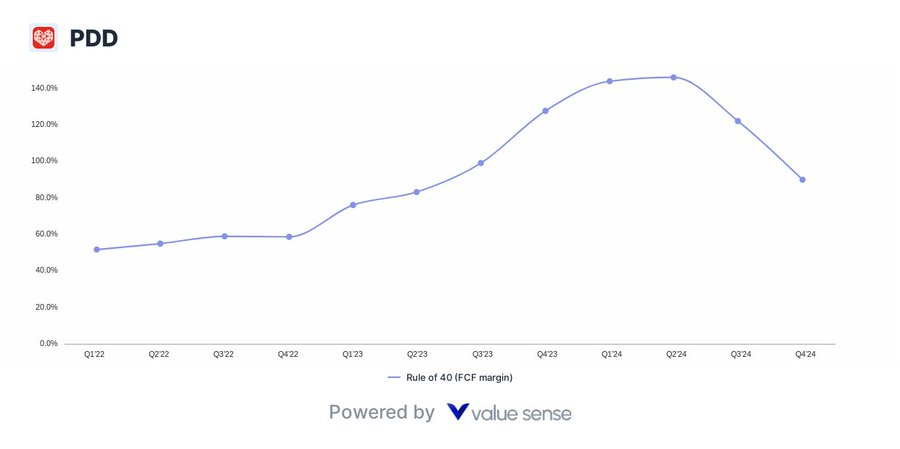

Pinduoduo (PDD)

- Quality Rating: 7.1 (Great)

- Revenue Growth: 56.4%

- FCF Margin: 31.0%

- Rule of 40 Score: 90.0%

China's Pinduoduo has transformed e-commerce with its social commerce model. The company's strong growth trajectory and increasingly robust cash flow generation result in a 90.0% Rule of 40 score, indicating significant business momentum.

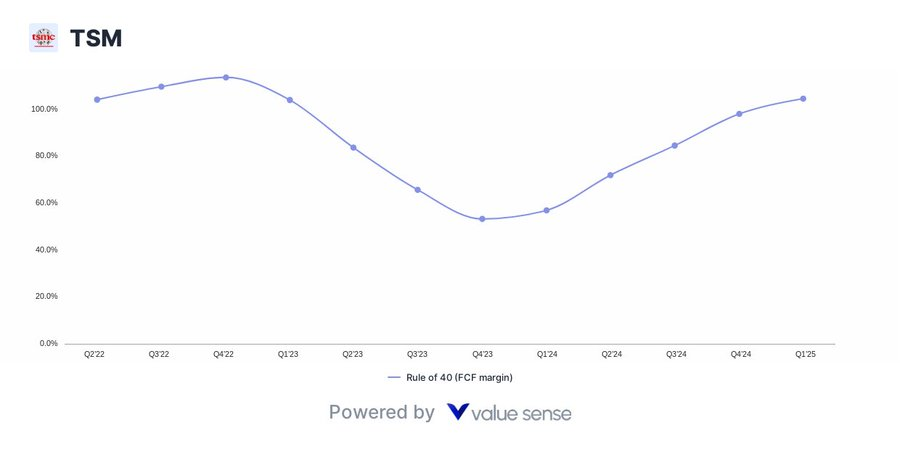

Taiwan Semiconductor (TSM)

- Quality Rating: 8.2 (Great)

- Revenue Growth: 35.3%

- FCF Margin: 29.4%

- Rule of 40 Score: 64.7%

As the world's leading semiconductor foundry, TSM combines strong growth with excellent free cash flow generation. Its Rule of 40 score reflects the company's critical position in the global technology supply chain and efficient operational execution.

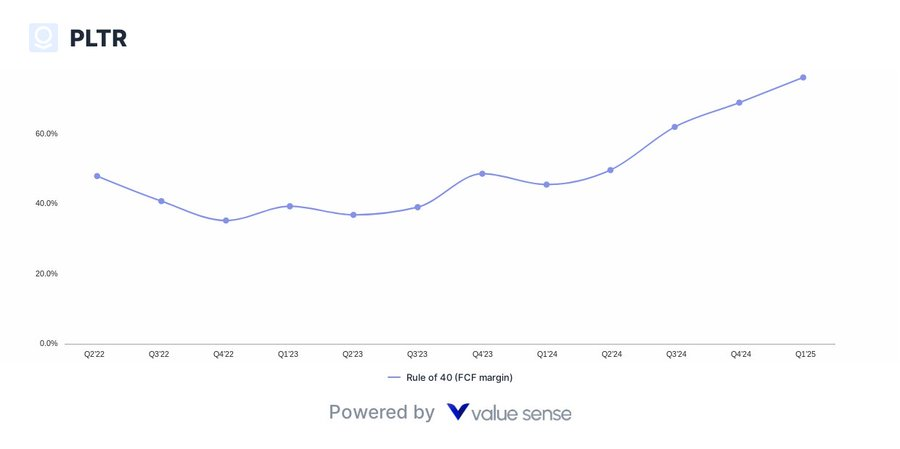

Palantir (PLTR)

- Quality Rating: 7.7 (Great)

- Revenue Growth: 33.5%

- FCF Margin: 42.3%

- Rule of 40 Score: 76.3%

Palantir's data analytics solutions continue to gain traction with government and commercial clients. The company stands out for generating substantial free cash flow while maintaining a strong growth trajectory, resulting in a 76.3% Rule of 40 score.

Why the Rule of 40 Signals Business Excellence

Companies that significantly exceed the Rule of 40 demonstrate several important characteristics:

- Strong Competitive Moat: These businesses typically have sustainable competitive advantages that allow them to grow rapidly while maintaining high margins.

- Operational Efficiency: Generating substantial free cash flow while growing demonstrates exceptional operational execution and business model efficiency.

- Market Leadership: Many of these companies are leaders in their respective markets, with strong brand recognition and customer loyalty.

- Pricing Power: The ability to maintain high margins suggests these companies have pricing power within their industries.

- Capital Allocation Prowess: These businesses efficiently deploy capital to generate high returns while maintaining financial flexibility.

Investment Performance of High Rule of 40 Companies

According to the analysis, a portfolio of these high-quality stocks with legendary Rule of 40 scores significantly outperforms the broader market. This outperformance isn't coincidental—it reflects the fundamental business strength these metrics reveal.

Investors looking for companies with long-term competitive advantages would be well-served to consider the Rule of 40 as part of their analytical toolkit. By focusing on businesses that can maintain both growth and profitability, investors can identify companies with sustainable business models positioned for long-term success.

Conclusion

The Rule of 40 provides a valuable framework for evaluating company performance, especially in high-growth sectors like technology. The ten companies highlighted in this article demonstrate that exceptional business execution leads to outstanding financial results. By achieving Rule of 40 scores far above the 40% threshold, these companies signal their strong competitive positions and operational excellence.

For investors, these metrics offer valuable insights into which businesses might continue to deliver superior returns. While past performance doesn't guarantee future results, companies that can maintain the delicate balance between growth and profitability often possess the fundamental strengths needed for long-term success.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 5 Most Undervalued Chip Stocks Right Now

📖 Analyzing Warren Buffett's Portfolio

📖 15 High ROIC Stocks With 5%+ FCF Yields

FAQ About the Rule of 40

1. What exactly is the Rule of 40 in business and investing?

The Rule of 40 is a financial metric used primarily to evaluate software and technology companies, though it can be applied to other high-growth sectors as well. It states that a healthy company's combined percentage of revenue growth rate and free cash flow margin should exceed 40%. This balanced approach helps investors identify businesses that can successfully manage the tradeoff between growth and profitability, indicating a potentially sustainable business model with competitive advantages. Companies that significantly exceed this threshold, like those highlighted in our article with scores above 70%, often demonstrate exceptional business execution and market positioning.

2. How do you calculate a company's Rule of 40 score?

Calculating a company's Rule of 40 score is straightforward: simply add the company's revenue growth percentage to its free cash flow margin percentage. For example, if a company has 25% year-over-year revenue growth and a free cash flow margin of 20%, its Rule of 40 score would be 45% (25% + 20%). The calculation provides a single metric that balances two critical aspects of business performance. Companies with scores above 40% are generally considered to be performing well, while those with significantly higher scores (like NVIDIA's 163.3%) demonstrate extraordinary business performance and potential competitive advantages in their markets.

3. Why is NVIDIA's Rule of 40 score so much higher than other top-performing companies?

NVIDIA's extraordinary Rule of 40 score of 163.3% significantly outpaces other companies due to its unique combination of explosive revenue growth (114.2%) and exceptional free cash flow margin (46.6%). This remarkable performance stems from NVIDIA's dominant position in the AI chip market, particularly with its GPU technology that has become essential for training and running advanced AI models. The company has effectively created and captured immense value in the rapidly expanding AI infrastructure market, with limited competition able to match its technological capabilities. This competitive advantage allows NVIDIA to maintain premium pricing while experiencing unprecedented demand growth, resulting in both accelerating revenue and strong cash generation—a rare combination that explains its outlier status even among high-performing companies.

4. Can the Rule of 40 predict stock market performance for investors?

While no single metric can perfectly predict stock performance, the Rule of 40 has shown strong correlation with market outperformance, especially for technology and growth companies. Businesses maintaining Rule of 40 scores well above the 40% threshold often demonstrate fundamental strength that translates to superior stock returns over time. The metric effectively identifies companies with sustainable business models that can balance growth with cash generation—a powerful combination for long-term value creation. Historical analysis suggests that portfolios of high Rule of 40 performers tend to outperform broader market indices, though investors should use this as one tool among many in their evaluation process, alongside valuation metrics, competitive analysis, and macroeconomic considerations.

5. How can investors use the Rule of 40 alongside other financial metrics for better stock selection?

Investors can maximize the effectiveness of the Rule of 40 by integrating it with complementary financial analyses. First, combine it with valuation metrics like P/E ratio, EV/EBITDA, or price-to-sales to avoid overpaying for quality. Second, examine the trend of a company's Rule of 40 score over multiple quarters or years to identify improving or deteriorating business performance. Third, analyze the components separately—some investors prefer companies with more balanced contributions from both growth and margins rather than those heavily weighted toward either metric. Fourth, supplement with qualitative analysis of competitive positioning, management quality, and addressable market size. Finally, compare Rule of 40 scores within specific industry sectors, as benchmark expectations may vary significantly between software companies and other sectors. This multi-faceted approach provides a more comprehensive view of potential investments.