Top 10 undervalued high-quality growth stocks

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

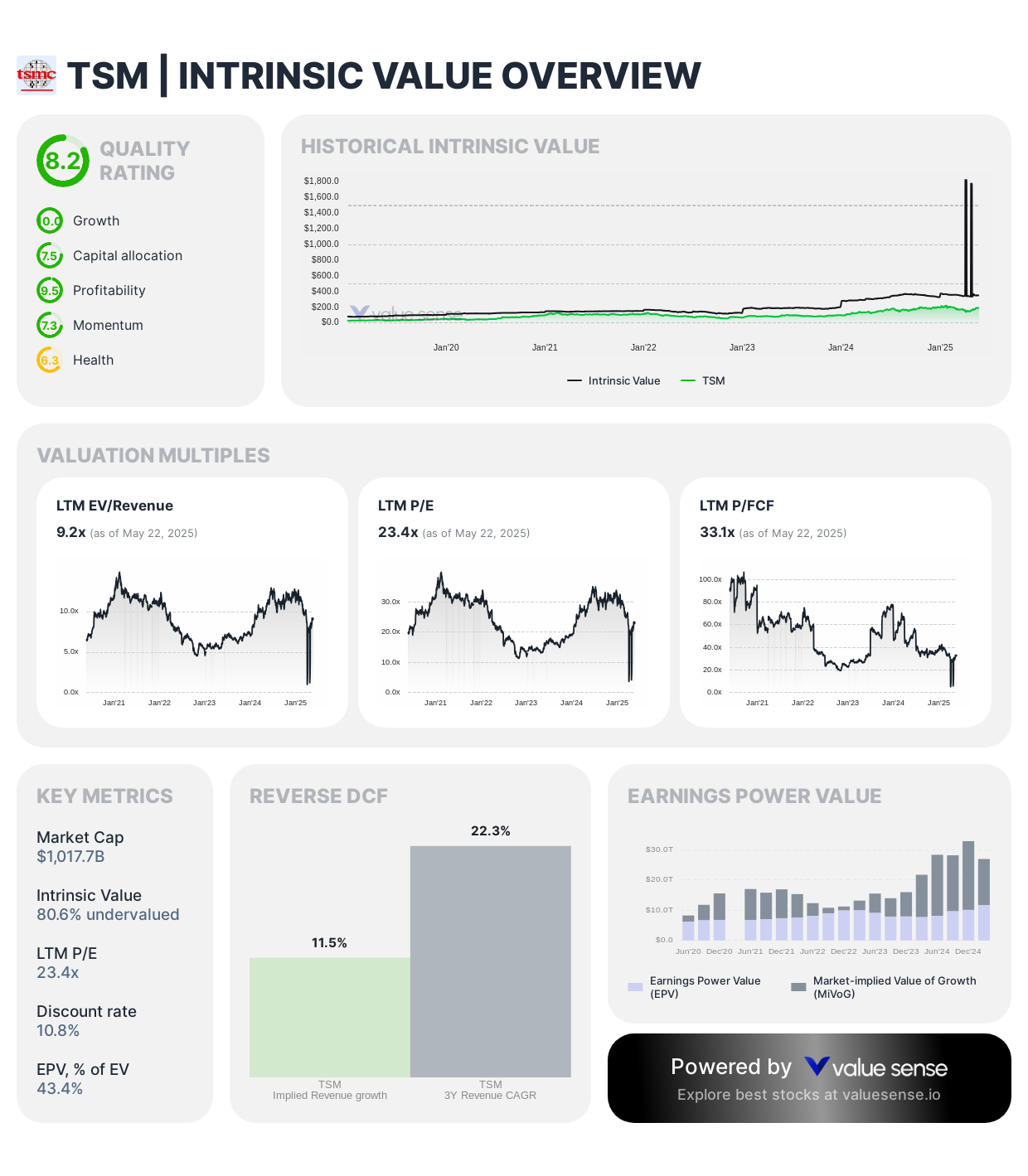

1. Taiwan Semiconductor (TSM)

Undervalued by: 80.8%

The chip-making giant posted impressive 46.5% year-over-year growth in March 2025. As the primary manufacturer for NVIDIA, AMD, and Apple chips, TSMC continues riding the AI wave with projected sales growth of nearly 25% for 2025. At a trillion-dollar market cap, it's still considered massively undervalued!

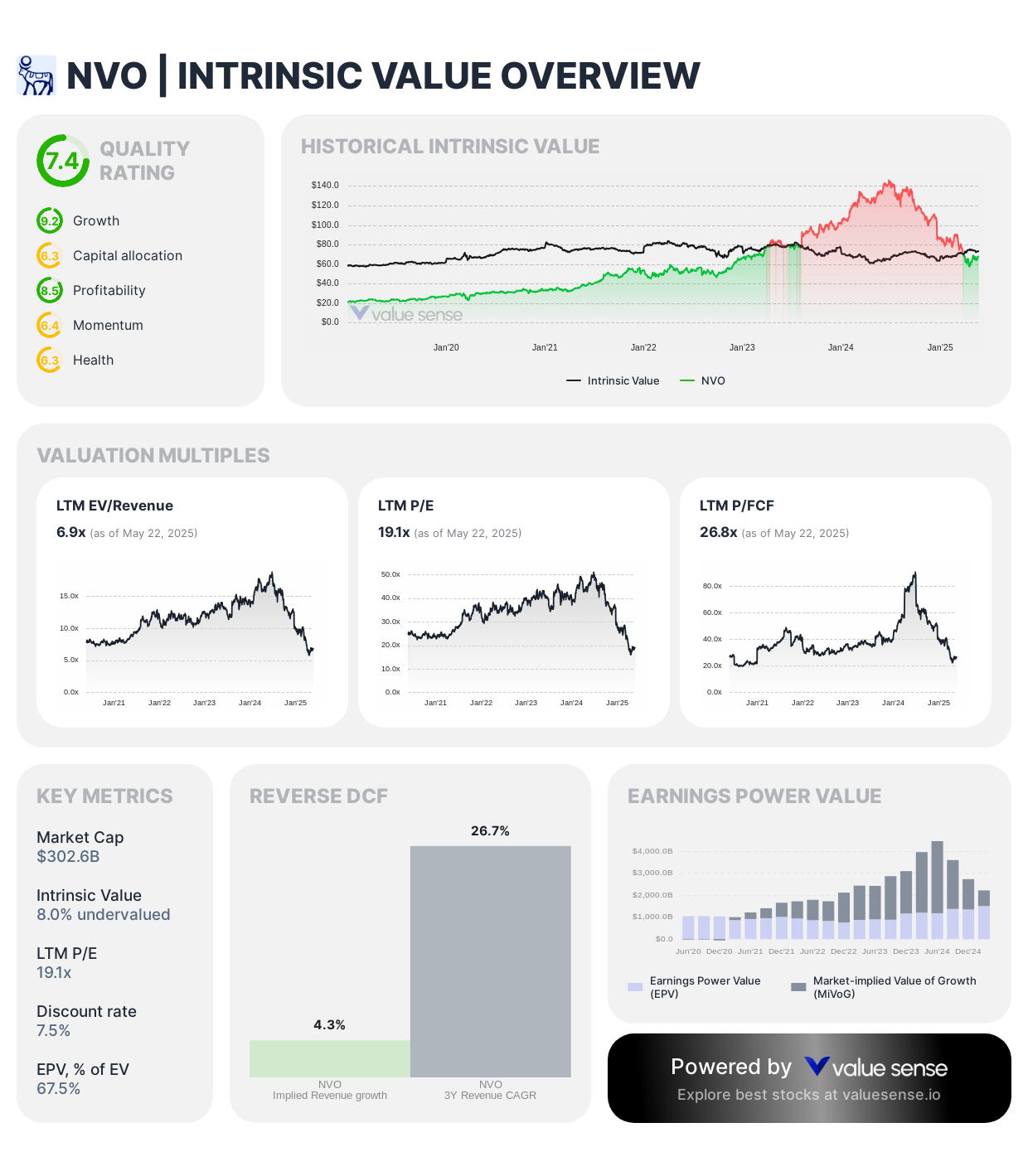

2. Novo Nordisk (NVO)

Undervalued by: 8.6%

The company behind Ozempic and Wegovy is crushing it with 24% annual revenue growth, blowing past its healthcare peers. While they've slightly dialed back 2025 projections, Novo's dominance in the booming weight-loss drug market keeps them firmly in growth territory.

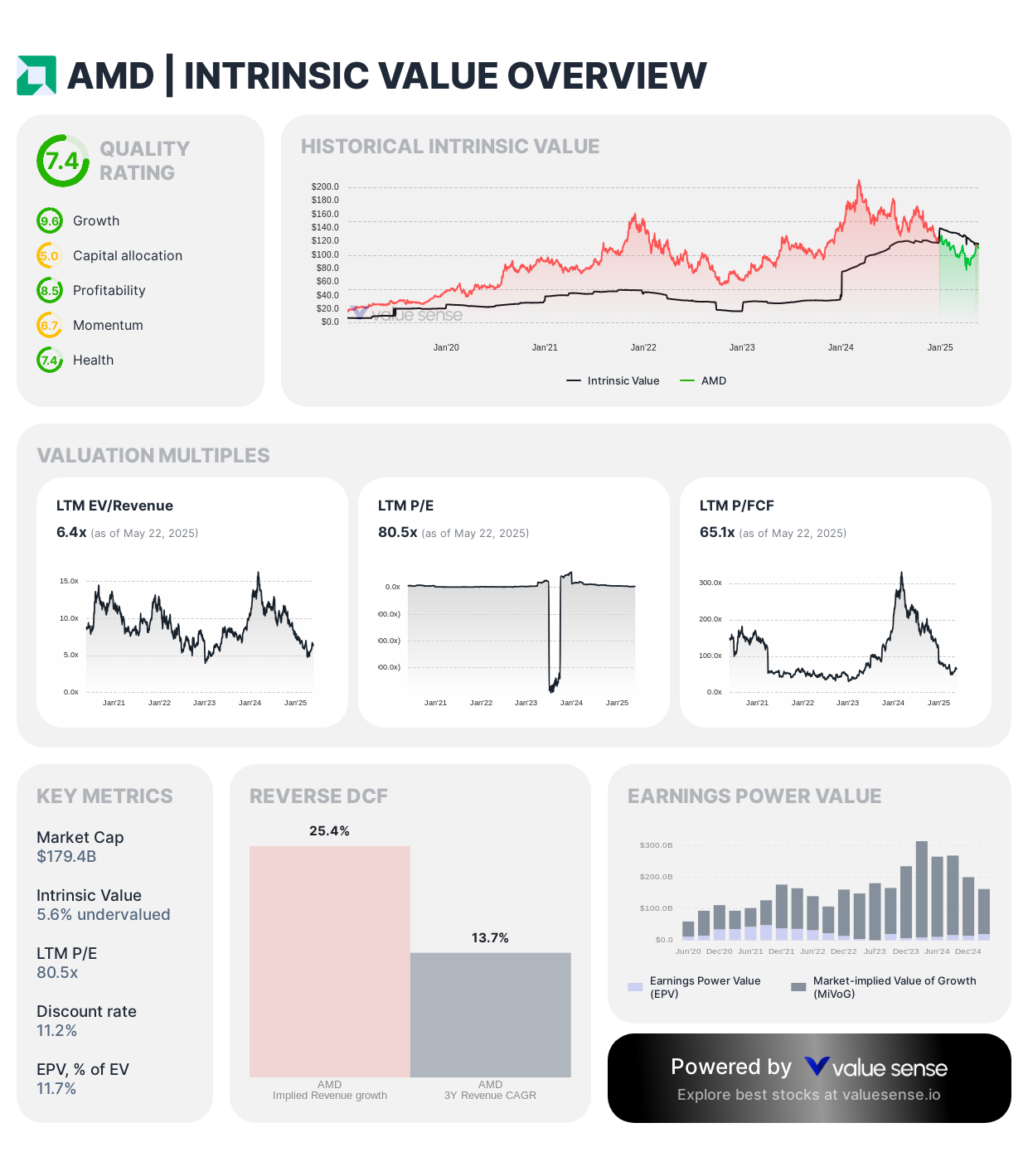

3. Advanced Micro Devices (AMD)

Undervalued by: 5.6%

AMD reported $7.4B in Q1 2025 revenue with healthy 50% margins. Their data center business keeps stealing market share with EPYC processors and MI300 AI accelerators. With record 2024 revenue of $25.8B, they're pushing hard into the AI space while maintaining strong positions across computing segments.

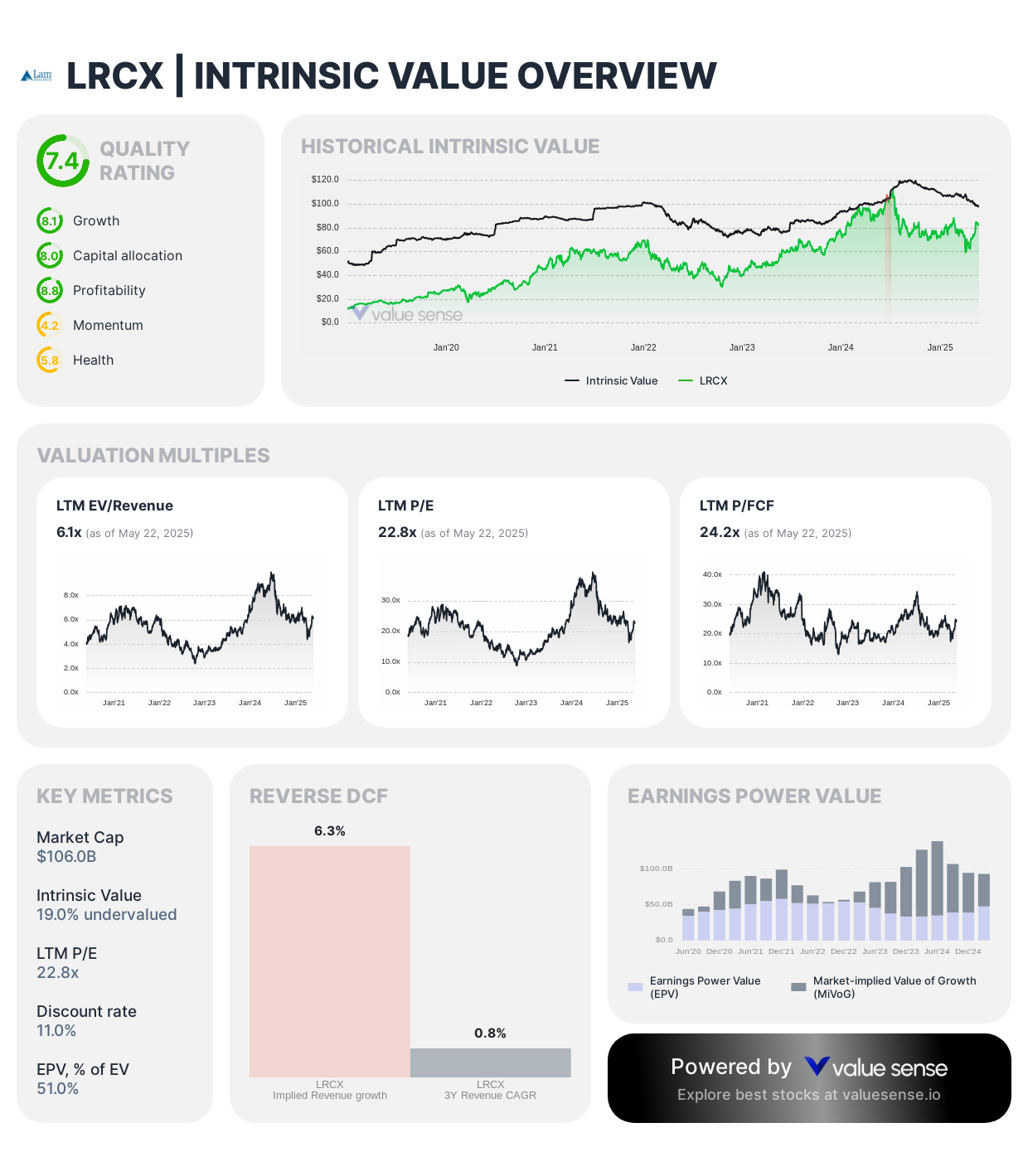

4. Lam Research (LRCX)

Undervalued by: 19.0%

This critical supplier of chip-making equipment has jumped 16.5% since its last earnings report. Analysts see another 14% upside as semiconductor manufacturers ramp up spending on advanced production technology. When chip makers expand, Lam wins.

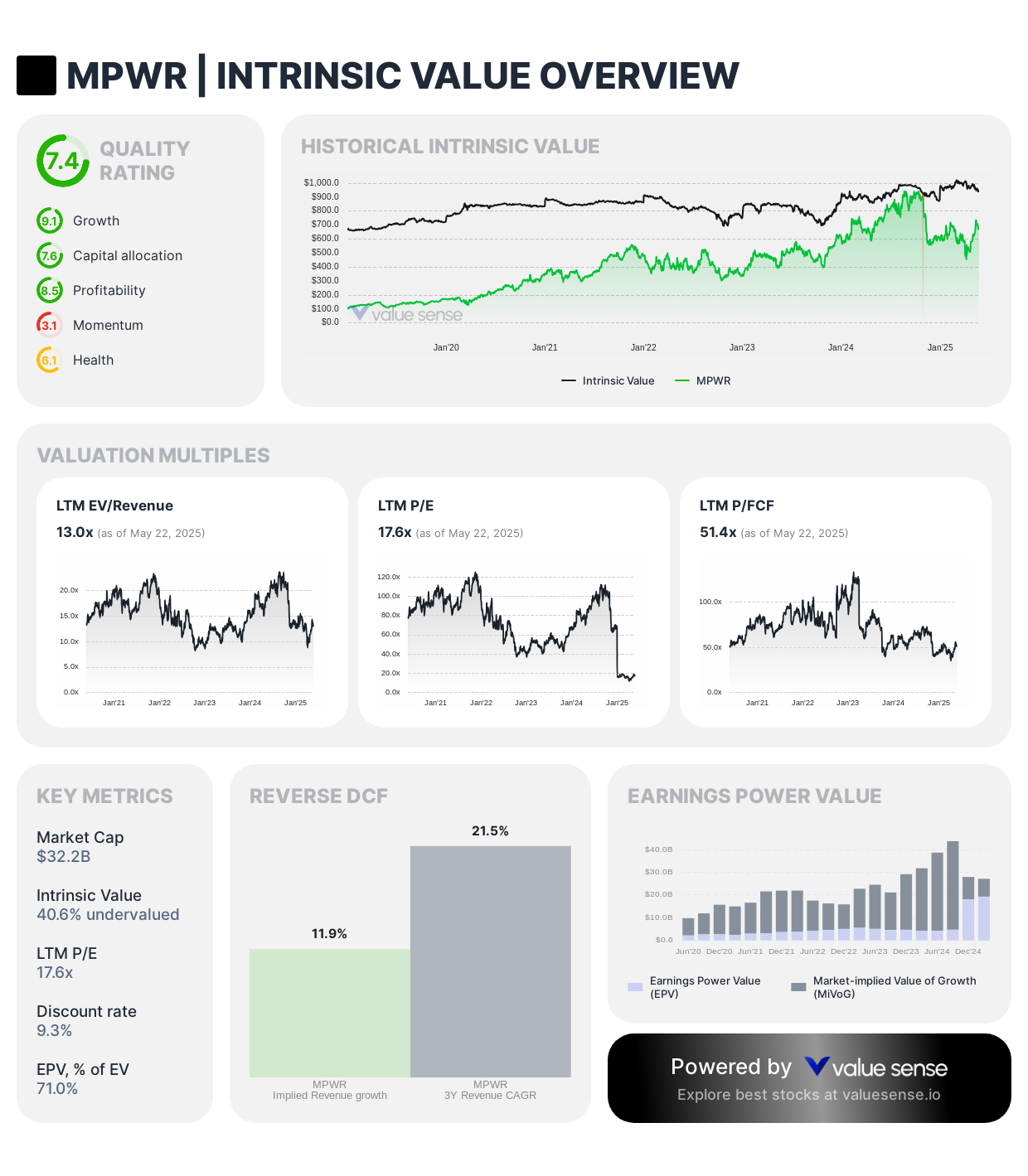

5. Monolithic Power Systems (MPWR)

Undervalued by: 40.8%

MPWR recently raised its Q1 2025 guidance, showing confidence in their specialized power management solutions. They're perfectly positioned for the increasing electrification trends in automotive, data centers, and industrial applications.

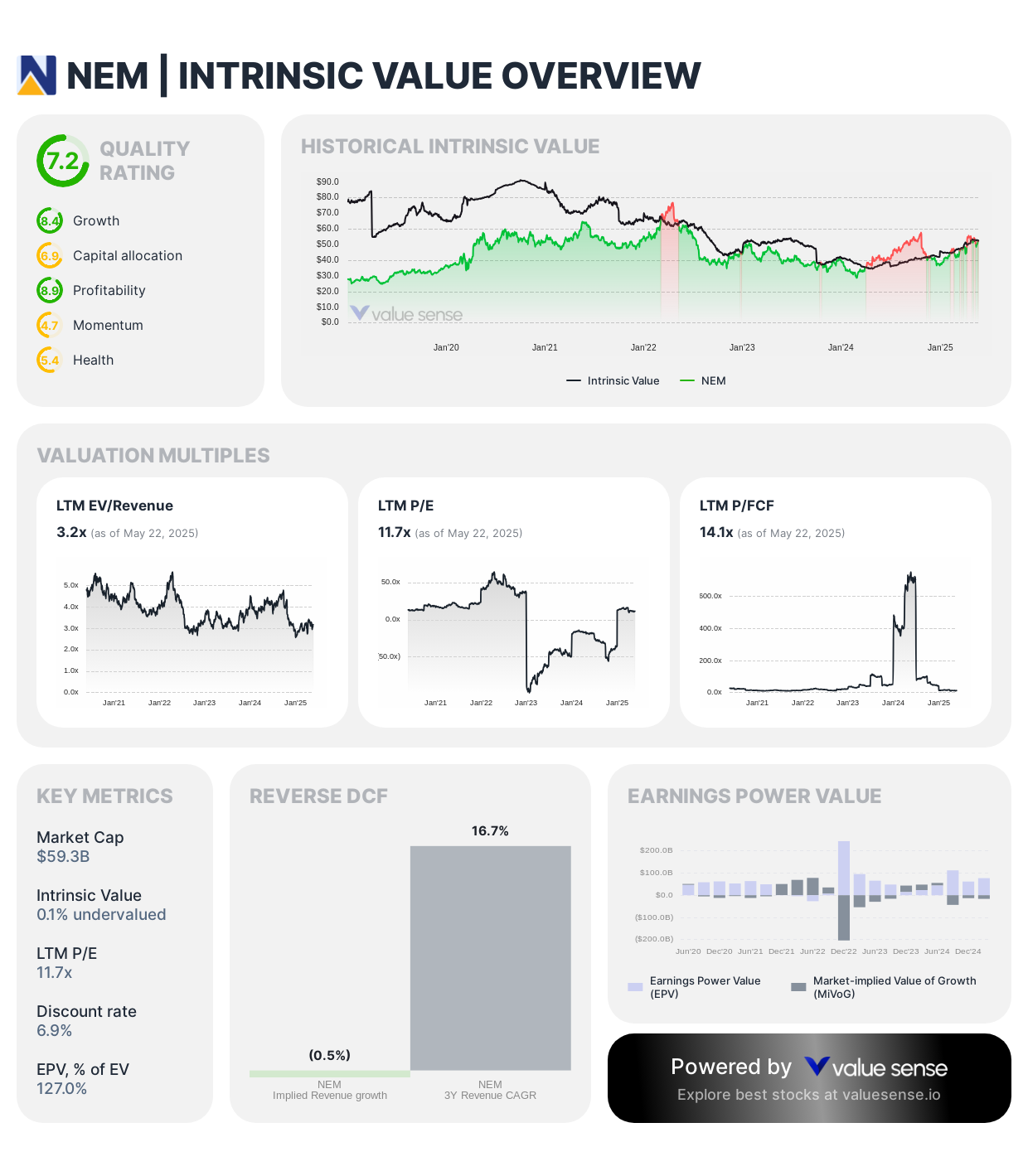

6. Newmont Corporation (NEM)

Undervalued by: 0.1%

The world's largest gold miner saw its Q1 EBITDA jump 55% year-over-year thanks to surging gold prices. With precious metals hitting record highs in 2025, Newmont is sitting pretty for substantial cash flows.

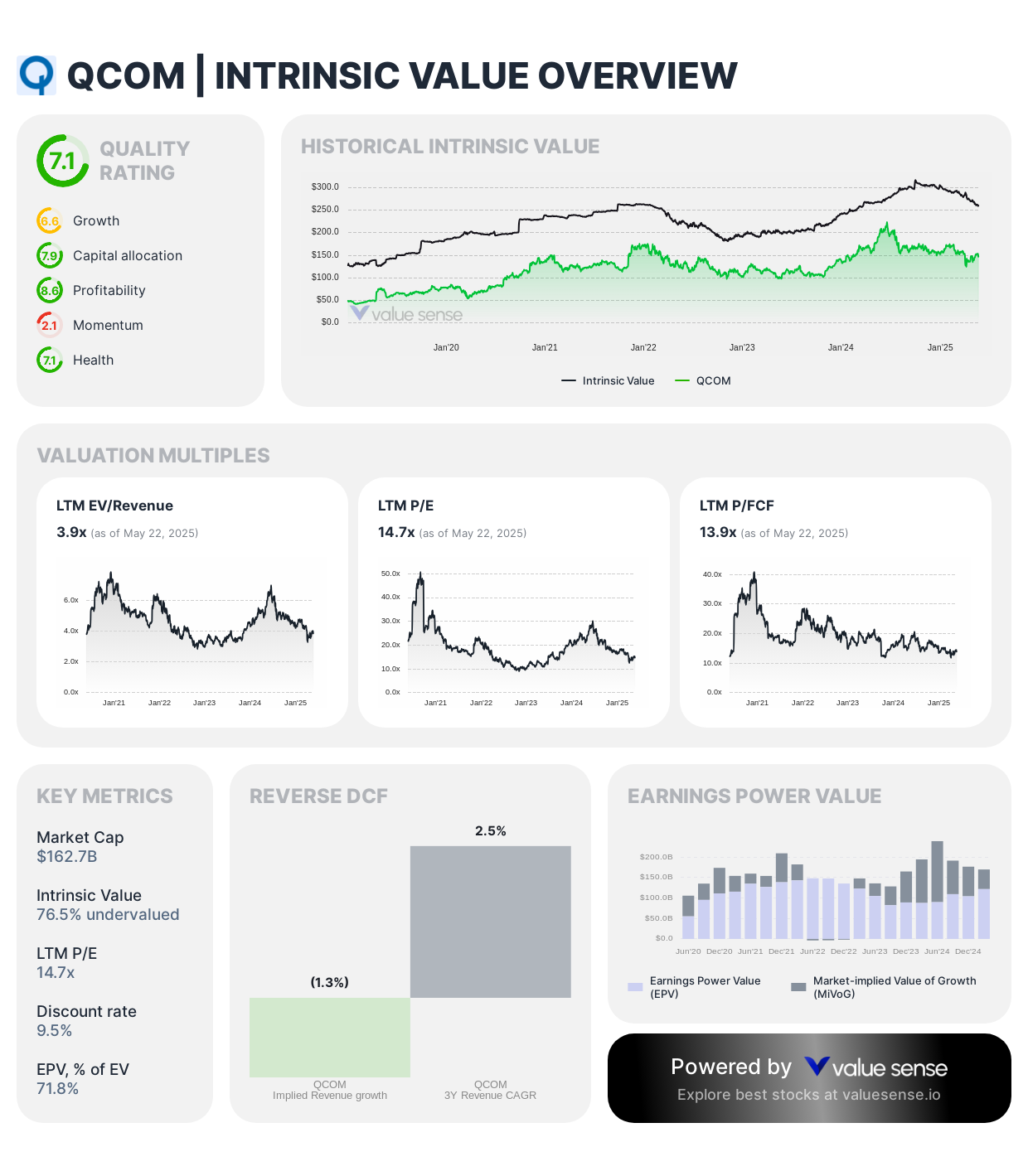

7. Qualcomm (QCOM)

Undervalued by: 76.5%

The wireless technology juggernaut holds a 5.2% global semiconductor market share. While its CPU comeback might not move the needle immediately, Qualcomm's stranglehold on mobile chipsets and 5G tech, plus expansion into automotive and IoT markets, keeps it well-positioned for growth.

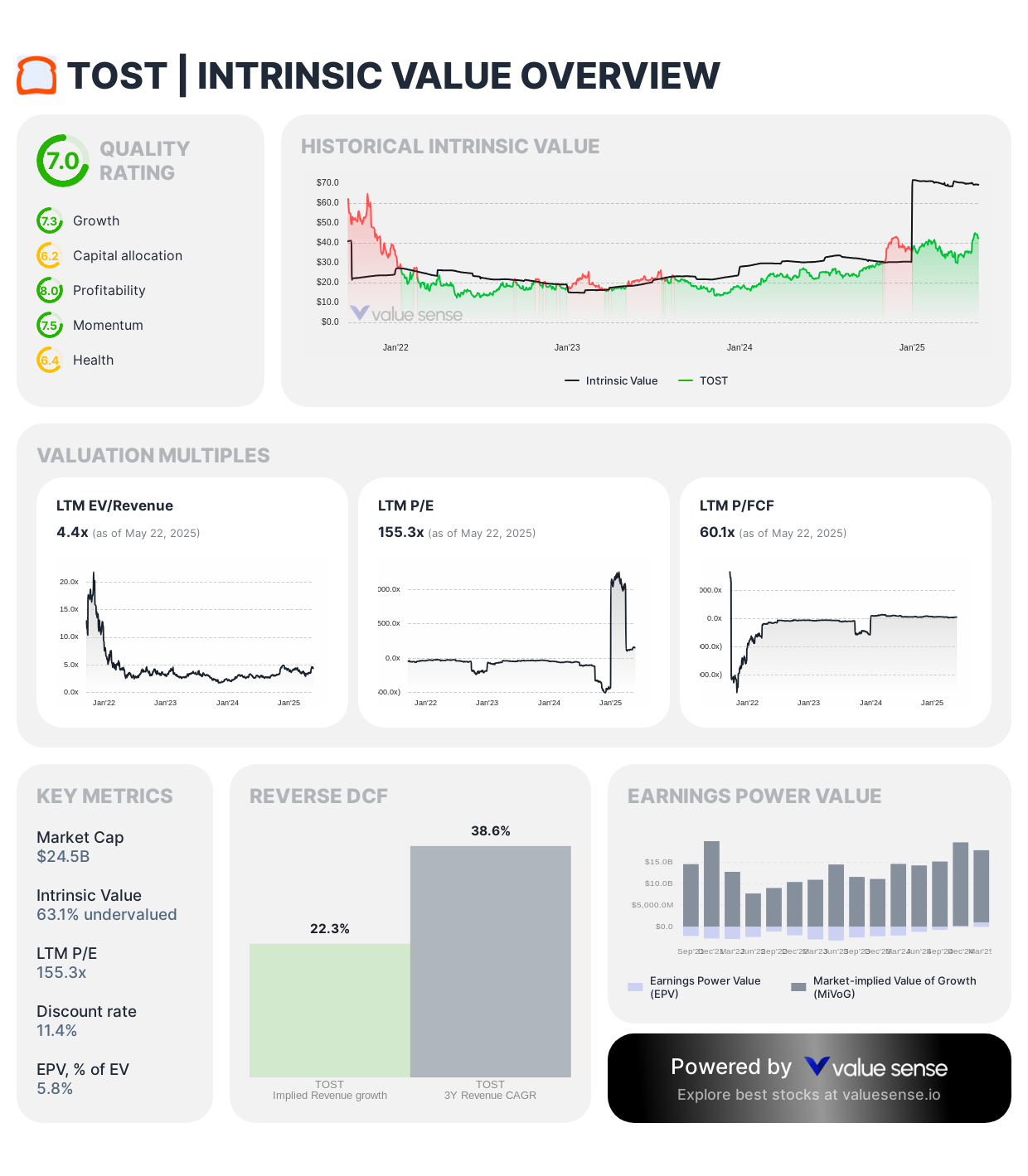

8. Toast (TOST)

Undervalued by: 63.1%

This restaurant technology platform achieved 31% annual recurring revenue growth in Q1 2025 and finally reached profitability. Toast's all-in-one platform continues gaining traction with restaurant owners, and their stock has outperformed the industry with a 51% surge over the past year.

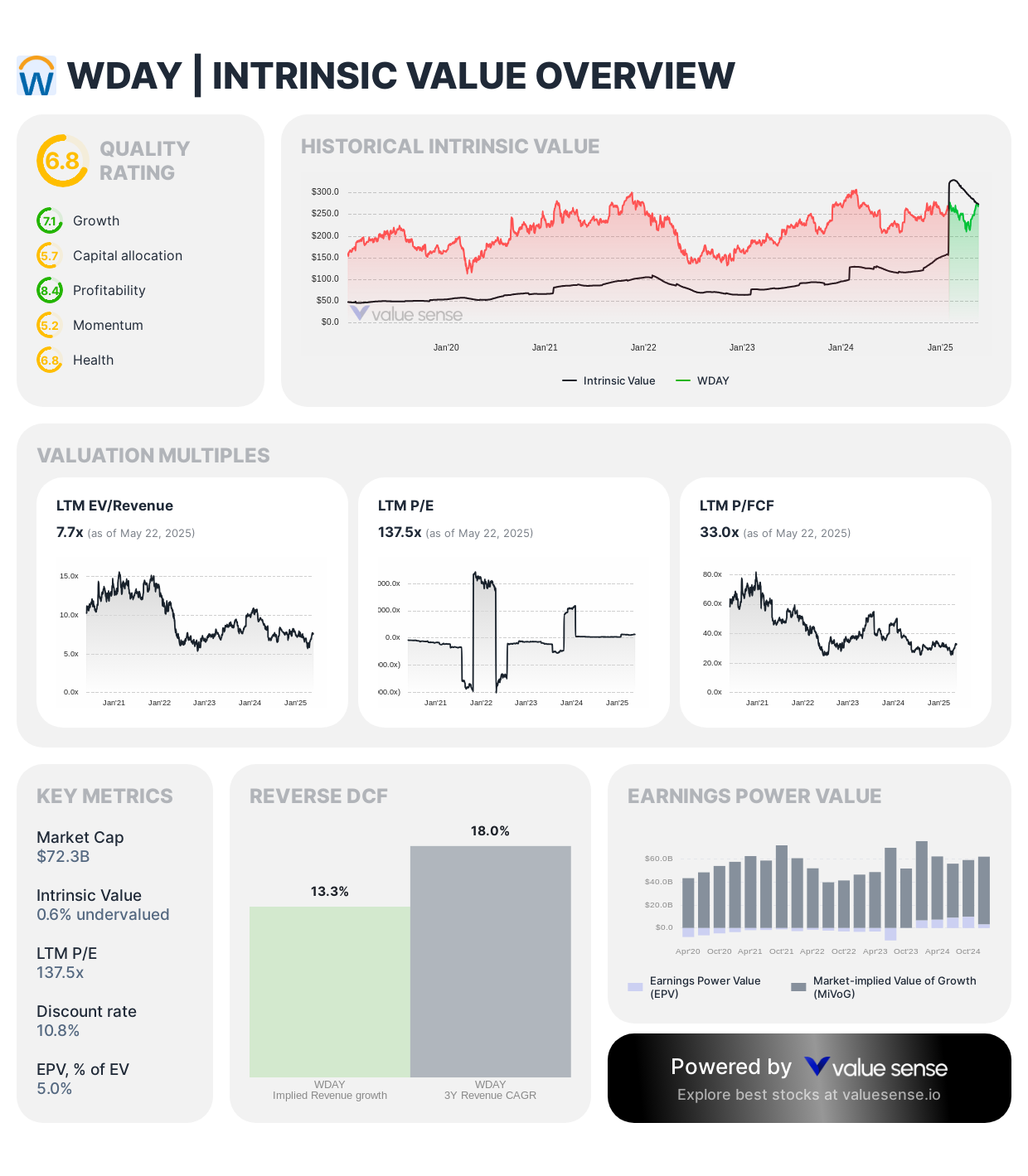

9. Workday (WDAY)

Undervalued by: 0.6%

The HR and finance cloud software leader recently took a hit despite solid earnings, creating a potential buying opportunity. With the enterprise resource planning market expected to grow at 12.1% annually through 2030, Workday's modern cloud approach gives it an edge against legacy players.

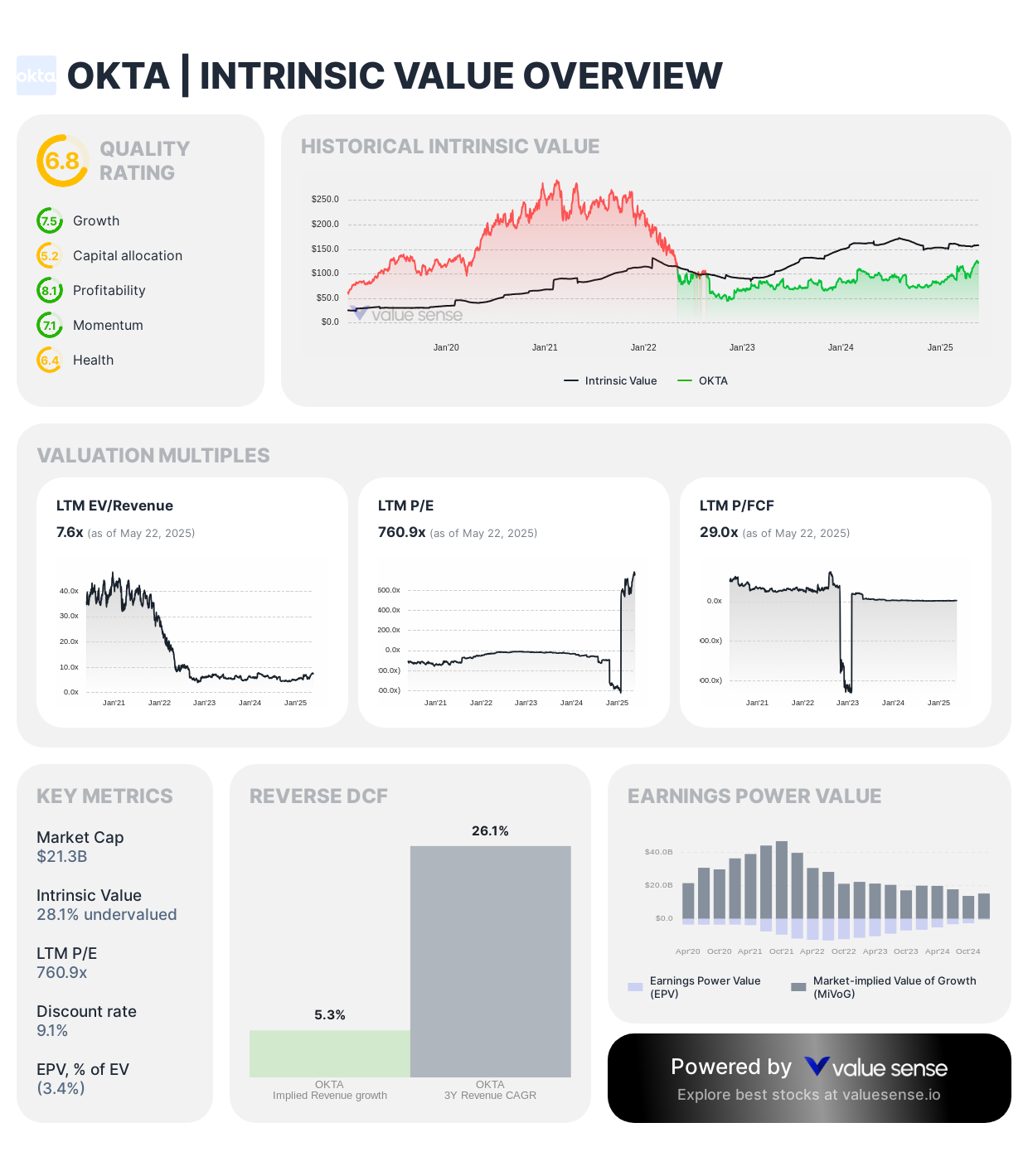

10. Okta (OKTA)

Undervalued by: 28.1%

The identity management specialist popped 12% after its latest earnings beat. With cybersecurity demand surging and digital identity management projected to grow at 15.3% annually, Okta's specialized focus puts it in a strong position to capitalize on increasing security needs.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 5 Most Undervalued Chip Stocks Right Now

📖 Analyzing Warren Buffett's Portfolio

📖 15 High ROIC Stocks With 5%+ FCF Yields